Editor’s note:

This is the last day Stocks & Income will be sent from Stefan & Wyatt at Alts.co

Starting next Monday, Alts community member Brandon Harris will be taking over the sending.

Brandon’s sports media company Playmaker, was acquired in 2023 for up to $54m, since then he’s dedicated his time to finance.

We’re excited to have Brandon put his energy into growing this newsletter!

The Bitcoin Corporate Treasury Convertible Bond ETF

REX Shares specializes in alternative exchange-traded funds.

BMAX is a pioneering ETF offering investors access to convertible bonds issued by companies that have integrated Bitcoin into their corporate treasuries.

This innovative fund provides a unique blend of debt stability and potential equity upside, allowing investors to engage with the evolving intersection of digital assets and traditional finance.

Why invest in Convertible Debt?

Convertible bonds are hybrid securities that offer interest payments and the potential for equity conversion.

They provide interest yields during the bond's life, with an option to convert into stock if the issuing company's share price exceeds a set conversion threshold at maturity.

This dual benefit structure offers exposure to Bitcoin-related corporate strategies while maintaining a foothold in traditional securities

Details

Ticker: BMAX

Asset Class: US Equity

Fund Inception: NASDAQ, March 14, 2025

Management Fee: 0.85%

Investing involves risk, including possible loss of principal. Investors should carefully consider the investment objectives, risks, charges, and expenses of BMAX before investing. This and other important information are contained in the Prospectus, which can be obtained by visiting the link above. Please read the Prospectus carefully before investing.

📰 Market Headlines

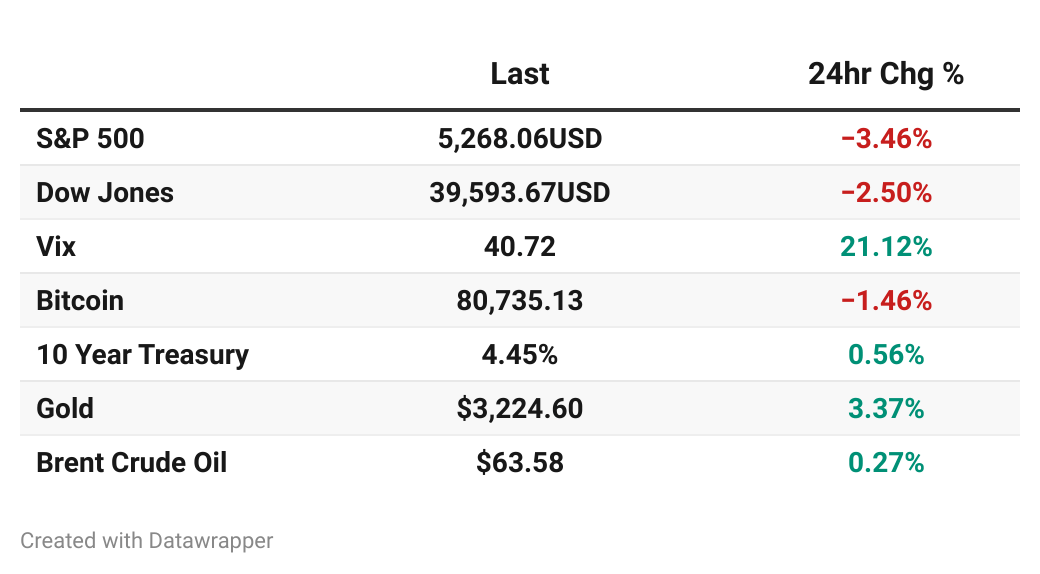

Markets plunged across the board as Wall Street gave back much of yesterday's historic gains.

The S&P 500 tumbled 3.5%, while the Nasdaq plummeted 4.3% and the Dow dropped 2.5%.

The selloff intensified after the White House clarified that total tariffs on China now stand at 145%, not the 125% previously reported.

The European Union matched President Trump's 90-day tariff pause, putting its retaliatory measures on hold and leaving room for negotiations.

