Good morning.

Here's a stat that should make you pause: between April and September of this year, the S&P 500 rose 19%. Solid returns by any measure.

Reddit's top 15 most-mentioned stocks? They rose 60% in the same period.

You would have tripled the market's returns by tracking what retail investors were talking about on Reddit. Not trading on memes. Not following hype blindly. Just paying attention to where conversation was intensifying.

And before you say that we’re abandoning fundamental analysis or just throwing our portfolio into whatever r/WallStreetBets is pumping this week, let us be clear: we are just making the argument that social sentiment data has become a legitimate leading indicator. And it’s one that hedge funds already use, and that traditional retail investors ignore a lot of the time.

Today we're breaking down how Reddit mention data actually correlates with stock performance, and how you can integrate it into your research process without turning into a meme stock gambler.

And AltIndex is offering our readers a 7-day free trial of their app, so you can try out every strategy we’ll cover today for yourself.

In today's edition:

📈 Real examples: PLTR up 139%, NBIS up 104% after Reddit spikes

🔍 Why mention increases often precede price moves

⚠️ How to separate signal from noise (not every spike matters)

🔔 The alert system that summarizes what Reddit is actually saying

📊 Integrating social data into your existing due diligence

Let's begin.

In partnership with Long Angle

How High-Net-Worth Families Invest Beyond the Balance Sheet

Every year, Long Angle surveys its private member community — entrepreneurs, executives, and investors with portfolios from $5M to $100M — to understand how they allocate their time, money, and trust.

The 2025 High-Net-Worth Professional Services Report reveals what today’s wealthy families value most, what disappoints them, and where satisfaction truly comes from.

From wealth management to wellness, from private schools to personal trainers — this study uncovers how the top 1% make choices that reflect their real priorities. You’ll see which services bring the greatest satisfaction, which feel merely transactional, and how spending patterns reveal what matters most to affluent households.

Benchmark your household’s service spending against peers with $5–25M portfolios.

Learn why emotional well-being often outranks financial optimization.

See which services families are most likely to change — and which they’ll never give up.

Understand generational differences shaping how the wealthy live, work, and parent.

See how your spending, satisfaction, and priorities compare to your peers. Download the report here.

Please support our partners!

