Good morning.

The economy is firing on all cylinders with GDP revised up to 3.8% and jobless claims beating expectations, but nobody seems to know what to do with the good news. Bitcoin traders are eyeing $90K as a buying opportunity, AI companies keep shuffling billions between each other, and Starbucks is closing iconic stores as part of a deeper restructuring push.

Meanwhile, housing will require either a 38% price crash or 60% income surge to become affordable again, according to Fannie Mae. Something's got to give. The tech sector keeps thriving though: CoreWeave just locked in another $6.5 billion with OpenAI, and Terawulf has the highest stock rating on AltIndex at the moment.

Overall: The economy's doing great (apparently?), housing's broken, and AI's still the main character.

In partnership with AltIndex

Why Retail Investors Always Buy at the Top

You buy after CNBC reports the story.

The best traders bought when Reddit mentions spiked 3,968%.

You buy after "strong earnings."

Wall Street bought when insiders loaded up $31M beforehand.

You buy after "analyst upgrades."

Smart money bought when Congress filed their positions first.

The pattern is obvious: You get yesterday's news. They get tomorrow's signals.

While you're reading quarterly reports, professionals track Reddit comments, Congressional trades, and insider purchases in real-time.

But what if you had their data?

AltIndex monitors the same signals Wall Street uses: 50,000+ Reddit comments daily, every Congressional filing, insider transactions from 500+ companies.

Every week, we send you the stocks showing the strongest signals before they hit mainstream financial media.

And we’re giving you a 7 day free trial of our app, so you can see new stock narratives happening in real time.

Stop being the last to know.

Please support our partners!

📰 Market Headlines

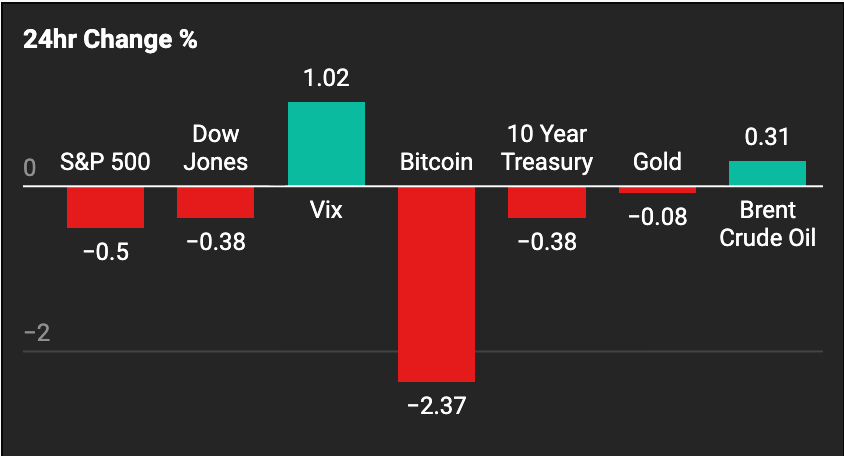

Stocks slid for a third straight day Thursday as Wall Street’s September slump deepened.

The Dow dropped 0.6%, the S&P 500 fell 0.7% for its worst day in over a month, and the Nasdaq tumbled 0.8%.

GDP got a major revision higher to 3.8% annualized growth in Q2, the fastest pace in nearly two years. The upgrade came from stronger consumer spending and business investment, plus a narrower trade deficit. But economists warned growth could decelerate as tariffs, immigration policy changes, and margin pressures bite in the back half.

Jobless claims dropped to 218,000 last week, crushing the 235,000 forecast. The labor market picture remains mixed though: payroll gains averaged just 29,000 monthly over the past three months versus 82,000 a year earlier, with unemployment near four-year highs at 4.3%. Fed Governor Miran pushed for faster rate cuts, arguing the central bank risks economic damage by moving too slowly.

CoreWeave signed a massive $6.5 billion extension with OpenAI, bringing their total partnership value to $22.4 billion. The GPU cloud provider called it "the quarter of diversification" as AI infrastructure demand explodes. The deal comes after Nvidia's $100 billion investment in OpenAI earlier this month, showing how much money is chasing AI compute capacity. AltIndex rates CRWV as a “hold” (48/100 AI Score).

Terawulf earned AltIndex's highest stock rating at 83/100, with revenue and net income growth plus 307% web traffic gains over three months.

Bitcoin is testing support after falling 5.5% over five days. Some Twitter traders are eyeing $90,000 as a potential buy zone before an extended run through 2028, though $70,000 or even $50,000 are on the table in a full recession scenario in their opinions. The crypto selling intensified yesterday when $100 million worth of ETH longs got liquidated in 60 minutes.

Trump unleashed a tariff blitz last night, announcing new duties on pharmaceuticals (100%), kitchen cabinets and bathroom vanities (50%), upholstered furniture (30%), and heavy trucks (25%), all effective October 1st. He also said he thinks interest rates would be at 2% right now if it weren’t for Fed Chair Jerome Powell.

Starbucks is closing iconic locations including its Seattle roastery in a $1 billion restructuring plan as CEO Laxman Narasimhan deepens the turnaround effort. The company is trimming underperforming stores while doubling down on drive-thru and digital ordering. AltIndex doesn’t like the stock, giving it a sell rating (38/100 AI Score).

Housing affordability requires economic extremes to fix, according to Fannie Mae's latest analysis. For homes to become affordable again, either 1) prices must crash 38%, 2) incomes must surge 60%, or 3) mortgage rates need to plummet 415 basis points. All three scenarios would require "something massive" happening to the macroeconomy.