March inflation data provided a rare bright spot as the CPI rose less than expected, increasing 2.4% year-over-year versus forecasts of 2.5%

🌏 Alternative investing news

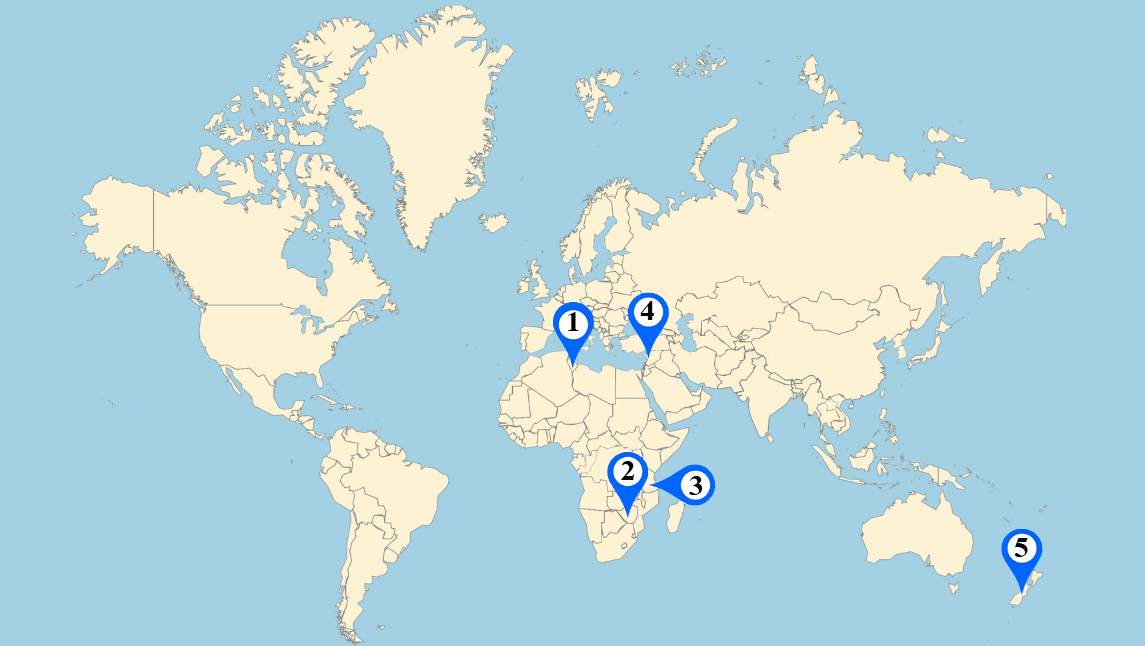

Five weeks ago, when the trade war began in earnest, Wyatt wrote a great issue on diversifying outside the US.

As you've no doubt noticed, the situation has escalated since then.

We, and our members, have taken note. From a Swiss community member this morning:

I am becoming increasingly cautious about investments related to the US or the USD. The odds: Swiss Franc—US Dollar are working against me. Also, the new president doesn't have my trust, to say it nicely. So, this makes me increasingly reluctant to invest in anything related to US relations.

Regardless of how you feel about the tariffs, it's undeniable that the world has changed forever.

There are two ways to approach an increasingly uncertain macro climate:

