Good morning.

This year, retail traders weren’t behind the curve. We beat Wall Street.

New data shows retail investors had their best year since the 1990s, outperforming professionals who've long dismissed them as "unsophisticated." Retail's biggest win? Buying the April tariff dip faster than institutions did.

In today’s edition (our last of 2025):

Warren Buffett retires today after 60 years and a 3,950,000% return

How to use Bitcoin to harvest tax losses before year end

Meeting minutes reveal an even more divided Fed

Let's close out the year strong.

In partnership with AltIndex

New Year, New Portfolio

Most New Year's resolutions about building wealth fail by February.

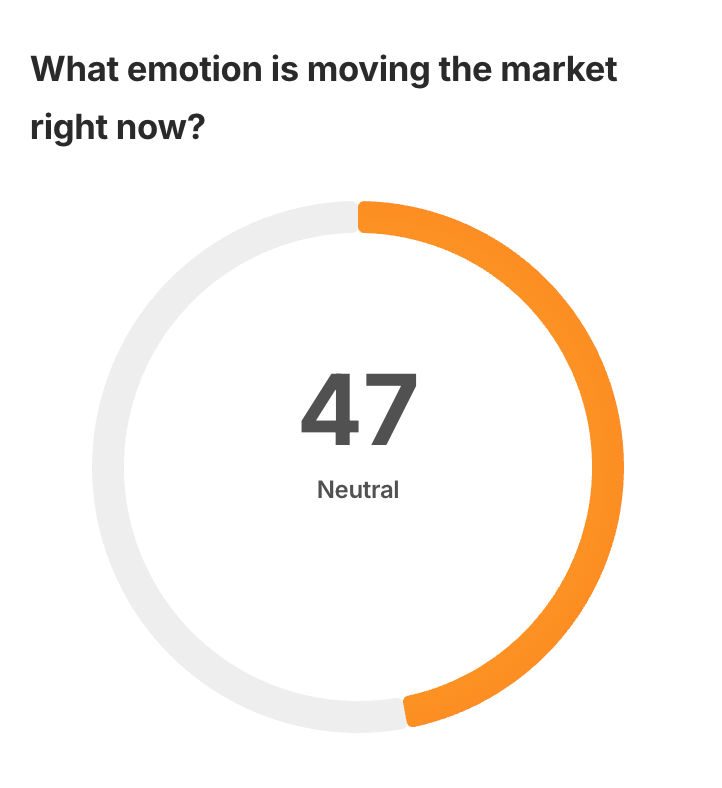

Make 2026 different. Stop gambling on gut instincts. Start using the data that actually moves markets.

AltIndex tracks Reddit sentiment, Congress trades, insider activity, and hiring trends. Then our AI analyzes it all to generate stock ratings.

The results: Our AI-powered picks beat the S&P 500 by nearly 30% during a 6-month test in 2025.

Right now: 50% off for an entire year. That’s less than 30 cents per day.

This is a New Year's deal, so it won't last long. Get the same alternative data and AI stock picks that outperformed the market, at half price.

Use code ALTNEWYEAR26.

Please support our partners!

📰 Market Headlines

US stocks fell slightly on Tuesday.

The S&P 500 dropped 0.1%, the Dow slid 0.2%, and the Nasdaq declined 0.2% in the penultimate trading session of 2025.

Retail traders beat Wall Street in 2025 and had their best year since the 90s. “Once thought of as unsophisticated and easily duped, a new breed of retail investor is giving the professionals who have long dismissed them a run for their money, according to investors and market data analysts interviewed by CNBC.” This is the type of investing community we want to keep building, and we’re so grateful for all of you. That is our mission, and out-trading Wall Street is the way for retail traders to get ahead. Here’s to 2026 🍻

Retail’s biggest win was buying the dip on April tariff lows quicker than Wall Street did. While institutions hesitated, retail traders pounced, and the rebound proved them right.