The Cases That Make You Pay Attention

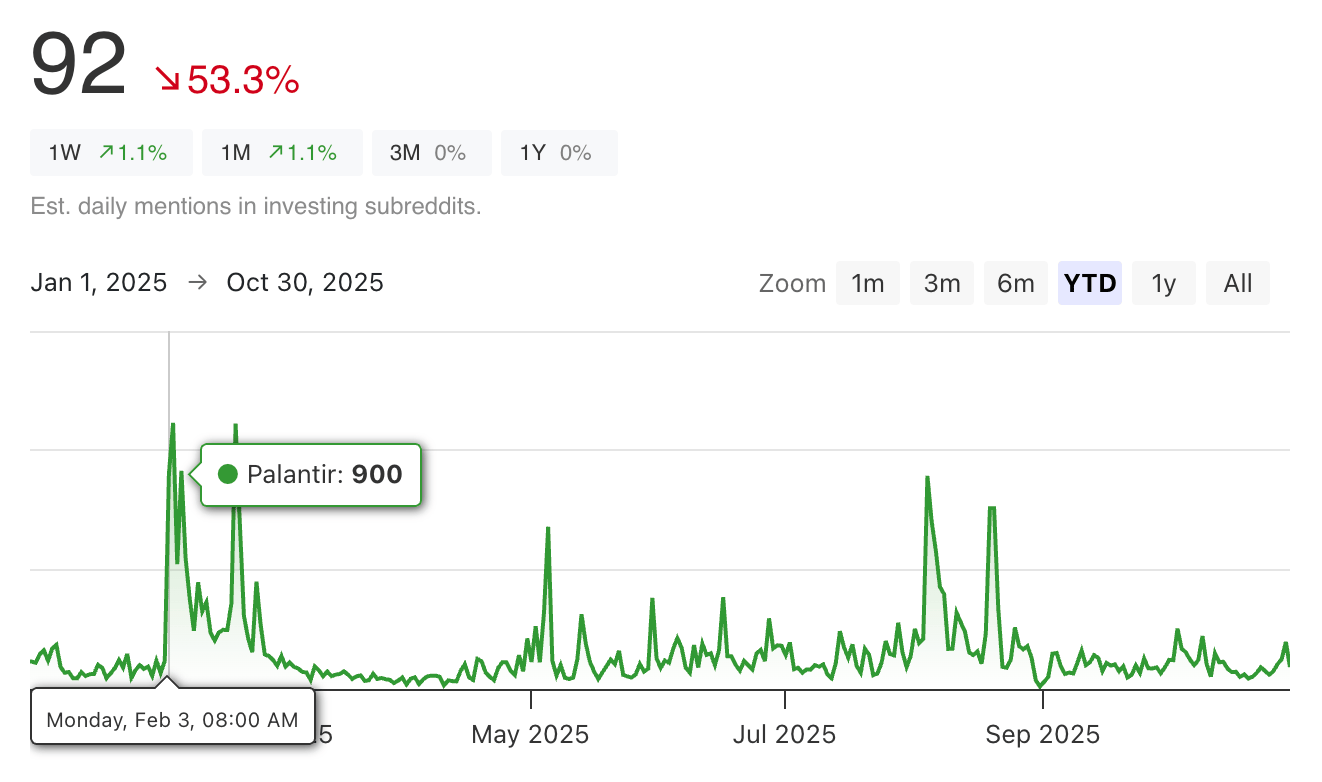

Palantir (PLTR): February 3rd, 2025

Reddit mentions spiked 669% in a single day. Over the next two weeks, the stock's price rose 49%. Today, PLTR is up 139% since that February spike.

there have been other spikes since then too, which is typically a sign of momentum (positive or negative). These have been positive, as PLTR just crossed $200 this week.

Was Reddit causing the move? Not exactly. But the increased discussion signaled that something was happening (earnings anticipation, new contracts, institutional buying) that retail investors were picking up on early. The rest is history!