Go completely risk off, fleeing to the safest thing possible, or

Realize risk is rising everywhere, so you may as well hunt higher returns

Check it out 👇

📊 Ideas, trends, and analysis

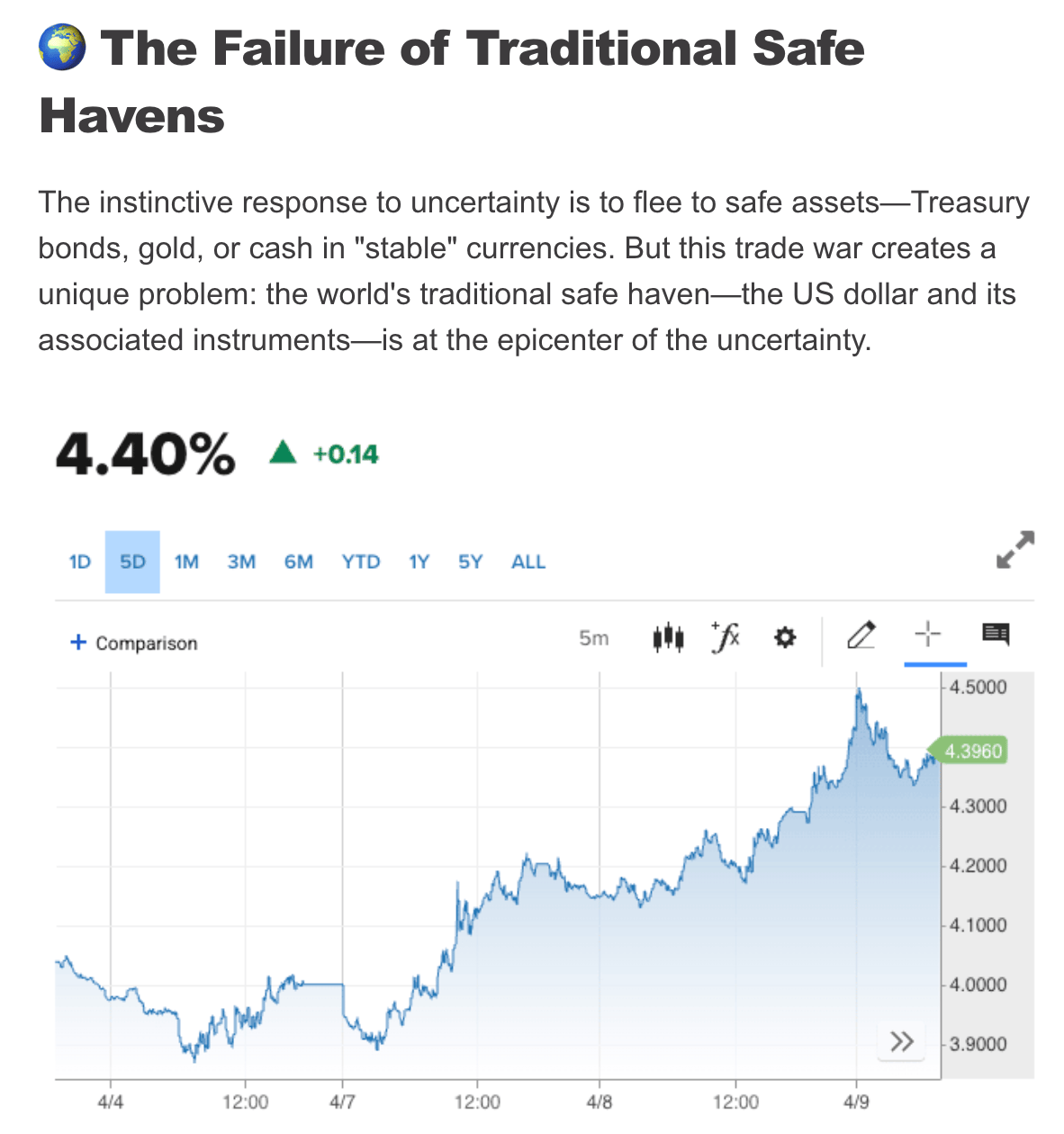

Usually when the market is going down, T-Bill yields also go down, as people move their money this traditionally safer asset class. But over the last three days, something odd is happning.

The 10-year T-Bills yields, already elevated, are continuing to rise…

This may indicate big-time bod investors are getting out of long-term US Treasuries. They did go down a bit after the tariff announcement yesterday, but went right back up again today.