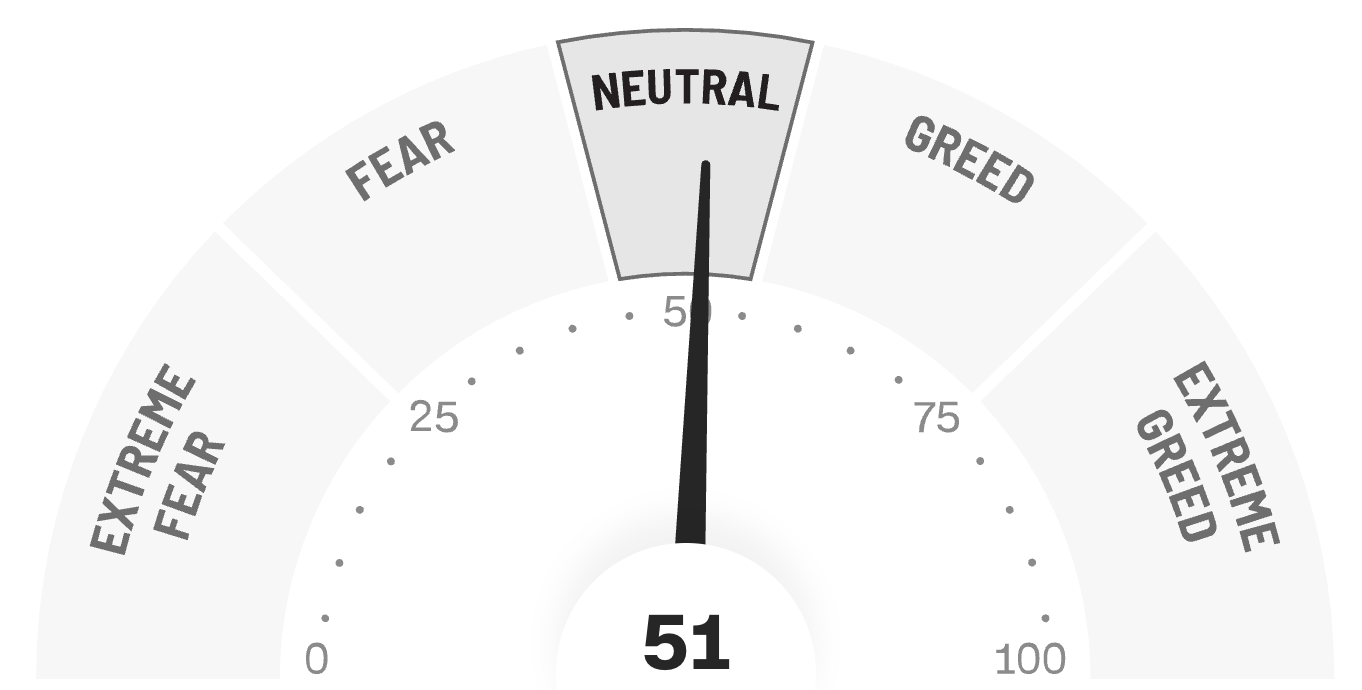

😱 Fear and Greed Index

Markets have been bouncing back and forth between low greed numbers and high neutral territory.

We have not dipped below a score of 50 on the Fear & Greed index since the first days of May this summer.

🪙 Crypto

Bitcoin slid under $109,000, its weakest price in nearly a month, while ether tumbled 8% toward $3,800 and Solana dropped below $200.

Cloudflare announced plans for a NET Dollar stablecoin, fully collateralized by US dollars and aimed at powering automated transactions.

🚨 Trending on Reddit

Reddit discussions around Google's AI advances are heating up, with some suggesting it could become the world's biggest company due to its AI infrastructure edge

Redditors are buzzing about Intel's stock price, with some expressing surprise and skepticism due to Intel's reported solicitation of investment from other companies such as Apple and TSMC. Some Reddit users are profiting from their call options on INTC while others express frustration at what they perceive as an undeserved increase in value given their negative view of the company's products and strategies.

All Reddit analysis provided by AltIndex.

🤫 Insider Trading

📊 IPOs and Earnings

Accenture beat Q4 forecasts with revenue of 17.6 billion and adjusted earnings up 9%; shares dropped 2.4%.

🚚 Market Movers

Amazon agreed to a $2.5 billion settlement with the FTC over “deceptive” Prime sign-ups. The deal includes $1.5 billion in refunds.

Lithium Americas surged 19% Thursday and has doubled after reports that Trump is considering a stake in the miner. The stock closed at $7.16.

Intel approached TSMC about a potential investment or joint venture. The talks follow Nvidia’s $5 billion stake and a $2 billion SoftBank injection.

Eli Lilly won FDA approval for its breast cancer drug imlunestrant (Inluriyo). The oral therapy targets ER+, HER2–, ESR1-mutated cancers.

🎙 What Do You Think?

Is the trade war back with all Trump's new tariffs?

🎤️ What you said last time

“Been there, done that, don't need to go back.”

🧠 The Missing (Market) Links

Former FBI Director James Comey has been indicted.

OpenAI launched Pulse for ChatGPT, a feature that actively researches for you while you work or sleep.

Citadel’s Ken Griffin warned that only half of Trump’s tariffs had hit the economy, saying inflation pain was still coming.

Elon Musk’s xAI hit OpenAI with another lawsuit, accusing it of poaching engineers and stealing trade secrets.

📜 Quote of the Day

Someone’s sitting in the shade today because someone planted a tree a long time ago.”

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.