🔔 The Opening Bell

Good morning.

After returning from a visit to China this month, Nvidia CEO Jensen Huang said that President Trump is “America's unique advantage that no country could possibly have,” and then explained himself.

Meanwhile, on the trade war front, President Trump just struck a deal with the EU. European stocks are breathing easier, and German automakers are calling it a win (while paying billions).

But for investors, the real story is what comes next: Big Tech earnings are rolling out this week, and they’ll likely set the tone for the next quarter.

More on the trade shake-up and this week's earnings avalanche below. But first, today’s partner is bringing an alternative investment opportunity to the table: walnut trees.

🌳 Invest in Walnut Trees

And harvest profits for 40 years.

The Walnut Fund lets you finance actual walnut trees that produce high-quality nuts for decades, and get a share of profits from harvested walnuts, processed products (like walnut oil and walnut butter), and eventually, the mature timber itself. 🪵

How it Works

You fund planting. Your capital funds the planting of walnut trees on pre-vetted farmland in Serbia.

Hands-off, passive investing. The Fund handles everything: Maintenance, harvesting, sales, and logistics.

Get dividends for 40 years. You receive annual payouts starting year ~5. These continue for up to 40 years

Get a final share of proceeds. At the end of their life, the trees are harvested for timber.

Why Invest in Walnuts?

Walnuts are a durable, high-demand crop with an exceptional shelf life.

They’re less water-intensive than almonds

Far less volatile than coffee or cacao

Sell for over $2,500/ton on global markets (This is 2x higher than palm oil)

The timber is valuable too — it’s prized for furniture and interior woodwork, with mature logs fetching up to $12,000 per tree.

Express Interest

This is one of the most interesting and unique deals we have seen all year.

The trees are insured, and even replaced if they fail to take root. You just share in the upside.

Express interest below.

Both accredited & non-accredited investors are eligible.

📰 Market Headlines

US stocks ended higher on Friday, with the S&P 500 and Nasdaq closing at record highs.

The Dow rose 0.4%, the S&P 500 gained 0.3%, and the Nasdaq climbed 0.5%.

The US and China will meet in Stockholm Monday to extend their tariff truce ahead of the August 12 deadline. Without an agreement, duties could skyrocket beyond 100% and disrupt global supply chains.

Mag 7 members Microsoft, Amazon, Apple, and Meta will all be reporting their earnings for Q2 of 2025 this week. Here’s what the numbers might look like, as well as thoughts on why Apple has been underperforming →

Trump’s presidency is making huge investments and taking positions in key companies—he holds the golden share in US Steel (which basically nationalized the country) and the Pentagon has invested $400 million in MP Materials. This level of government investing is “rarely seen in the U.S. outside wartime or economic crisis,” according to CNBC.

Deputy Attorney General Todd Blanche conducted nine hours of meetings with convicted sex trafficker Ghislaine Maxwell over two days but made no public statements about the outcome.

President Trump clinched a major EU trade deal, with European leaders accepting a 15% tariff on exports to the US while committing to $600 billion in American investments and significant purchases of US energy and military equipment. One of the sectors affected most by the deal will be EU automakers. The German Association of the Automotive Industry calls it a fundamentally good deal, even though it will cost them millions. Here’s why→

Are tariffs helping or hurting Americans?