“Retail is just getting smarter, and they’re getting hardened to the market,” according to Mark Malek, Siebert Financial investing chief. That’s right, we are! See the full breakdown of how retail won 2025 →

Warren Buffett's final day as CEO marks the end of a 60-year run that took Berkshire Hathaway shares from $19 to $750,000; a 3,950,000% increase. But Buffett didn't wind down during his final years. He rebuilt Berkshire's entire financial structure from the ground up: selling 74% of his Apple stake, buying 5% of all US Treasury bills, and repositioning the company for the next two decades. Here's the full list of massive changes Buffett made to set Berkshire up for the next 20 years →

Greg Abel, Berkshire's current Vice Chairman of Non-Insurance Operations, takes over tomorrow. Buffett has said he'll still come into the office.

Don’t forget that crypto has no wash sale rules, so you can use Bitcoin to harvest tax losses. so (for example) you could sell your Bitcoin that’s down for the year, book a capital loss for taxes, and then buy the BTC back immediately (Ankur Nagpal). Note: this only works with crypto. Stocks have wash sale rules. And this isn't financial or tax advice; consult a CPA before executing any tax-loss harvesting strategy.

Fed minutes revealed deep divisions among officials over their December rate cut decision. The 9-3 vote to lower rates by 25 basis points was closer than it appeared, with some supporters admitting the decision was finely balanced and they could have voted to keep rates unchanged. Officials are split on future cuts, with most requiring inflation to decline before considering additional easing.

NVIDIA is in advanced talks to acquire Israeli AI startup AI21 Labs for up to $3 billion. The chip giant's primary interest is AI21's 200-person workforce of AI specialists with advanced degrees. NVIDIA previously invested in AI21's $1.4 billion funding round in 2023 alongside Google.

Platinum surged toward its biggest monthly gain in 39 years, jumping 33% in December alone. The metal hit a record $2,478 per ounce on Monday after the EU's reversal on its 2035 combustion engine ban extended demand for autocatalysts. Platinum rallied 146% for the year, its largest annual gain on record.

🤖 AI/Future/Tech News

The Tesla Model Y is the top selling vehicle in the world for the third year in a row, according to Elon Musk.

However, Tesla Q4 deliveries re expected to drop 13% per Visible Alpha poll, with full-year deliveries down 7.8%.

The Virgin Islands sued Meta over scam ads that internal docs show could generate $16 billion annually.

🪙 Crypto

The SEC charged firms over a $14 million fraud run through 'exclusive' WhatsApp investment clubs.

A hacker started laundering $4 million in ETH stolen from Unleash Protocol through the Tornado Cash mixer.

Chinese users are bypassing local crypto restrictions with viral, stablecoin-linked "U cards".

🤫 Insider Trading

❓Market Trivia Corner

Which Warren Buffett fact is FALSE?

