The War in Ukraine, a Billion-Dollar Drug, and the 20-Year Patent Arbitrage

On Behalf of BioNxt Solutions Inc.

Good morning.

The story of BioNxt Solutions (CSE: BNXT | OTCQB: BNXTF) isn't a typical biotech tale of a drug discovery in a lab. It begins thousands of miles away, during the early days of the war in Ukraine.

When Russia invaded, a highly respected oncologist lost everything: his advanced laboratory, his manufacturing factory, and years of specialized research into targeted chemotherapy. Instead of walking away from his life's work, he chose to relocate and pivot. He partnered with BioNxt, bringing his deep expertise in drug formulation and oncology to their innovative oral thin film technology platform.

This partnership is the key to the entire operation. It fuses world-class pharmaceutical expertise with a disruptive drug delivery system.

The first major target of this new collaboration is a proven, high-value drug: cladribine.

Cladribine is the active ingredient in Merck's multiple sclerosis pill, Mavenclad®, which generates over $1 billion in annual sales and costs patients upwards of $60,000 per year. The problem? Merck's patent on the pill expires in 2026.

Here is where the arbitrage opportunity emerges: BioNxt has filed broad, foundational patents on that exact same drug (cladribine) but delivered as a needle-free, dissolvable strip that melts under the tongue. This reformulation could grant them patent protection that runs into the 2040s.

For multiple sclerosis patients, nearly half of whom suffer from difficulty swallowing (dysphagia), this new delivery format is a major quality-of-life upgrade. And instead of banking on getting a new drug approved, BioNxt is simply putting an already-successful treatment into a more-accessible form (and they’re doing it with other drugs, too).

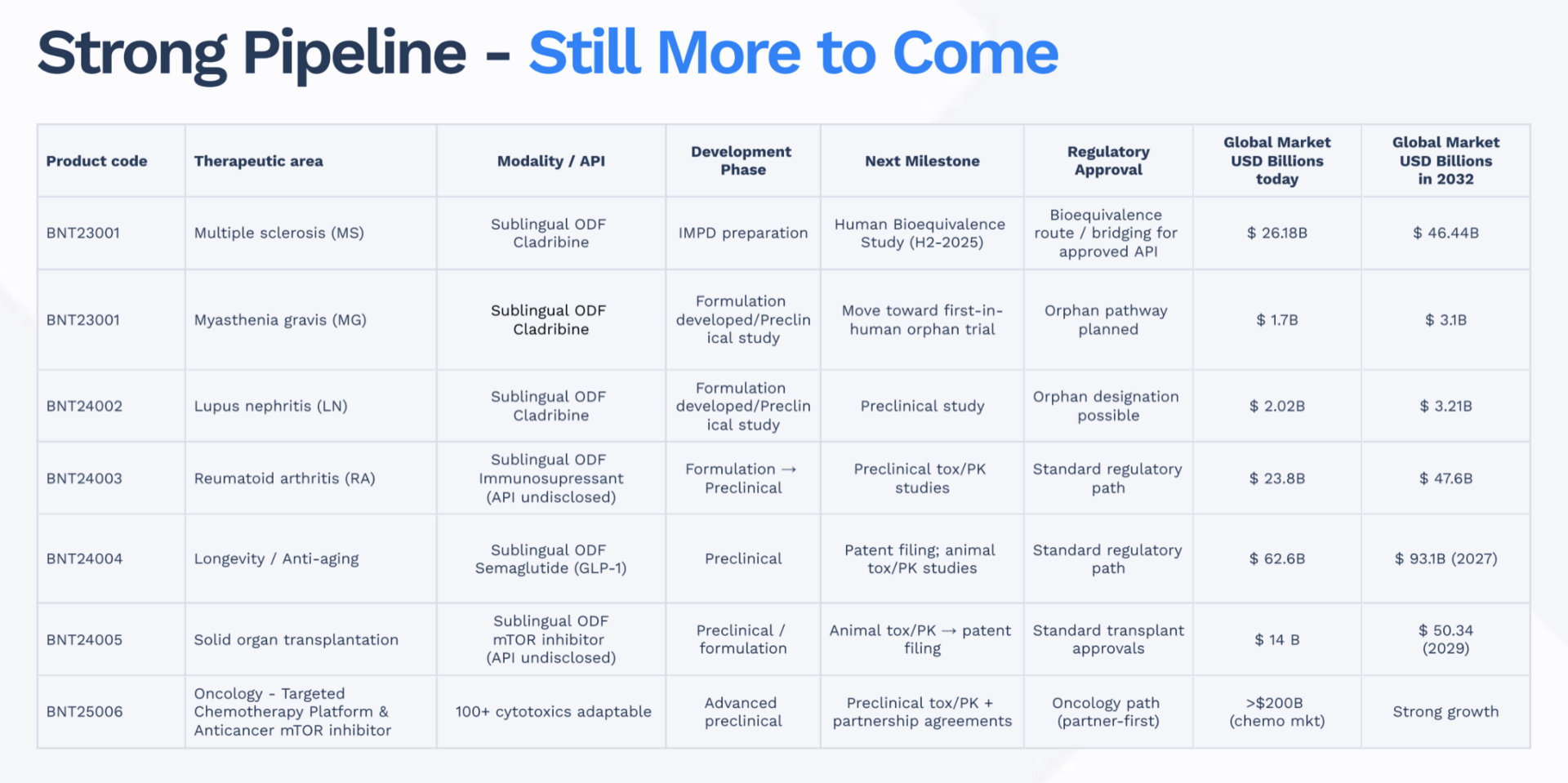

Below, we detail how BioNxt's "thin-film" platform works, why it's a lower-risk development strategy, and how their pipeline of six programs across major therapeutic markets, from MS to the exploding GLP-1 (obesity) sector, makes the company's current small-cap valuation noteworthy.