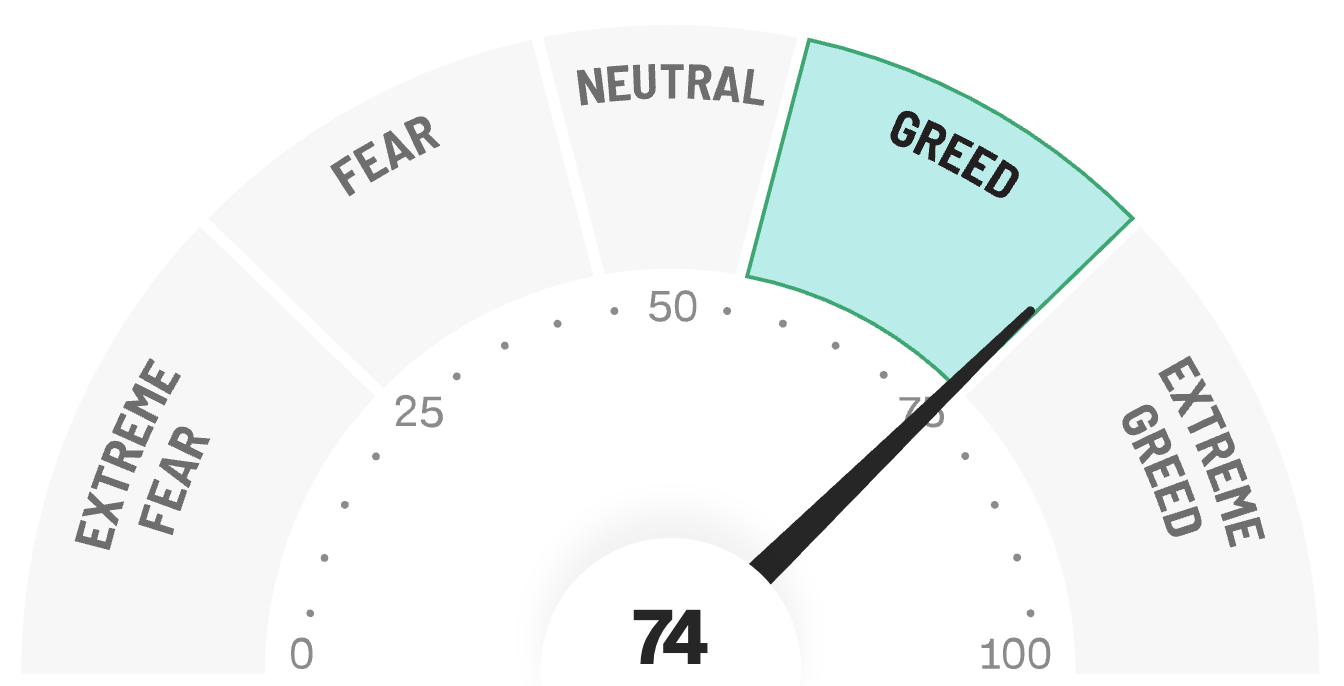

😱 Fear and Greed Index

🧠 The Missing (Market) Links

🌃 Astronomer hired Gwyneth Paltrow, Coldplay’s lead singer’s ex-wife, as its “very temporary” spokesperson in a funny PR video response to the “kiss cam” controversy.

🏥 Healthcare M&A activity slumped 18% in the first half of 2025 compared to the same period last year, with 12 of 18 healthcare sectors seeing fewer closed deals.

😎 Here’s why a four-day work week actually makes people happier.

😨 “Quishing” is on the rise—a new type of scam involving QR codes.

💳 About 67% of newlyweds used financing for their weddings, with 24% charging their ceremonies on credit cards.

💸 The South claims six spots among the 10 worst states to retire.

🤡 Meme Stocks

Jim Cramer claims that GameStop has cleaned up its balance sheet, saying the company has “now gone all crypto.”

Business Insider asked ChatGPT “What's the best way to identify what could be the next meme stock?"

GAP’s mentions on r/WallStreetBets are up 700% according to AltIndex—but the total is still only 40 mentions in the past 24 hours.

🪙 Crypto

Venture capital firm Dragonfly faces potential charges over its 2020 investment in Tornado Cash developer PepperSec.

Hong Kong's new stablecoin bill activates Friday, positioning online brokers like Futu Holdings to capitalize on institutional crypto trading.

Vietnam unveiled NDAChain, a national blockchain processing 3,600 transactions per second through 49 validator nodes operated by government agencies and private companies.

The TRON-based $TRUMP token was deployed this week, using LayerZero and Stargate protocols to enhance cross-chain liquidity.

💰 Alternative Investing News

KKR entered advanced acquisition talks to purchase ST Telemedia Global Data Centres in a deal valuing the Asian digital infrastructure provider at more than $5 billion.

A new infrastructure finance report highlighted major investment shifts post-COVID, as governments faced shrinking fiscal space.

Sudan's gold production is forecasted to reach 37 ton for the first half of 2025, potentially generating 403 billion Sudanese pounds in revenue.

🤖 AI/Future/Tech News

Anthropic discussed a staggering $150 billion valuation in its latest funding round, marking a significant milestone for the AI company.

China unveiled plans for a new global AI cooperation organization to counter US influence, with Premier Li Qiang warning that AI risks becoming an "exclusive game" of a few countries and companies.

Revival Healthcare Capital and Olympus Corporation announced a joint $458 million investment in their co-founded company Swan EndoSurgical to develop endoluminal robotics for gastrointestinal treatments.

🌍 International Markets

🇨🇳 China's industrial profits fell 4.3% in June compared to a year earlier amid persistent producer deflation and subdued domestic demand.

🇰🇷 South Korea roared to become 2025's hottest major stock market, attracting significant foreign investment as regulatory reforms force accountability on board members and challenge the dominance of family-run conglomerates.

🇷🇺 Russia's Central Bank cut its key interest rate from 20% to 18% on July 25, marking its second reduction after nearly three years of consecutive hikes.

🎤️ What you said last time

🚚 Market movers

Paramount’s $8 billion merger secured FCC approval, sparking discussions on potential political influence and $2 billion in cost-cutting measures.

Tesla signed a deal with Samsung for $16.5 billion in semiconductors.

Alibaba is launching AI glasses to compete with Meta’s product.

Chevron sealed its $53 billion acquisition of Hess, expanding its footprint in key oil-producing regions like the Bakken and Permian Basin.

IonQ, the quantum computing firm, hired JP Morgan’s (former) head of applied research as their new senior vice president of industry relations.

Eli Lilly’s Verve buyout is completed, aiming to transform cardiovascular treatment with genetic medicines.

More job cuts:

TCS announced a reduction of over 12,000 jobs, primarily affecting middle and senior management, driven by shifts in AI and tech.

Duke University planned involuntary layoffs following nearly 600 voluntary buyouts, citing federal funding cuts.

📊 Earnings

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt

Thumbnail image: Michael Daddino, flickr

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.