Good morning.

Tech just had its best day in six months, which is great for the industry overall.

But beneath the surface, Tesla and Google are threatening serious competition with NVDA in the chip space.

In this issue:

Alphabet hit $325 and a near-$4 trillion valuation as Gemini 3 AI beat OpenAI and Anthropic

Tesla rocketed 7% on full self-driving hype and Musk's AI5 chip timeline

Bitcoin limped above $88,000, down 20% from highs, headed for its worst month since the FTX collapse

Let's get into it.

In partnership with Elf Labs

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Please support our partners!

📰 Market Headlines

Markets roared back Monday as tech stocks powered a broad rally.

The Nasdaq jumped 2.7%, its biggest one-day gain since May. The S&P 500 climbed 1.5%, and the Dow added 0.4%.

NVDA lost $300 billion in market cap today because Meta is looking at Google for chips instead. Near on Twitter said “The people have discovered Google had an Nvidia inside of it.” Meanwhile, Tesla’s AI4 chips have already been deployed in vehicles, and its next-gen AI5 chips will hit production by mid-2027. Whether it’s temporary or a long-term shift, Nvidia seems to be losing mind share, if not market share.

Alphabet raced to a record high above $300 to reach $325 for the first time, closing in on a $4 trillion valuation after its latest Gemini 3 AI model impressed analysts and a report that Meta will be using Google’s chips instead of Nvidia’s. The stock jumped over 8% since last week as experts declared Google's new AI capabilities ahead of OpenAI and Anthropic's offerings. Warren Buffett's recent Berkshire investment in the company also drew investor attention.

Twitter trader Luc has named Coinbase (COIN) as a potential buy. He highlighted a mystery announcement coming on December 17th, multiple new unnamed acquisitions, and the fact that Liz Martin, Vice Pres. of Product @ Coinbase (and formerly of Goldman Sachs), wants to “expand $COIN beyond cryptocurrency trading.”

AltIndex just flashed a Reddit alert for Meta, citing increased mentions of the company and the following sentiment analysis:

Tesla rocketed 7% after Melius Research called it a must-own stock due to its full self-driving progress. Regardless of your thoughts on Elon Musk outside of business, he has brought Tesla to a $1.29 trillion market cap, SpaceX to ~$500 billion, and xAI to $243 billion. In our opinion, giving this man a performance-based pay package that requires him to make Tesla the biggest company in history by a factor of 2X (market cap of $10T, twice that of NVDA’s) is extremely bullish long term. Not financial advice, DYOR.

Musk added fuel by announcing Tesla's AI4 chips were already deployed in vehicles and that the next-gen AI5 chips would hit production by mid-2027. The analyst argued autonomy would shift "hundreds of billions in value" to Tesla from struggling legacy automakers.

Amazon is ramping up CapEx while cutting jobs. The e-commerce giant is about to spend $50 billion on AI infrastructure for the US government but is also planning to eliminate 14,000 roles. Here’s an article breaking down the divide from AltIndex →

Abercrombie shares rose 18% after the company posted a double beat as business booms at Hollister. Here were the numbers:

Earnings: $2.36 per share vs. $2.16 per share expected

Revenue: $1.29 billion vs. $1.28 billion expected

Bitcoin edged above $88,000 but remained down over 20% from recent highs as the cryptocurrency struggled to match the broader market rally. Bitcoin ETFs are headed for their worst monthly outflows since launching, with November shaping up to be Bitcoin's worst month since the 2022 crypto collapse that toppled FTX.

🤖 AI/Future/Tech News

OpenAI launched shopping research, a ChatGPT feature that builds detailed product guides using live retail data.

Anthropic launched Claude Opus 4.5, saying it outperformed Gemini 3 and GPT‑5.1 in coding and agent tasks.

Aramco and Pasqal installed Saudi Arabia’s first quantum computer, a 200‑qubit system in Dhahran.

🤫 Insider Trading

🥃 Alternative Investment: Whiskey

Whiskey barrels have become a sought-after asset as institutional investors move into the market. The US whiskey industry reached $5.2 billion in 2024, compounding at 6.6% annually for two decades, with exports hitting $1.3 billion.

Barrel prices fell from over $1,000 in 2023 to around $600, drawing in family offices and private equity funds such as Prospero Spirit Funds and ASM Capital Partners. These groups built laddered portfolios and targeted returns above 20%.

Production dropped 28.3% year-to-date through June 2025, setting up a potential shortage by 2029 that could lift aged-whiskey prices. As Prospero’s founder Ben Bornstein said, “People drink whiskey in good times and bad.”

