Good morning.

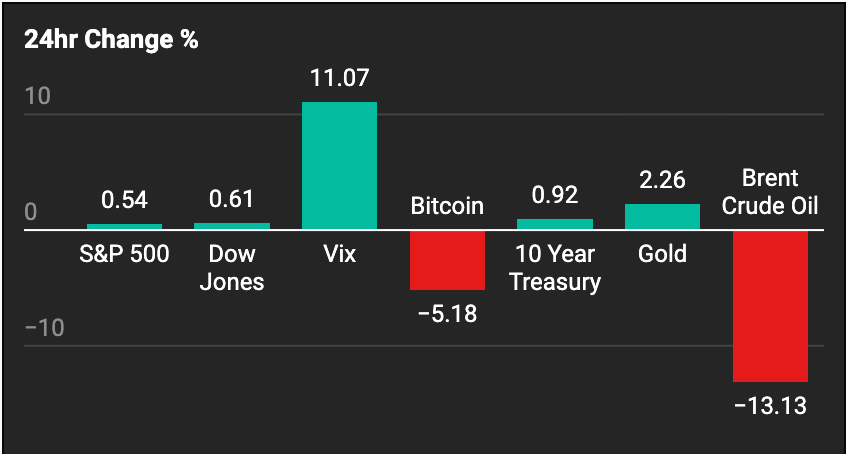

Japanese yen carry trade unwinding → US 10-year treasury yield rising → stocks and crypto falling again.

But hints of a new Fed Chair and rising rate cut odds for December have silver breaking through all-time highs.

And Intel (INTC) is outside of all expectations, smoking the market with a 10% rise almost out of nowhere.

Big week ahead. Let’s get into it.

In partnership with Elf Labs

Make Every Ad Dollar Work Harder

Great measurement is pointless if you don’t act on it.

BlueAlpha is the AI Action System for Marketing, built to turn noisy data into weekly, campaign-level moves your team can actually take. Not dashboards. Not stale reports. Actions.

Every week, BlueAlpha delivers transparent, trusted recommendations your team can approve in minutes. Reallocate. Scale. Cap. Pause. All backed by Bayesian MMMs, causal tests, and explainable AI from the team that built Tesla’s growth systems.

Brands like beehiiv, MUBI, and Klover, use BlueAlpha to cut waste, compound ROI, and grow faster.

Please support our partners!

📰 Market Headlines

Markets are down pre-market today after moving back toward record highs last week.

Dow futures are down 0.4%, while S&P 500 and Nasdaq futures are down 0.6% and 0.7%.

Crypto has fallen again too: Bitcoin is down 6.4% over the last ~10 hours, and Ethereum is down 7.3% over the same time period.

AI stocks cooled in November. Meta fell 13%, Nvidia dropped 8%, and Oracle slid nearly 30%. Google gained 20% after strong earnings and reports of a chip deal with Meta.

Japan’s 10 year bond yield may have contributed to the crypto selloff and the spike in the US’s own 10 year. The Japanese 10 year rose to its highest level since 2008 (1.84%) after the Bank of Japan hinted at rate hikes. The 10 year yield rising signals that Japanese investors might be more interested in earning safe, guaranteed yields from the government rather than investing their money in foreign markets.

Intel (INTC) rose 10% on Friday after an analyst predicted it would make a chip deal with Apple; the stock has sustained its rise today during pre-market trading.

Black Friday set a new online spending record. U.S. consumers spent $11.8 billion online, up from $10.8 billion last year, according to Adobe Analytics. Shoppers spent $12.5 million per minute between 10 a.m. and 2 p.m., and Cyber Monday is expected to top $14.2 billion.

Silver hit a new all-time-high price of $58/ounce. The main catalysts are 1) that markets expect Trump to announce a more dovish Fed chair and 2) industrial demand is rising for the metal, according to The Economic Times.

A CME outage froze global futures trading on Friday after a cooling system failure at a Chicago data center. Trading resumed by 8:30 a.m. ET, restoring activity across commodities, FX, and equity futures. Analysts said the timing limited the impact.

Putin signaled openness to peace talks on Ukraine, saying a U.S.-backed draft plan could form the basis of a deal. Moscow’s comments followed reports that Kyiv had tentatively agreed to a 19-point framework. Energy and defense traders are watching for signs of de-escalation, which could decrease the valuation of energy and defense stocks.

Here’s every bullish and bearish catalyst right now as we see it.