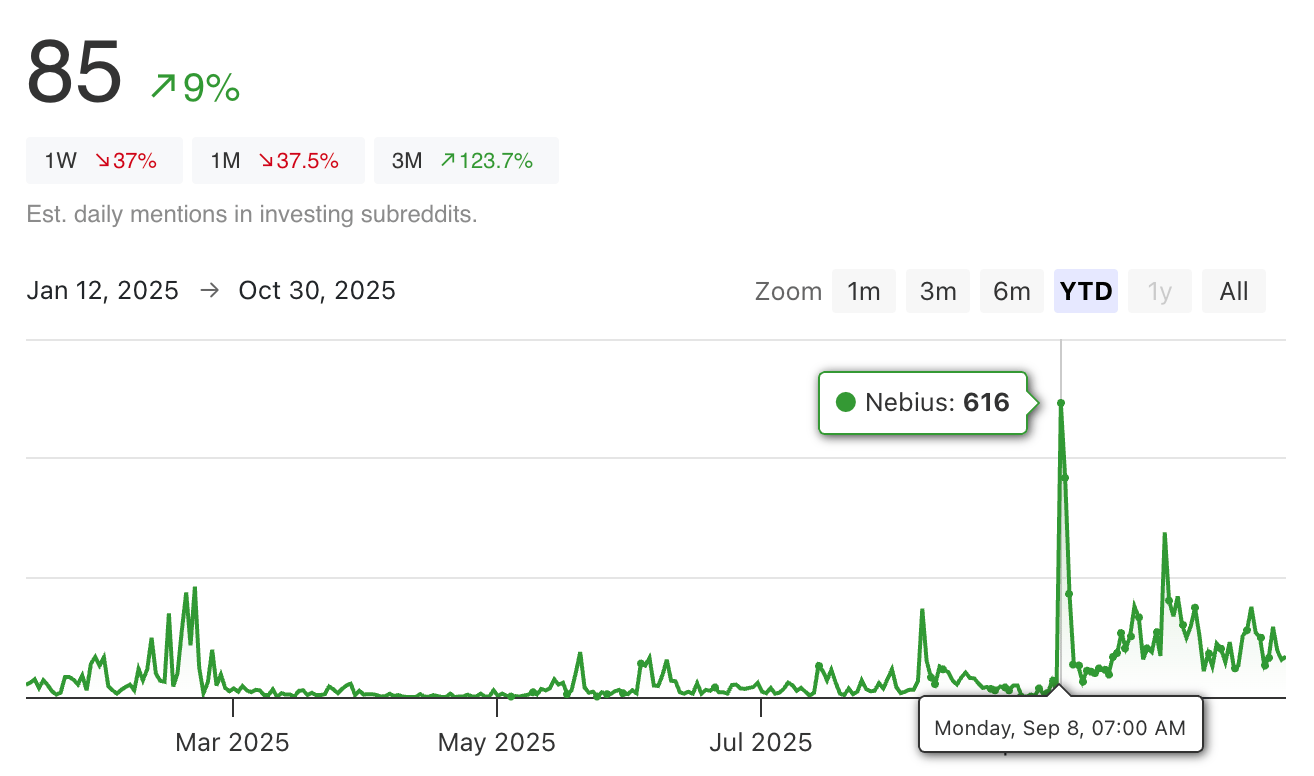

Nebius (NBIS): September 8th, 2025

Reddit mentions exploded by 4,638% overnight. The stock has climbed 104% since that day.

Again, Reddit didn't create the move. And you didn’t have to get in on the move instantly in order to be in the green. But the conversation surge indicated that traders were discovering something: AI infrastructure potential, revenue growth, or partnerships (before they fully played out in price).