📊 IPOs and Earnings

Zoom beat Q3 estimates, driven by 6.1% enterprise customer growth, and raised its Q4 earnings guidance; shares climbed 4% in after-hours trading.

StoneX Group posted record annual net income of $305.9 million, a 17% increase, and a record quarterly net income of $85.7 million; its stock jumped 3.93% in after-hours trading.

🎙 What Do You Think?

Will NVDA lose market share to GOOGL's & TSLA's chips?

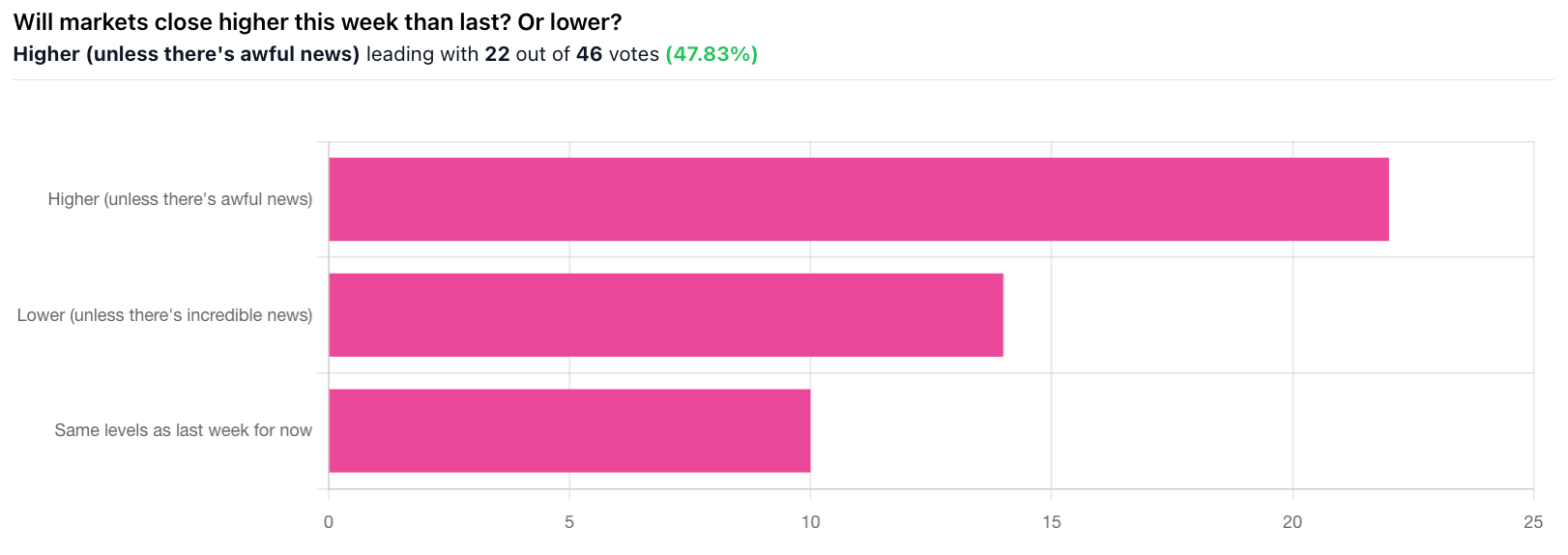

🎤️ What you said last time

“From an analyst's perspective this correction has another week at least.”

🎪Crowdfunding Showcase

Lumi is turning every wall into a movie screen. Founded by the former GoPro CMO who helped scale that brand to an $8B IPO, the company builds portable projectors that transform backyards, vans, and classrooms into immersive theaters. It hit $1.1M in first-year revenue with 55% margins and has contracts with the SEC, Philadelphia Phillies, and Valero PGA Tour.

The new Lumi Max is the first US-based projector with native Google TV integration, backed by a team with experience at Red Bull, Google, and Tesla. Early-bird allocation: $121,439 remaining.

🧠 The Missing (Market) Links

Ukraine just agreed to a peace deal with Russia; no word from Russia yet though.

US bottled water sales soared as health-focused shoppers ditched soda, with premium and eco-friendly brands cashing in.

The heavy lifting equipment market jumped from $31.5 billion to $55.9 billion in projected value by 2035, fueled by automation and green tech.

Nearly half of insured Americans got surprise bills last year, and one doctor revealed how to dodge the next one.

📜 Quote of the Day

If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.