🔔 The Opening Bell

Good morning.

We’re getting into the thick of Magnificent 7 earnings now, with Meta and Microsoft reporting today and Amazon and Apple tomorrow. Sherwood compared the Mag 7s’ historical price movements to what traders, and Meta showed a significant difference.

But it’s not all about tech—while everyone's been obsessing over AI chips, industrial stocks have actually been outmuscling tech giants this year. Boeing's surprising comeback tells a different story about where smart money might be flowing. But the industrial sector isn’t the only one outperforming tech—two other sectors are too.

And Spotify's CEO just delivered the corporate equivalent of a public apology after the stock crashed yesterday, showing its worst performance in two years.

More on each of these below—but first, an alternative investment option from our partner, FarmTogether.

🌾 Farmland: The real asset investors turn to in uncertain times

Over the past 30 years, farmland has delivered stock-like returns with about one-third the volatility.

Intrinsic value. Food is indispensable. You can’t just print more of it

Stable. Positive historical correlation to inflation

Income-generating. It generates steady cash flow,

Utility. Real-world demand regardless of economic cycle

FarmTogether sources and manages institutional-grade farmland investments, giving accredited investors access through both individual properties and a diversified fund.

Right now, the standout opportunity is Landmark Mandarin Grove — a producing citrus orchard in California’s Central Valley:

🍊 80-acre grove growing Tango and Golden Nugget mandarins

💧 Dual water sources: surface water and private well

📈 Targeting 11.1% net IRR and 9.4% net cash yield

📆 10-year unlevered hold with seasoned local operator

Prefer a fund-based approach? FarmTogether’s Sustainable Farmland Fund offers exposure to a curated portfolio of U.S. farms across multiple regions and crops. It’s targeting:

🌱 8–10% net IRR with 4–6% annual distribution

🪵 Properties in CA, OR, CO, and OK — citrus, grapes, pecans, and row crops

⏳ 2-year lockup, evergreen structure

For investors looking to rebalance into resilient, income-producing assets, farmland is emerging as a compelling alternative.

Investments are open to accredited investors only.

Historical data is not indicative of future results and may not reflect fees which may reduce actual returns. Any historical information is illustrative in nature and may not represent future results, therefore any investor investing through the FarmTogether platform may experience different returns from examples and projections provided on the website. You should not make investment decisions based solely on the information and charts contained in this email.

FarmTogether does not provide tax advice or guidance. Any information provided within this document is for reference only. We recommend consulting a tax professional for your individual tax situation.

📰 Market Headlines

The S&P 500 snapped its six-day record streak Tuesday, with all three major indices closing in the red.

The S&P 500 slipped 0.3%, the Nasdaq fell 0.4%, and the Dow dropped 0.4% as investors absorbed a wave of corporate earnings and braced for today’s Fed decision.

Industrials outpaced tech stocks this year, surging 16% compared to technology's 13% rise. Boeing $BA ( ▼ 0.82% ) posted better-than-expected results Tuesday, while GE Vernova $GEV ( ▼ 0.33% ) rocketed over 90% year-to-date on strong data center power demand. It’s not just industrials, though. We dove into all three sectors that are outperforming tech, along with investment ideas for each →

Meta and Microsoft will report earnings today, and historically, $META ( ▼ 1.34% )’s stock tends to experience pretty large swings post-earnings. Interestingly, traders seem to think it won’t swing as much this time around (based on options prices). $AMZN ( ▲ 1.0% ) and $AAPL ( ▼ 3.21% ) will report tomorrow, and in a market that looks like a “paddling duck” (according to an analyst), Mag 7 earnings could lead to a lot of capital rotation—whether they’re good or bad reports. See what traders predict the Mag 7’s price swings will be →

US-China trade talks concluded without an immediate announcement of a further tariff delay. Treasury Secretary Scott Bessent said another pause remains on the table, but President Trump will make the "final call" on whether to prevent duties from surging on August 12.

Spotify stock plummeted 11% for its worst day in two years after missing revenue expectations and posting weak guidance.

$SPOT ( ▲ 3.89% ) CEO Daniel Ek admitted he was "unhappy with where we are today" as ad-supported revenues declined 1%.

