Good morning.

The US-NATO relationship is fracturing. Or at least that's what President Trump wants markets to think.

Trump is making massive moves: threatening 200% tariffs on French champagne, promising 25% tariffs on NATO allies, calling the UK's Chagos Islands decision "an act of GREAT STUPIDITY," and posting images showing Greenland and Canada as part of the USA.

But here's the pattern we've seen repeatedly: Trump threatens tariffs → markets drop → Trump announces diplomatic talks → markets recover. He just posted that he plans to meet "various parties" in Switzerland this weekend.

Is this a dip to buy? There are at least 13 high-quality stocks down in premarket that could reverse on diplomatic progress.

In today's edition:

13 stocks down premarket that could surge on NATO resolution

Serenity's breakdown of 10 stocks that profit from NATO implosion

More on all of it below.

In partnership with Wispr Flow

Investor-ready updates, by voice

High-stakes communications need precision. Wispr Flow turns speech into polished, publishable writing you can paste into investor updates, earnings notes, board recaps, and executive summaries. Speak constraints, numbers, and context and Flow will remove filler, fix punctuation, format lists, and preserve tone so your messages are clear and confident. Use saved templates for recurring financial formats and create consistent reports with less editing. Works across Mac, Windows, and iPhone. Try Wispr Flow for finance.

Please support our partners!

📰 Market Headlines

Markets were closed for MLK Jr. Day, but gold and silver rocketed to new record highs as President Trump's Greenland push fueled fears of a damaging US-Europe trade war.

Spot gold surged as much as 2.1% to nearly $4,700 an ounce, while silver jumped 4.4%. Gold has now rallied about 70% over the past year, with Citigroup forecasting $5,000 within three months.

The TACO Trade Is in Play: here are 13 Stocks to Watch. President Trump's Greenland tariff threats rattled markets Monday. The damage:

NATO allies: 10% tariffs starting Feb 1, rising to 25% by June unless the US gets Greenland

France: Threatened 200% tariffs on wine and champagne

UK: Called their Chagos Islands decision "an act of GREAT STUPIDITY"

Symbolic? Posted images of Canada and Greenland as part of the USA

Many stocks fell as much as 8% in premarket trading. Smart traders are asking: Is this a dip to buy? Because these stocks’ fundamentals haven't changed.

What happens next? This mix of conditions follows the classic TACO trade pattern:

Trump threatens tariffs

Markets sell off

Trump announces diplomatic talks (← we're here now)

Markets recover

Trump just posted he'll meet "various parties" in Switzerland this weekend. If history repeats, we're at the beginning of step 3… right before the recovery.

These include:

ONDS, HOOD, EOSE (all down 2-8% premarket)

Plus 9 others with strong fundamentals despite the selloff

But, to play devil’s advocate: here’s Serenity's deep dive on X: Which stocks actually benefit from an all-out NATO trade war.

President Trump linked his Greenland push to losing the Nobel Peace Prize, texting Norway's PM that he "no longer feel[s] an obligation to think purely of Peace" after the committee gave the 2025 prize to Venezuelan opposition leader Maria Corina Machado instead.

The EU is weighing retaliation, including tariffs on €93 billion ($108 billion) of US imports and possible deployment of its "anti-coercion instrument," which could target US investments, banking activity, and digital services.

Deutsche Bank flagged a nuclear option: Europe holds $8 trillion in US bonds and equities. Selling those assets could spike US borrowing costs and tank equities.

Most analysts doubt Europe would actually weaponize its holdings. The bulk sits with private funds, and dumping them would hurt European investors too.

🤖 AI/Future/Tech News

An xAI employee who did what looks like an unauthorized podcast detailing the company’s inner workings and plans has now stepped down.

AMD CEO Lisa Su thinks that AI compute will increase by 100x in just the next 4-5 years, while AI users explode from 1 billion to 5 billion people.

OpenAI CFO declared 2026 the year of "practical adoption". Revenue jumped from $2 billion to over $20 billion since 2023.

