Good morning.

The market’s on pause, and everyone’s staring at Powell.

Stocks were mixed Tuesday as investors waited for the Fed’s final policy move of 2025.

But things aren’t exactly quiet:

Elon Musk’s SpaceX is apparently planning to IPO in 2026

McDonalds got lambasted for an awful AI-generated ad in the Netherlands

Oracle’s earnings today will tell us about AI industry’s strength/weakness

Let’s get into it.

In partnership with Roku

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Please support our partners!

📰 Market Headlines

Markets were mixed on Tuesday as investors waited for the Federal Reserve’s final policy decision of the year.

The Dow slipped 0.4%. The S&P 500 hovered near flat, and the Nasdaq edged up 0.1%.

All eyes are on the Fed as it prepares for a third straight rate cut of 25 basis points on Wednesday, bringing the benchmark range to 3.5% to 3.75%. The committee remains divided between members worried about labor market weakness and those concerned about inflation staying above target. Economists expect a “hawkish cut,” signaling that further easing may pause in 2026.

Bitcoin (BTC) is hovering around $92,000 at the moment, and it’s likely that a rate cut is already priced in. However, if Kevin Hassett is confirmed as the next Fed Chair, the struggling cryptocurrency might get a serious tailwind (Hassett is likely to cut rates aggressively).

Oracle (ORCL) is reporting earnings today. Larry Ellison’s company is up 30% YTD, and is expected to post $16.21 billion in revenue for the quarter (up 15% from a year ago), according to Yahoo Finance.

Fun fact: if you didn’t know, Oracle CTO and majority shareholder Larry Ellison’s son David Ellison is the CEO of Paramount, which is at the center of the Netflix-Warner Bros.-Paramount deal war that’s happening right now. Larry Ellison is fronting $40 billion of Paramount’s $108 billion hostile counter-bid for WBD.

Elon Musk’s SpaceX is reportedly planning to IPO in 2026 at a valuation of $1.5 trillion (raising $30 billion, which would be the largest IPO ever). A $1.5 trillion market cap would automatically make SpaceX the tenth-largest company in the world. As always with the biggest IPOs, retail investors are excited to own a piece of the pie, but also lament the fact that they couldn’t buy in at a lower price.

Silver just hit a new all-time high of $60/ounce.

Labor market data cooled further. Job openings rose slightly to 7.67 million in October, while hiring fell by 218,000, and quits dropped to their lowest level since 2020. The “no-hire, no-fire” trend continues, with layoffs inching up to 1.85 million. Economists say the cooling job market could justify a cut from the Fed to get ahead of deeper weakness.

Oil prices slid again, with Brent closing at $61.94 and WTI at $58.25. Traders are watching the Ukraine peace talks and the Fed’s decision for direction. A potential deal could bring Russian supply back online, while lower US rates might support demand. Analysts expect crude to stay in the $60 to $65 range amid ample supply and cautious demand forecasts for 2026.

🤖 AI/Future/Tech News

McDonald’s pulled down its AI-generated Christmas ad in the Netherlands after catching a ton of heat for it.

Accenture partnered with Anthropic to train 30,000 employees on Claude models, marking Anthropic's largest deployment to date.

🪙 Crypto

PNC Bank launched Bitcoin trading for high-net-worth clients through its Coinbase partnership.

See Nvidia CEO Jensen Huang explain how Bitcoin works: “Takes excess energy, stores it as currency, transport it everywhere.”

🚨Trending on Reddit

1-800-Flowers.com posts climbed as users speculated on a short squeeze and a push past $5 amid rising trading volume and high short interest.

Ageagle Aerial Systems chatter spiked on hopes of a rebound tied to new Army contracts and global distribution deals—and even rumors of an AeroVironment buyout.

🤫 Insider Trading

🪑 Alternative Investment: Antique Furniture

Antique markets are heating up as collectors chase scarcity and craftsmanship. Tiffany lamps sold for an average of $27,000 on 1stDibs, with demand for Art Nouveau glasswork and floral motifs pushing prices higher through 2025.

Art Nouveau glass by Emile Gallé and Lalique climbed in value as collectors paid premiums for vases and figurines featuring botanical or animal themes. Searches for Gallé pieces jumped on 1stDibs, signaling a broader shift toward colorful, handcrafted decor.

Victorian furniture and ceramics rebounded in popularity. Fine wood tables by Howard & Sons and porcelain from Meissen drew new buyers who viewed “brown furniture” as undervalued. As mid-century modern cooled, ornate craftsmanship regained investor attention.

❓What do you think?

Are you interested in the SpaceX IPO?