Starbucks shares rose 4% after US same-store sales fell less than feared.

$SBUX ( ▼ 0.06% )’s sales dropped 2% versus an expected 2.5% decline as new CEO Brian Niccol's turnaround efforts showed progress.

Where are Meta and Microsoft shares going today?

😱 Fear and Greed Index

🧠 The Missing (Market) Links

The CEO role is now the most precarious in S&P 500 boardrooms, with 41 chiefs ousted already this year, and turnover is at a 20-year high.

Stock signal: Walgreen’s open job listings just jumped by 55%, according to AltIndex.

One investor watched $6 million in crypto on his phone vanish after a costly mistake.

Gen Z faces a quarter-life crisis: only 17% report deep social connections, and happiness levels now lag behind older generations.

US median home prices hit a record in June, pushing typical monthly mortgage payments to $2,273.

🚚 Market movers

Anthropic secured discussions to raise up to $5 billion, potentially valuing the AI startup at $170 billion.

Novo Nordisk stock plummeted over 21% after slashing sales and profit forecasts due to competition in the weight-loss drug market.

Citi poached Pankaj Goel from JPMorgan to co-lead its tech investment banking, continuing its aggressive hiring spree.

Freshworks raised its annual revenue forecast to $822.9 million-$828.9 million, driven by increased demand for its AI-powered software.

CyberArk shares soared 13% following reports of acquisition talks with Palo Alto Networks, valued at over $20 billion.

Royal Caribbean boosted its full-year guidance on strong cruise bookings.

🪙 Crypto

Bitcoin and ether slipped as investors awaited the Federal Reserve's decision on interest rates this week.

XRP consolidated, down 1.47% daily, with volume declining 13.36%.

SharpLink Gaming acquired 77,210 ETH worth $290 million last week.

BitMine Immersion Technologies tumbled 13% after announcing a $1 billion share buyback program.

💰 Alternative Investing News

HarbourView Equity Partners secured $630 million for its music royalties fund.

Private equity-owned companies drove an 80% jump in defaulted debt, with distressed debt exchanges increasing after US tariff announcements worsened credit conditions.

🤖 AI/Future/Tech News

Block’s Cash App rolled out a “pools” feature for group payments, letting even non-users chip in via Apple Pay or Google Pay.

Aeva Technologies sealed a manufacturing deal with LG Innotek, which took a 6% stake and committed up to $50 million.

Google’s AI Mode in Search gained new tools, letting desktop users upload images and PDFs to ask questions.

Jack Dorsey’s Bluetooth-powered messaging app, Bitchat, landed on the iOS App Store.

A security researcher exposed flaws at Lovense that leaked user emails and left accounts open to takeover.

🌍 International Markets

🇫🇷 France's Prime Minister François Bayrou broke with his pro-EU stance by condemning the new US-EU trade deal as "submission".

🇲🇽 Mexico's economy grew 0.4% in Q2, driven by manufacturing and services offsetting weak agricultural output.

🇮🇳 The Indian rupee slumped to its lowest level this fiscal year at 86.8150 against the dollar.

🇷🇺 Russia's defense spending hit a post-Soviet record of 6.3% of GDP in 2025 as its militarized economy sustained growth despite sanctions.