Bullish:

New Fed Chair to be announced

$2,000 tariff dividend checks next year

Black Friday online consumer spending broke records

December rate cut odds at 90% (Polymarket)

Russia-Ukraine peace talks

Crypto looks fundamentally good, though it keeps dropping

Hedge funds are buying the dip

Bearish:

AI industry circular funding

More and more industry execs are sounding alarm on AI bubble

Michael Burry’s big short on AI

Japanese yen carry trade is unwinding

Private credit industry looks shaky

Doesn’t matter if crypto looks fundamentally good if it keeps dropping

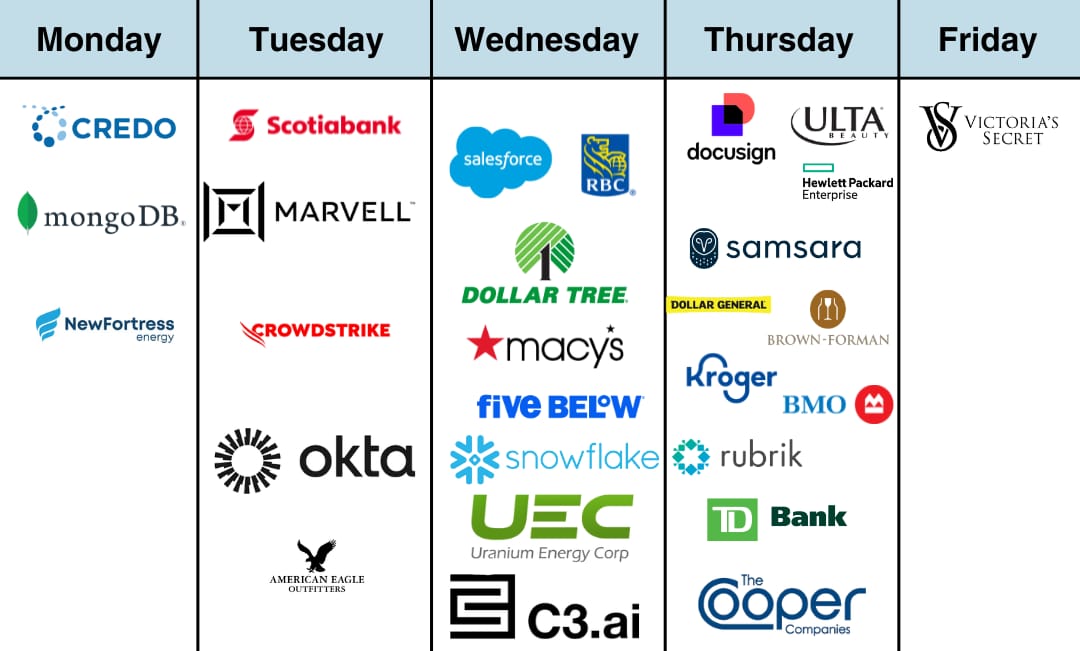

This week in earnings:

Today: Credo Technology (CRDO), MongoDB (MDB),

Tuesday: BHP Group (BHP), Crowdstrike (CRWD),

Wednesday: Okta (OKTA), Salesforce (CRM), Snowflake (SNOW), UiPath (PATH), C3.ai (C3)

Thursday: SentinelOne (S), Ulta Beauty (ULTA), Toronto Dominion Bank (TD)

In partnership with AltIndex

Last Chance: AI Beat the S&P 500 by 27.5%?

Ending today, get every piece of backroom stock data that CNBC is NOT telling you about (for 50% off).

AltIndex is running their Black Friday + Cyber Monday deal for half-off market signals, stock ratings, and unlimited data sets.

1 subscription, ½ the price, 100% of the alternative data. Ends today.

Get social media stock sentiment, hiring data, web traffic, and more. Sign up here:

Please support our partners!

🤖 AI/Future/Tech News

AI startup valuations exploded this year with back-to-back rounds doubling or tripling within months.

Google's Gemini 3 sent the stock soaring 6% as users praised it over ChatGPT.

Micron (MU) pledged $9.6 billion for a new AI memory chip plant in Japan. The company aims to start construction in May 2026.

🪙 Crypto

Visa teamed up with Aquanow to expand stablecoin settlement across CEMEA, pushing its stablecoin volume to a $2.5 billion annualized run rate.

China’s central bank reaffirmed its crypto ban and warned that stablecoins pose money-laundering and financial-stability risks.

The UK’s latest budget confirmed crypto reporting rules taking effect on January 1.

Trending on Reddit

Cava mentions spiked 3300% in a day. Redditors are split between “next Chipotle” dreams and overcooked hype.

Super Micro Computer chatter surged after a 16% drop, with users arguing over AI server demand and short-term profit taking.

Starbucks threads lit up as shares slid 6%, sparking debate over whether pumpkin spice season has lost its magic.

First Solar mentions climbed after an 8.5% dip, with energy bulls and bears clashing on solar’s staying power.

📊 IPOs and Earnings

🎙 What Do You Think?

Will Japan's economy collapse?

