Good morning.

Real estate has always been a way for investors to diversify their portfolios and to access huge amounts of leverage in the form of mortgages.

That’s all fine and dandy—but with median home prices near all-time highs, not every investor is interested in or able to tie up $400,000+ in a home over the next 5 years to seek a return. And with real estate crowdfunding apps like Yieldstreet getting beaten up in the news (for good reason), it’s tough to know just how risky the “democratized” investing options are.

So today, we’re covering 6 ways that you can gain exposure to real estate through investing, renting, and lending—without buying a home, and with as little as $50 to invest.

In today’s edition:

🧑🌾 Time to Farm Yields

📈 AltIndex’s Top 3 REITs

🌽 Lend a Hand (and Make a Cut)

💾 Real Estate on the Blockchain?

🏘️ Rental Arbitrage Is not Arbitrary

😬 Crowdfunding—Big Risk

Let’s begin.

1. Farmland

Over decades of data, farmland has proven to be a historically high-yield, low-risk asset—and there are several platforms out there that allow you to invest fractionally in entire farms to make passive income. The statistics are compelling: $100 invested in farmland in 1990 would be worth about $2,321 today.

Chart: AcreTrader

Farmland investment returns have averaged 11% since 1990 with less than half the volatility of stock market investments (which average a 17% return). The only thing with higher returns than stocks? REITs (real estate investment trusts), which we’ll cover below.

AcreTrader is a well-known platform that enables investors to diversify into real estate and to make money in two ways at once: through increasing land value over time and through rent payments from farmers. (This is not an ad, and gains are not guaranteed—do your own research.)

Details

Minimum investment amount: $15,000

Requirements: Accredited investors only

Typical property holding length: 3-10 years

2. REITs

Public REITs (real estate investing trusts) are a way for investors to get exposure to real estate with nothing more than a stock brokerage account. Simply put, an REIT is a “company that owns, operates, or finances income-producing real estate,” according to Nareit. Most REITs pay dividends, so they’re a great fit if you’re an income-focused investor specifically.

We will say that REITs tend to be more correlated with the stock market than straight-up real estate investments are (because they are literally traded on stock exchanges), but they’re still a way to diversify your portfolio.

Equity REIT companies make money by buying properties, leasing them out, and collecting rent. Mortgage REIT companies make money from (you guessed it) mortgages—specifically from the interest they charge on the money they loan out.

Here are AltIndex’s top REIT stock picks right now:

Prologis $PLD

Prologis, Inc. (NYSE: PLD) is a global leader in logistics real estate, with a focus on high-barrier markets and high-growth hubs around the world. The company specializes in owning, managing, and developing logistics properties.

The data:

AI Score: 76/100

Dividend yield: 3.74%

Congressman Thomas H. Kean bought shares (July)

93% positive employee outlook

31% increased web traffic

8.76% revenue growth YoY

33.68 decrease in net income YoY

2.28% increase in EBITDA

Equity Residential $EQR

Equity Residential operates as a real estate investment trust. It engages in the acquisition, development, and management of rental apartment properties, which includes the generation of rental and other related income through the leasing of apartment units to residents.

The data:

