Good morning.

We’re three days into 2026, but traders on Twitter have been building up their conviction on top 2026 stock plays for a lot longer than that.

Today, we’re sharing stocks that 3 traders with a reputation for picking well have highlighted.

Timeframes range from short term to swing trade to year long.

Trading styles? Everything from social arbitrage to value investing to tech-maniac growth monster trading.

Let’s begin.

Not financial advice. Always do your own research, and past performance doesn’t guarantee future results.

In partnership with Alts.co

These guys go way beyond stocks and bonds

Alts is the go-to newsletter for investors who are tired of the same public market ideas.

Each week, Stefan and Wyatt surface real opportunities in overlooked asset classes — from tequila barrels, to K-Pop music rights, to film financing bridge loans.

This isn’t just a newsletter though. They create special purpose vehicles (SPVs) so you can invest directly into each deal alongside the community.

If you’re an accredited investor, Join 135,000 subscribers and see what you’ve been missing.

Please support our partners!

Why Listen to Twitter Traders?

Great question. We don’t share these trade ideas with the intention of saying “You should buy whatever these guys say!”

The point is that Twitter is a platform where people with opinions and philosophies about the market that you wouldn’t hear elsewhere get a platform. They can say whatever they want, and a lot of Twitter traders are just plain bad and wrong.

But the ones who prove themselves over time? We are at least interested in hearing their stock picks and takes on current market dynamics.

But the overall idea is that this is just another part of the due diligence process.

So, without further ado… here are some of the first big 2026 stock picks we’ve seen on Twitter:

1. Shay Boloor’s Tech Growth Monster Lineup

You may know of Shay for calling a bunch of AI, quantum, and space stocks correctly and making a fortune off of it.

Well, true to his roots, the man is still convinced that those sectors will define the future of our economy, and he made a big post about how important the SpaceX IPO (valued at ~$1.5T) will be for all space-related stocks. Or at least the successful ones.

The stocks he listed as “getting repriced” (a hint at the growth he sees coming):

Redwire (RDW)

Rocket Lab (RKLB)

Planet Labs (PL)

AST SpaceMobile Inc (ASTS)

Space companies are still highly speculative, but that does mean there’s a possibility that they actually could rise along with SpaceX. There’s also the possibility that they could fall, though.

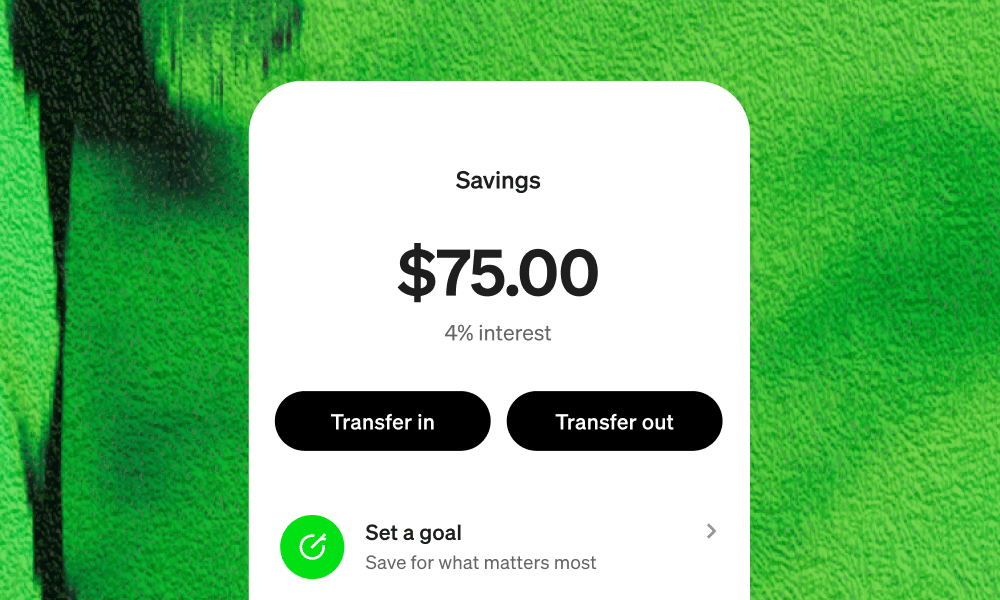

Unlock Cash App’s highest savings interest offer of up to 3.25%.