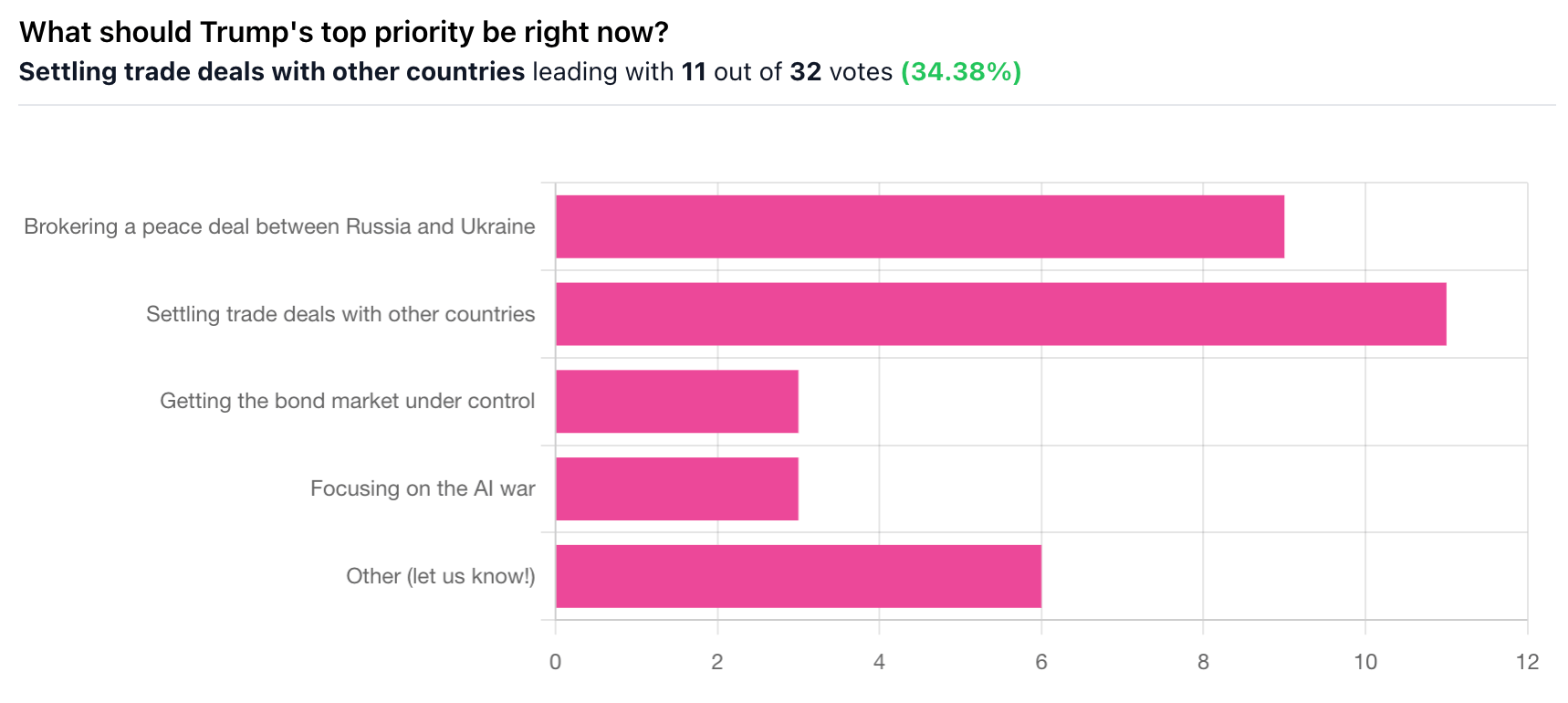

🎤️ What you said last time

“Release the Epstein Files.”

“Working more with China & less with Russia… More Aid to Ukraine...”

“Going to prison”

📊 Earnings

Boeing beat Q2 revenue estimates with a 35% jump and slashed its per-share loss, driven by a 63% surge in commercial deliveries; shares still fell 4.37%.

UnitedHealth Group reported mixed Q2 results, missing profit estimates after its medical expense ratio hit a record high of 89.4%, so shares tumbled 7.46%.

SoFi Technologies crushed Q2 estimates with a 700% surge in net income and a 43% jump in revenue, with shares soaring 6.57%.

United Parcel Service missed Q2 earnings estimates as US package volumes fell, blaming weakness in the China-US trade lane on tariffs; shares plunged 10.57%.

Visa posted a Q3 profit jump with a 14% rise in net revenue, driven by an 8% increase in payment volumes, yet its stock slid 1.18%.

Procter & Gamble beat fiscal Q4 estimates but warned of a 1 billion profit hit from tariffs; shares closed down 0.32%.

PayPal beat Q2 revenue and earnings estimates, but slowing growth in transaction margin dollars sent shares sinking 8.66%.

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt

Thumbnail image: www.shopcatalog.com, flickr

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.