The Problem: When Pills and Needles Fail

Traditional drug delivery methods are surprisingly inefficient:

Pills must survive the stomach, meaning a large amount of the drug is lost before reaching the bloodstream.

Needles introduce cost, complexity, and patient aversion.

For a disease like multiple sclerosis, up to 43% of patients suffer from difficulty swallowing (dysphagia), according to meta-analyses, making traditional oral tablets a poor fit for a significant portion of the market.

The Thin Film Solution

Oral thin films effectively address all three problems. They dissolve in seconds under the tongue, delivering the drug directly into the bloodstream through the rich blood vessels in the mouth. This sublingual delivery gets around metabolism issues in the gut and liver, possibly improving bioavailability and allowing for a lower overall drug dose. This rapid, patient-friendly administration, which requires no water, is an ideal upgrade for patients who struggle with swallowing or need medication on-the-go.

BioNxt's strategy is low-risk, high-reward: take proven, billion-dollar drugs and simply reformulate them into this superior delivery system. This approach means faster development timelines, cheaper trials (as the drug's safety profile is already known), and the same massive market upside.

The $360 Billion Pipeline: Six Programs, One Platform

BioNxt’s proprietary thin-film technology has allowed them to rapidly advance a diverse pipeline of six treatments across some of the most lucrative therapeutic areas in pharmaceuticals.

1. Multiple Sclerosis Film: The Flagship Program

BioNxt’s cladribine thin film targets the same $1 billion+ annual market as Merck’s Mavenclad®. The critical difference is the patent runway: Merck’s exclusivity ends in 2026, while BioNxt's patents could extend into the 2040s. A human bioequivalence trial, the final step before potential regulatory submission, is scheduled for early 2026. If successful, results are expected in weeks, not years, positioning BioNxt to capture market share immediately as generic competition floods the tablet market.

2. The Next Wave: From Autoimmune to Obesity

Beyond MS, the company is applying its thin-film approach to other multi-billion-dollar markets:

Immunosuppressant Oral Film: Targets rheumatoid arthritis and myasthenia gravis, for patients who struggle with current pill or injection therapies.

Semaglutide Oral Film: BioNxt has completed a working prototype for a semaglutide thin film. If successful, this taps directly into the exploding GLP-1 market, projected to hit $150 billion by 2030 for diabetes and obesity treatments.

Targeted Chemotherapy Platform: Leveraging the expertise of its Ukrainian oncology partner, this platform is designed to concentrate drugs directly at tumor sites, sparing healthy tissue. The global oncology market is projected to reach $360 billion by 2034.

The Core of the Investment Thesis: Patent Arbitrage

BioNxt’s business model centers entirely on Intellectual Property (IP) Arbitrage. They are not looking to invent a drug, but rather to invent a better way to take a pre-existing drug. By reformulating the drug into an oral film, they secure new, broad patents (which the European and Eurasian patent offices have already indicated they intend to grant). These patents cover the method of delivery, effectively extending the drug's commercial life by two decades.

The arbitrage: Merck's Mavenclad patent expires in 2026. BioNxt's cladribine film patents could run until the 2040s. That’s the core opportunity.

Valuation and Catalysts: A Discounted Pipeline?

Most biotech companies with a single experimental drug in early-stage trials (Phase 1 or Phase 2) often trade at market capitalizations in the billions. BioNxt, with its six programs across major, known markets, trades at a fraction of that: it has a US$75 million market cap at time of writing.

The company is focused on a leaner, faster-to-market strategy: reformulation plays are inherently lower-risk than discovering new molecules. The key question for investors is:

If the flagship MS treatment is successful in the 2026 human trial, does the market immediately re-rate BioNxt to a valuation as large as its single-program biotech peers? If so, the potential upside is substantial.

Take a look at BioNxt’s competitors below. BNXT’s market cap would need to grow by 764x just to match the valuation of its smallest competitor, Merck.

Company | Symbol | Drug | Market Cap (USD) | Peak Annual Sales | Patent Expiration |

AbbVie | NYSE:ABBV | Humira | $402B | $20B | 2023 |

Novartis | NYSE:NVS | Gleevec | $252B | $5B | 2016 |

Eli Lilly | NYSE:LLY | Zyprexa | $745.5B | $5B | 2011 |

Novo Nordisk | NYSE:NVO | Ozempic Wegovy Rybelsus | $237B | $14B $4.5B $2.7B | 2032 |

Merck KGaA | OTC:MKKGY | Mavenclad | $57.9B | $1.1B | 2026 |

BioNxt Solutions | CSE:BNXT OTCQB:BNXTF | BioNxt Oral Film Platform | $75.29M | N/A | 2040+ |

Key Catalysts

Near Term (6-12 months): Final patent nationalization in the U.S., Canada, and other major markets. Launch of the human bioequivalence study for the MS program.

2026-2027: MS bioequivalence trial results (expected within weeks of trial completion). Merck's Mavenclad patent expiry creates a clear market opening for a new, patient-friendly alternative.

The Bottom Line

The data points to a massive total addressable market and a lower-risk strategy to capture it. The patents create a multi-decade runway.

Can the company execute on the vision in the 12-18 months ahead? That's what active investors will be watching.

For a full breakdown of the science, the patents, and the company’s valuation, click here:

⭐️ What did you think of today's edition?

Disclosures

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.