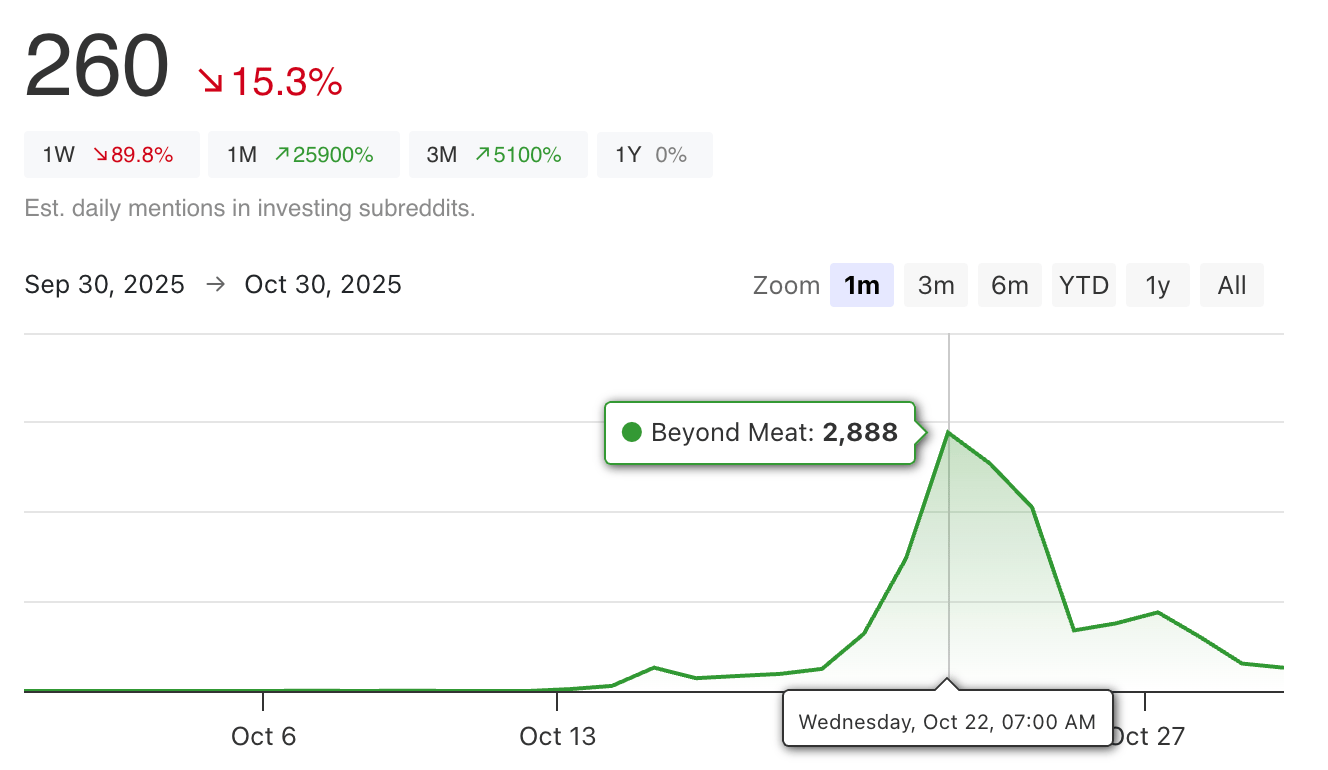

Beyond Meat (BYND): October 12-22, 2025

This one's more extreme, and certainly a meme. Beyond Meat went from essentially zero daily Reddit mentions to 2,888 mentions in just 9 days. It was a 13,652% increase in discussion volume. Over that time, the stock surged 647%.

Now, Beyond Meat is a meme stock situation. It’s volatile, speculative, and driven partly by momentum and short squeezes. But even in this extreme case, the Reddit data gave you advance notice. The conversation exploded before most of the price move happened. And that’s worth paying attention to.

Why This Works (When It Works)

Reddit mention spikes aren't magic. They're a proxy for several real factors:

Early signal of retail interest

When discussion increases dramatically, it often means retail traders are discovering a catalyst, whether that’s earnings beats, new partnerships, or analyst upgrades. A lot of the time, those events haven’t been fully priced in yet.

Momentum confirmation

In markets, momentum begets momentum. When more people start talking about a stock, more people start buying it, which validates the initial interest and attracts more buyers.