AI Score: 70/100

Dividend yield: 4.24%

28% increase in job postings

Web traffic up 22%

5.86% revenue growth YoY

8.38% increase in net income YoY

2.43% increase in EBITDA

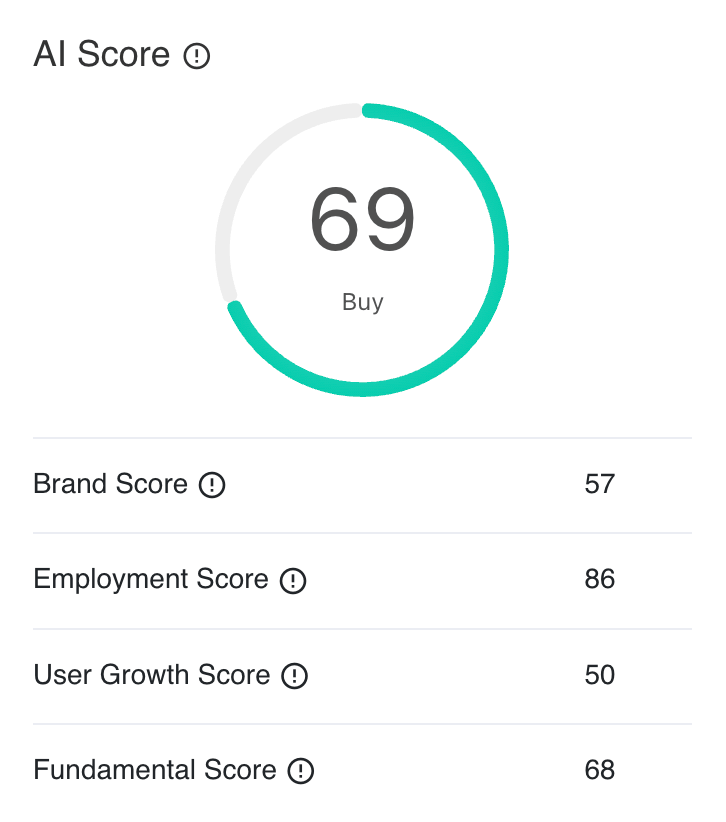

Arbor Realty Trust $ABR

Arbor Realty Trust (NYSE: ABR) is a Real Estate Investment Trust (REIT) primarily involved in the origination and servicing of residential and commercial mortgage loans. The company employs a diverse business model that includes mortgage banking, structured finance, and investment in single-family rental properties.

The data:

AI Score: 69/100

Dividend yield: 12.8%

Lots of insider buying this year

100% increase in job posting

82% employee business outlook

80.77% decline in revenue YoY

58.52% decrease in net income YoY

32.72% decrease in EBITDA

3. Real Estate Lending

If you’re interested in an even more consistent form of yield, you can look at investing in debt—some real estate lending platforms allow investors to crowdfund loans to businesses and earn money from interest over time as the loan is repaid.

The great thing about real estate lending platforms is that they’re a way to diversify into the real estate industry without much capital—some platforms only require $100 minimum (and you don’t have to be accredited).

The not great thing about them is that you’re only able to earn yield from the loan; you don’t co-own the land, and won’t make any money from it directly.

Steward is a platform that lets you participate in crowdfunded loans to farmers specifically. The loans tend to go to smaller family farms (per The Modest Wallet), and investors usually receive monthly payments until the loan matures. It’s an easy way to earn passive income—just keep in mind the risk of farmers defaulting on their loans (which is possible with any type of debt investment).

Current opportunity: The Evergreen Campaign

Minimum investment amount: $100

Requirements: All investors welcome

Loan duration: 9 months

APR: 6.5%

$29,325,603 raised so far

4. Tokenized Real Estate (Blockchain-Based Exposure)

Blockchain technology has made it possible to buy and sell “shares” of real estate on-chain by tokenizing properties using smart contracts and allowing investors to trade them just like crypto or stocks. This technology is still (relatively) new, but there are several platforms out there already—and the industry is set to grow, according to Deloitte:

Source: Deloitte

This type of asset is a part of the greater RWA (real-world asset) trend, where real assets are tokenized and made available for trading on the blockchain. Tokenization opens up liquidity where there was none before, lowers the barrier to entry, and still allows you to invest in specific, singular properties rather than getting a share in a company with hundreds of properties. Owning tokens in rental properties also earns you rent payments, too, so this can be a true source of passive income.

However, there are also potential downsides: the technology is still relatively new, so you need to extensively vet out any platform you might use for this. Also, the ease of entry into these investments also makes them easy to exit—so the other thousands of users who are invested in a property alongside you may not have the level of conviction that an actual homebuyer would. And of course, the quality of the properties available for investment is totally up to the platform that you’re using, so you may only be offered C- and D-tier properties (this is the same problem that crowdfunding platforms face).