🎤️ What you said last time

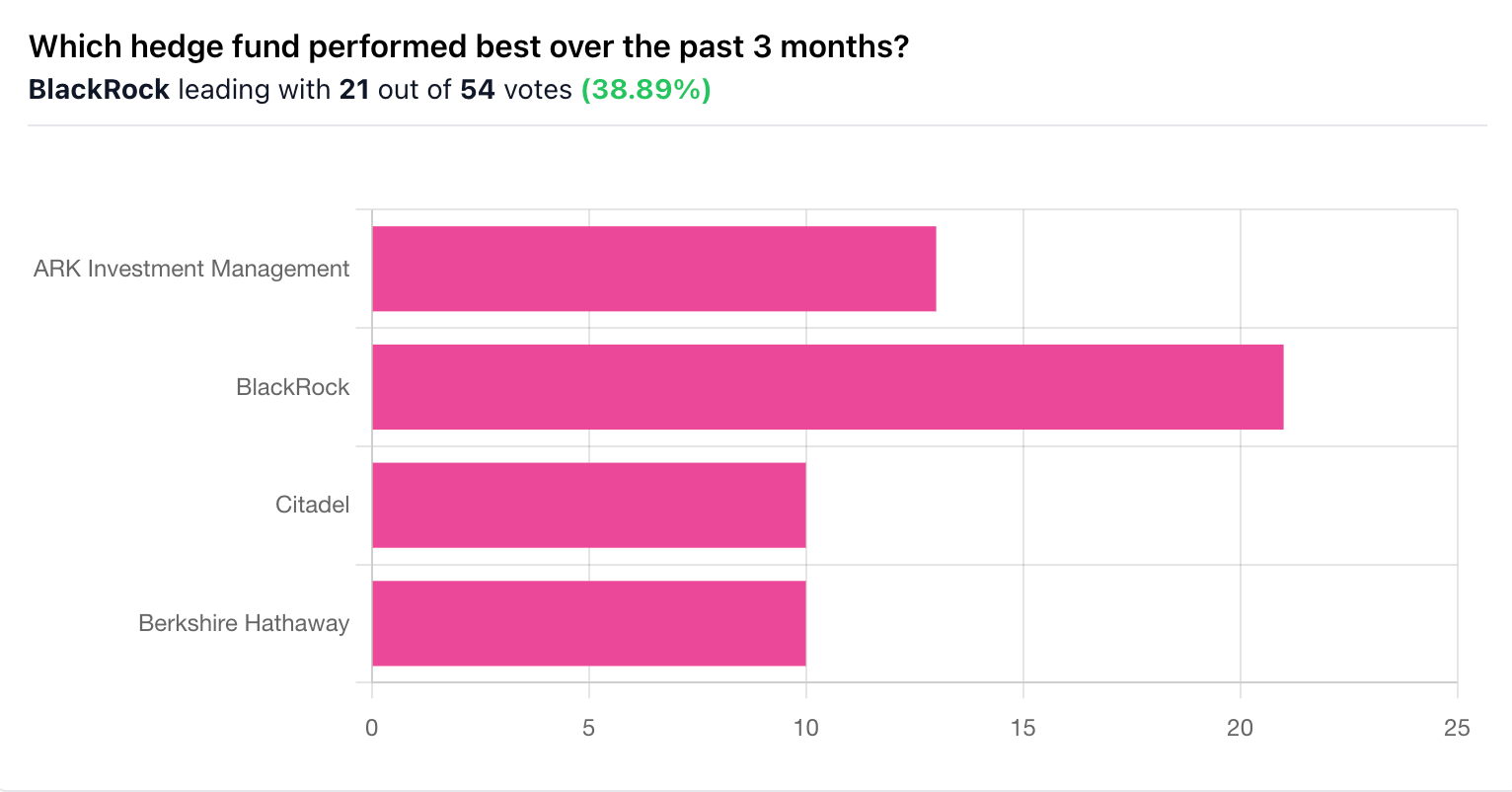

Blackrock was the correct answer, but ARK was surprisingly close. Also, typo; the time frame was meant to be 3 years, not 3 months. Apologies. Still, many of you got it!

Blackrock: +133.99%

ARK: +127.39%

🧠 The Missing (Market) Links

The Somali daycare fraud allegations have led the Dept. of Health and Human Services to freeze all child care payments to the state of Minnesota.

An in-depth list of random quality of life improvements that could truly change the way you live.

The WSJ let Anthropic’s Claude AI run a vending machine, and the model gave away a PlayStation and bought a live fish.

Today is Tiger Woods’ 50th birthday, so here are the 50 best shots of Tiger’s career (PGA Tour).

Seafood is getting stolen in New England: Forty-thousand oysters, lobster worth $400,000, and cache of crabmeat, according to ABC.

China approved 44 firms to export silver through 2027, expanding its list as prices hit record highs and global supply chains brace for impact.

📜 Quote of the Day

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: Flickr, TEDizen

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance doesn’t guarantee future results.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.open