Sentiment gauge

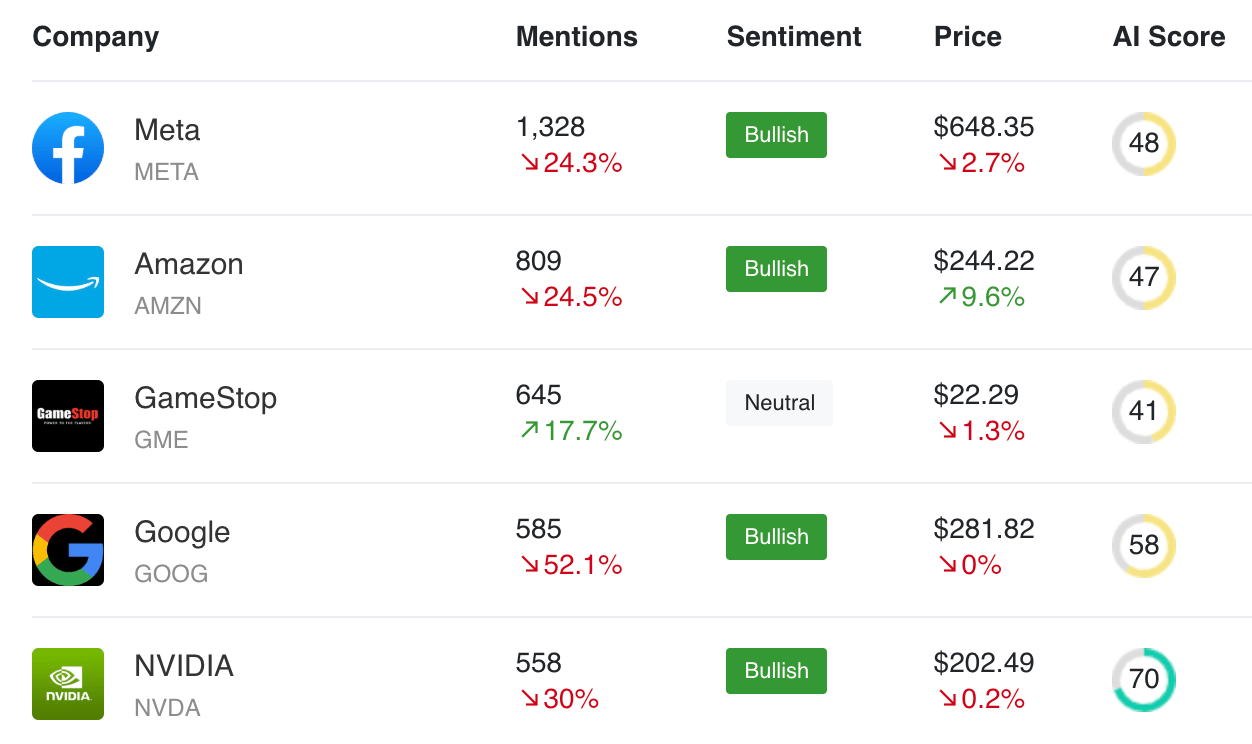

Reddit discussion isn't just volume—it's tone. When mentions spike and sentiment turns bullish, that's a stronger signal than mentions alone. AltIndex always provides an indication of whether sentiment about a stock is bullish, neutral, or bearish.

Crowd wisdom (sometimes)

Despite the meme stock reputation, Reddit investors collectively process a lot of information. When thousands of people suddenly focus on one stock, they're often responding to real catalysts, not just coordinating pumps.

The key insight here is that Reddit data doesn't predict the future, it just shows you what's happening right now in retail sentiment. And that often leads price action by a few hours at least (sometimes until the next day).

The Alert System That Changes Everything

Raw Reddit mention counts are useful, but limited. A 500% increase in mentions tells you something is happening. It doesn't tell you what is happening.

That's where AltIndex’s Reddit alerts become genuinely valuable. Instead of just seeing "PLTR mentions up 669%," you get summaries of what people are actually discussing.

We’ll share some instances from this week of valuable insights that the app provided in the form of a notification on your phone.

Example alert from yesterday:

This gives you actionable context. Palantir wasn’t just being mentioned more; there was a specific catalyst (crossing $200), a debate about institutional buying, and anticipation around earnings. That's information you can research and trade on.

Another example:

This is a warning signal about NVO. Yes, mentions are up, but sentiment is mixed and some investors suspect a pump from people trying to unload positions. That's very different from organic bullish discovery.

The alerts do the work of reading through hundreds of comments to extract the actual themes and sentiment. You get the insights without spending hours on Reddit.

When Reddit Data Doesn't Matter

Not every mention spike is meaningful. Here's when to ignore the noise:

Low liquidity stocks: If a penny stock goes from 5 mentions to 50, that's a 900% increase that might not mean very much (at least not yet). The absolute volume matters, not just the percentage change. Also, with a lot of stocks you want to see sustained momentum, not just a one-day increase in Reddit mentions that never goes anywhere.

Coordinated pump attempts: When discussion is clearly trying to manufacture momentum ("everyone buy at market open!"), that's different from organic discovery of a catalyst.

Sentiment is mixed or bearish: A spike in mentions with neutral or negative sentiment isn't the same signal as a bullish surge. People might be discussing a stock because it's collapsing, not because they're excited about it.

No fundamental catalyst: If mentions explode but there's no earnings report, no product launch, no analyst coverage—just hype—the move is less likely to sustain.

Already-massive stocks: When Apple or Microsoft gets a Reddit mention spike, it's less meaningful than when a mid-cap with less coverage suddenly enters the conversation.

Bottom Line

Reddit mention data definitely isn’t fortune-telling… it’s more just pattern recognition.

When discussion of a stock suddenly explodes, it's often because retail investors are collectively discovering something. It could be a catalyst, a trend, or a mispricing. The key is that the catalyst usually hasn’t fully played out yet.

And sometimes the Reddit spike is an early signal of a real move. Palantir up 139% (over time). Nebius up 104% (fairly fast). Even the meme stock extremes like Beyond Meat's 647% gain (just 10 days) started with a surge in social discussion.

Try out AltIndex for free with a 7-day trial today:

⭐️ What did you think of today's edition?

🫡 See You Next Week

That’s all for today’s special edition. We hope you got value from it. Reply and let us know if you did.

Until next week,

— Brandon & Blake

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.