Canada lifted 100% tariffs on Chinese EVs, allowing up to 70,000 Tesla imports within five years at 6.1%.

🪙 Crypto

Bitcoin has been consolidating between $80,000 and $98,000 for 59 days, approaching the 60-day window that historically triggers breakout rallies.

Bermuda announced plans to become a "fully on-chain" economy, partnering with Coinbase and Circle to pilot stablecoin payments across government agencies and expand USDC adoption among local businesses.

Animoca Brands' Yat Siu says NFTs are not dead, with wealthy crypto collectors still driving the market.

🚚 Market Movers

The US and Taiwan signed a trade deal requiring $250 billion in Taiwanese semiconductor investment on US soil. Taiwan gets tariffs capped at 15% and duty exemptions for companies building new chip capacity stateside.

The Trump administration slapped a 25% tariff on advanced AI chips like NVIDIA's H200 and AMD's MI325X, citing national security. Automotive and data center uses are exempt for now, but broader semiconductor tariffs loom.

Micron broke ground on its $100 billion megafab in New York, the largest semiconductor complex in US history. The project is expected to create 50,000 jobs statewide, with manufacturing set to begin in 2030.

🎙 Make yourself heard

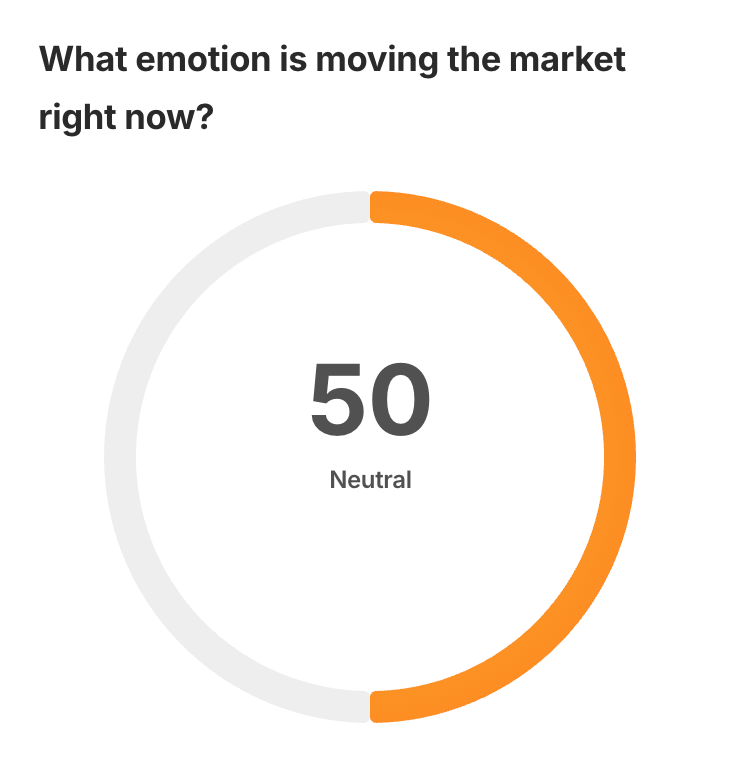

TACO trade or all-out trade war with NATO?

🎤️ What you said last time

“Money is a tool, and it’s utility should be able to be used to secure the most basic of needs such as permanent shelter.”

🧠 The Missing (Market) Links

Walmart still won't accept Apple Pay in US stores, pushing customers toward its QR code system to collect transaction data.

Retiring at 65 requires $2.2 million in Hawaii versus $735,000 in Oklahoma to cover basic expenses for 25 years.

Wellness travel is shifting toward "purposeful" experiences as younger travelers demand tech-enhanced treatments and impactful wellness trips.

📜 Quote of the Day

📢 We want to hear from you.

Your feedback matters to us! Let us know what you liked or didn’t like about today’s edition.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance doesn’t guarantee future results.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.open