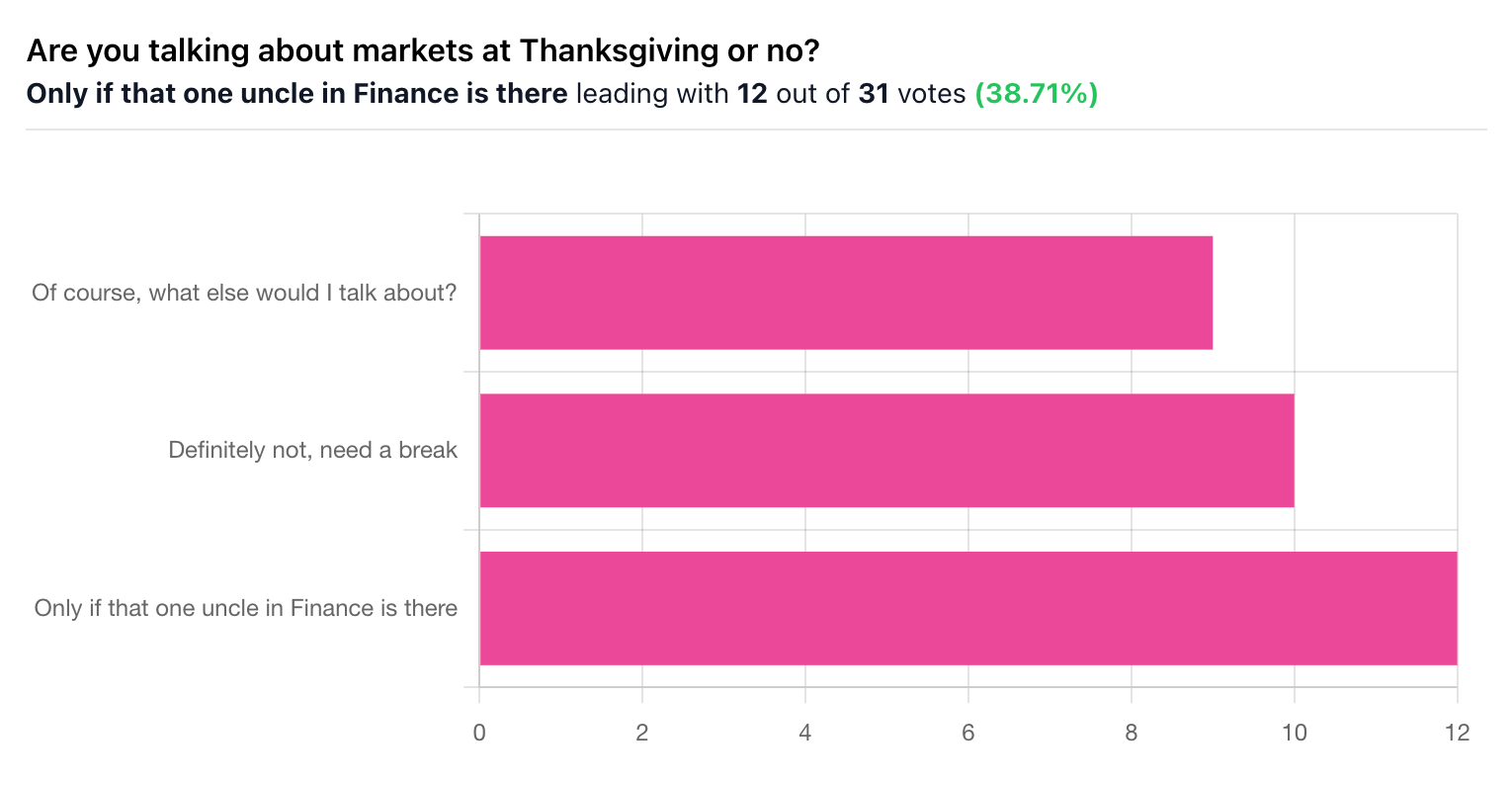

🎤️ What you said last time

“I...think I'm that uncle in my family, which is kind of scary since I'm not in finance and some family members are. Yet they all talk to me like I know anything”

🎪Crowdfunding Showcase

Mercor, the algorithmic trading infrastructure startup, is offering accredited investors a limited opportunity to participate through a secondary SPV on Republic. The deal provides indirect exposure to Mercor’s Series A preferred equity at a $10B post-money valuation. After factoring in a 10% placement fee and an 8% one-time management fee at the first layer, the effective entry valuation lands near $12B.

The two-tier SPV structure keeps ongoing costs minimal, with the second layer charging no management fee and a 5% carry. Accredited investors only.

🧠 The Missing (Market) Links

See the lesson Warren Buffett’s learned about investing from baseball.

Read the “untold story” of the final years of Charlie Munger (Warren Buffett’s business partner).

New York’s pricing law forced companies to disclose when algorithms set prices using personal data.

Millennials drove a $707B sports tourism boom, spending thousands to travel for pickleball, tennis, and surf trips.

📜 Quote of the Day

“Opportunities multiply as they are seized.”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.