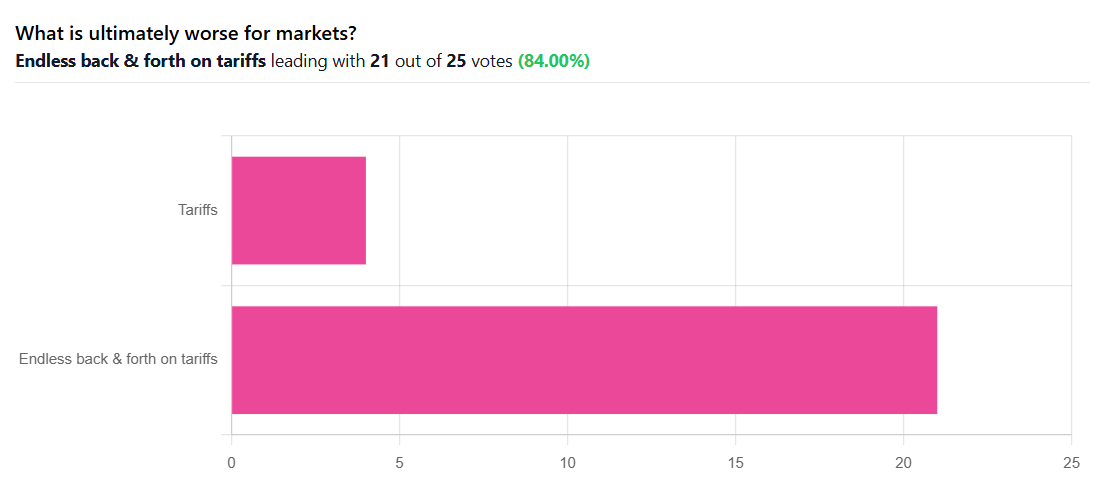

🧠 Make yourself heard

Ok, for the sake of argument, let’s say you think we’re indeed headed towards a recession.

Where are you parking cash?

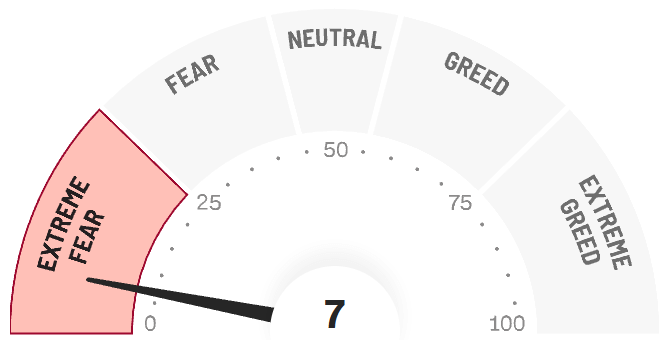

😱 Fear and Greed Index

📊 Earnings this week

CarMax scrapped its long-term goals and missed Q4 profit expectations, citing shifting consumer trends; shares plunged 17%.

Market movers

Novavax shares plunged 22% after Health Secretary Kennedy questioned its COVID-19 vaccine's efficacy.

The Pentagon ended $5.1 billion in IT contracts with Accenture, Deloitte, and others, calling them wasteful consultant spending that staff could handle in-house.

Jeff Bezos-backed EV startup Slate Auto was spotted testing its $25,000 electric pickup truck in Los Angeles.

Google signed a deal with the US government to reduce software prices during broader tech spending cuts.

GSA's tech division begins major layoffs, cutting 50% of staff and eliminating its 18F consulting team.

📊 Crypto

Jack Dorsey's Block was fined $40 million by New York regulators for alleged AML and crypto compliance failures with Cash App.

Paul Atkins was confirmed as the new SEC Chair in a 52-44 Senate vote.

China and Russia increasingly embrace Bitcoin for energy trades.

🌍 Global Perspectives

🇹🇳 Tunisia dismantled dozens of coastal migrant camps housing over 20,000 people hoping to reach Europe.

🇿🇼 Zimbabwe made its first $3 million compensation payment to white farmers whose lands were seized in 2000.

🇹🇿 Tanzanian opposition leader Tundu Lissu was charged with treason after calling for electoral reforms ahead of the October elections.

🇸🇾 Kurdish parties agreed to push for federalism in post-Assad Syria, seeking regional autonomy for their quarter of Syrian territory.

🇳🇿 New Zealand's controversial Treaty Principles Bill was voted down 112-11 after receiving over 300,000 public submissions.

🎤 What you said last time

“I run a biz that gets most of its stuff from china. If there was a semblance of a plan I could make moves. but this just seems like another one of moms drunk boyfriends picking a new religion each week.”

“I don't know if real ‘free trade’ will ever be a thing. Therefore, if tariffs exist, they need to be a mutual agreement between nations to determine amounts that are appropriate for the needs of said nations. But that would mean politicians working for their people...”

🧠 Miscellanea

DOGE reported uncovering $382 million in fraudulent claims from people with impossible birthdates.

Scientists decoded the first ancient DNA from the Green Sahara, revealing a unique North African lineage that remained isolated for 50,000 years.

ESA's Mars Express spotted mysterious moving rocks on the Red Planet, pushed by ancient ice flows across the Martian landscape.

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Or find me in the Alts Community.

Cheers,

Stefan and Wyatt