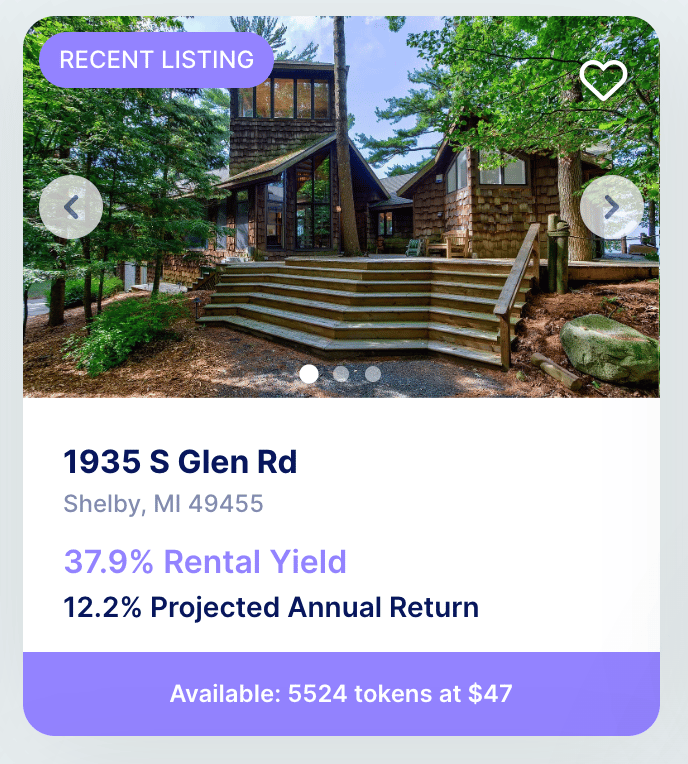

Here’s an example of a tokenized real estate opportunity on Lofty.ai:

Source: Lofty.ai

One of Lofty.ai’s tag lines is “Buy and sell real estate as effortlessly as trading a share of TSLA,” and the platform does seem to follow through on that promise. They offer 150 properties in 40 markets starting at a minimum of $50 (or less, depending). Lofty pitches its services as a “path to financial freedom.” We don’t know if we buy into that hype—but as much as any financial investment can be, it might serve as a step along the way or a tool for diversification.

Details

Minimum investment amount: $50

Requirements: Open to all investors

150 properties available

Earn passive income through rent payments

5. Rental Arbitrage

If you have more of an entrepreneurial spirit (and don’t mind being told “no”), you might consider trying rental arbitrage. This is the process of renting a home or apartment from a landlord and, instead of living in it, turning that property into an investment of your own by using it as an AirBnB (or similar platform).

Source: Open Grid Scheduler, Flickr

Obviously, this technique requires asking for full permission from your landlord, and their answer will depend on a range of factors from individual preferences to risk tolerance. You may be told “no” many times, but all you need to do is secure one “yes,” and then you can begin.

Your initial goal is to break even by making the AirBnB successful enough to cover the rent that you’re paying the owner—and from there, everything else is profit for you (or capital to reinvest in the space, or put into your next BnB, etc.). Rental Arbitrage may sound simple, but as with many business ideas, what’s simple on paper translates to hard work and challenges in the real world. But if you can find a good rental in a popular area and put in some hard work, you have a chance at creating a successful investment.

6. Crowdfunding

And finally, we have the real estate investing vehicle that has made some not-so-great headlines recently (looking at you, Yieldstreet). Crowdfunding apps have been touted as the “democratization of real estate investing,” but one of the main criticisms users throw at them is that they choose low-quality properties to invest in.

Now, it’s worth acknowledging that any real estate investing opportunity where YOU do not have control of what property is being invested in could be potentially dangerous. However, if you are not an expert in real estate, choosing your own property could also be dangerous. That’s kind of just how investing works, no? And you need to decide if you know what you’re doing, or if you trust someone else to know what they’re doing, or if you should stay away entirely.

You’re more than welcome to explore these apps if you want, and they are a legitimate way to diversify your portfolio and get exposure to real estate; it’s just a question of how high-quality the properties and management are, so be careful. You probably already know the app names, but here are some of them if you want to take a look on your own: Fundrise, RealtyMogul, Groundfloor, and CrowdStreet.

Bottom Line

Investors have been diversifying their portfolios with real estate since the 1930s (in its modern form, at least), and there are more options for getting into it now than ever before.

Here’s how we’d match the six options we covered to different investing styles:

🥵 High risk: Crowdfunding, tokenized real estate, rental arbitrage

😯 Medium risk: REITs, farmland

☺️ Low risk: Real estate lending

⭐️ What did you think of today's edition?

🫡 See You Next Week

That’s all for today’s special edition. We hope you got value from it—reply and let us know if you did.

Until next week,

— Brandon & Blake

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.