Customers can qualify for Cash App Green by spending $500 in Qualifying Purchases using your Cash App Card or Cash App Pay per month, or by depositing $300 of Qualifying Deposits per month. Eligibility restrictions apply to some benefits. See Terms and Conditions (https://cash.app/legal/us/en-us/tos) for more information.

To earn the highest interest rate on your Cash App savings balance, you need to (a) have a Cash App Card, or sponsor one or more sponsored accounts, and qualify for Cash App Green or (b) have a sponsored account with sponsor approval. Customers can qualify for Cash App Green by spending $500 in Qualifying Purchases using your Cash App Card or Cash App Pay per month, or by depositing $300 in Qualifying Deposits per month. See terms and conditions for more information on how to qualify.

If you are signed up to earn interest, Cash App will pass through a portion of the interest paid on your savings balance held in an account for the benefit of Cash App customers at Wells Fargo Bank, N.A., Member FDIC. Exceptions may apply. Savings yield rate is subject to change.

Cash App is a financial services platform, not a bank. Banking services provided by Cash App’s bank partner(s). Prepaid debit cards issued by Sutton Bank, Member FDIC. See Terms & Conditions. Eligibility restrictions apply to some benefits. See Terms and Conditions for more information.

2. The Olympics, $LULU, and Luc

The winter olympics are coming up in February, and Twitter trader Luc has a stock pick thesis to go along with it. Call it simple if you will, but the logic seems to make sense.

Lululemon has had a bad year (down 43.38%), but that’s the great thing here: it’s a new year!

It’s also true that Michael Burry is big on $LULU right now. Whether that makes you more bullish or more bearish about it totally depends on what you think of Burry, though.

2.5. Luc’s Chinese Technology Play

The US might be in a deadlock race against China in the AI field, but that isn’t stopping US investors from getting exposure to Chinese AI companies in their portfolios.

Luc sees Chinese tech ETF $KWEB doing quite well in 2026. We’ll see if he’s correct!

3. Liquid Capital’s $GLXY Essay

We’ve referenced this stock pick before, but wanted to resurface it on the New Year. Galaxy Digital (GLXY) is a fascinating stock that sits at the intersection of AI and crypto. In this thesis, Duncan (Flood Capital) lays out how he thinks GLXY could go from $30 to over $250 over the next 3-7 years:

That’s an obscene amount of upside that he sees; hard to believe, no? Well, would you have believed it if someone told you that Robinhood (HOOD) would soar from $8.10 in 2023 all the way to $148.67 last year?

We’re not saying that this will happen for GLXY. Just that it’s possible. And when smart people lay out 1,000-word theses on Twitter about a stock they’re bullish on, we’re intrigued.

You should check the essay out for yourself and let us know what you think!

🎤 What are your thoughts?

Are you interested in any of these stocks/themes?

Bottom Line

Just because someone on Twitter talked about a stock does not mean you should buy it. However, if someone makes some good points about a stock that you hadn’t considered before, why not read what they had to say and evaluate it for yourself as you do your own research?

That’s our philosophy, anyway.

Happy Saturday!

⭐️ What did you think of today's edition?

📰 Want to Advertise In Stocks & Income?

Interested in sponsoring our newsletter and putting your brand in front of 100K+ readers?

Reach out to us here, we’d love to talk:

🫡 See You Next Week

That’s all for today’s special edition. We hope you got value from it. Reply and let us know if you did.

Until next week,

— Brandon & Blake

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance is not indicative of future results. All investing involves risk, including the loss of principal.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.