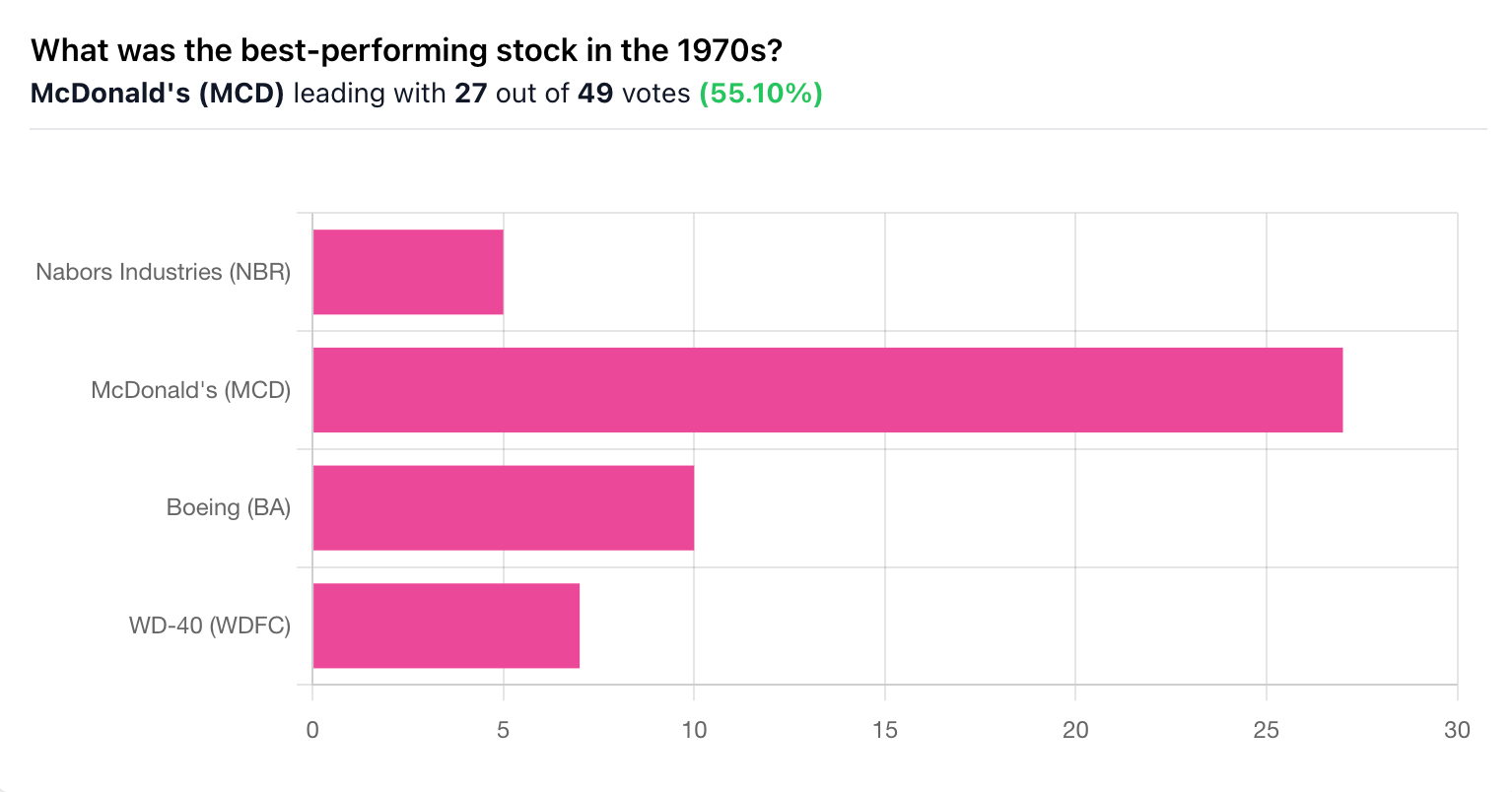

🎤️ What you said last time

📊 IPOs and Earnings

AutoZone missed Q1 estimates on both earnings and revenue, reporting an EPS of $31.04 against an expected $32.24. Shares dropped 7%.

Campbell's beat Q1 estimates with an EPS of $0.77 and revenue of $2.68 billion, with shares missing 5.2%.

Cracker Barrel Old Country Store missed Q2 earnings estimates, reporting a loss per share of $0.74 against an expected $0.66, yet shares traded up 1.4% on heavy volume.

Dave & Buster's Entertainment beat estimates with an adjusted loss per share of $1.14, topping consensus by $0.05; shares climbed 1.1%.

GameStop beat earnings estimates with an EPS of $0.24 (estimate was $0.20), but shares fell 6% (revenue was lower than expected).

🚚 Market Movers

JPMorgan shares slid 4.3% after projecting 2026 expenses would climb to $105 billion.

Wells Fargo signaled more job cuts are coming in 2026, with severance costs expected to rise in Q4.

DirecTV is offering streaming discounts as it lost an estimated 288,000 cable subscribers last quarter.

🧠 The Missing (Market) Links

Vietnam’s VNM ETF surged 62% this year, doubling China’s 31% gain. FTSE Russell’s 2026 upgrade could bring $6 billion in new inflows.

Nearly two-thirds of young investors took advice from finfluencers. Half failed to spot obvious scams, and 30% bought meme stocks just because they were trending.

Three in ten US teens use AI chatbots daily, with 59% choosing ChatGPT. Pew’s study linked the trend to rising safety concerns and lawsuits.

📜 Quote of the Day

Time is your friend; impulse is your enemy”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.