Editor’s note:

This is the last week Stocks & Income will be sent from Stefan & Wyatt at Alts.co

Starting next Monday, Alts community member Brandon Harris will be taking over the sending.

Brandon’s sports media company Playmaker, was acquired in 2023 for up to $54m, since then he’s dedicated his time to finance.

We’re excited to have Brandon put his energy into growing this newsletter!

The Bitcoin Corporate Treasury Convertible Bond ETF

REX Shares specializes in alternative exchange-traded funds.

BMAX is a pioneering ETF offering investors access to convertible bonds issued by companies that have integrated Bitcoin into their corporate treasuries.

This innovative fund provides a unique blend of debt stability and potential equity upside, allowing investors to engage with the evolving intersection of digital assets and traditional finance.

Why invest in Convertible Debt?

Convertible bonds are hybrid securities that offer interest payments and the potential for equity conversion.

They provide interest yields during the bond's life, with an option to convert into stock if the issuing company's share price exceeds a set conversion threshold at maturity.

This dual benefit structure offers exposure to Bitcoin-related corporate strategies while maintaining a foothold in traditional securities

Details

Ticker: BMAX

Asset Class: US Equity

Fund Inception: NASDAQ, March 14, 2025

Management Fee: 0.85%

Investing involves risk, including possible loss of principal. Investors should carefully consider the investment objectives, risks, charges, and expenses of BMAX before investing. This and other important information are contained in the Prospectus, which can be obtained by visiting the link above. Please read the Prospectus carefully before investing.

📰 Market Headlines

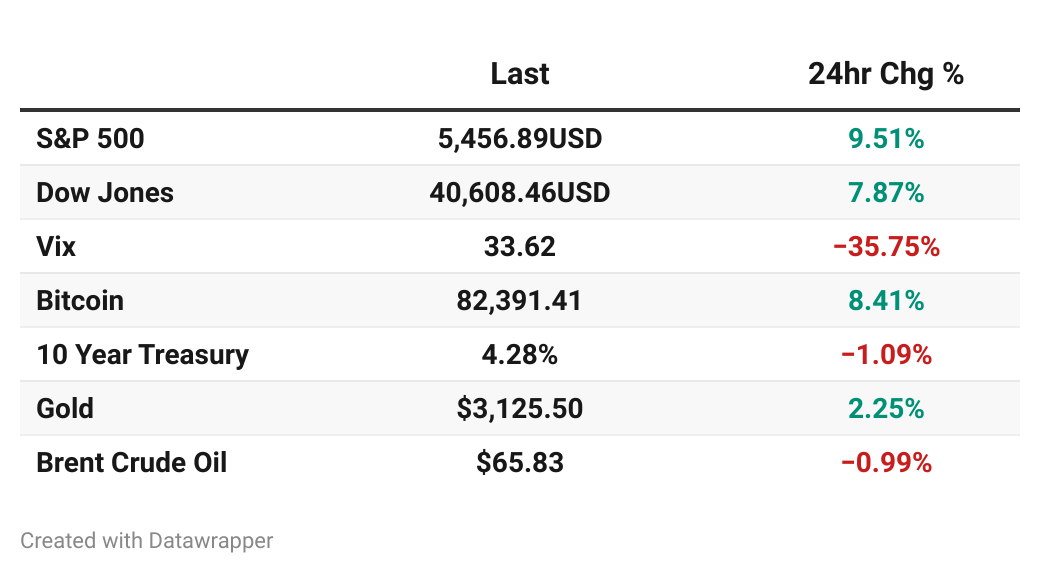

Markets soared after President Trump announced a 90-day pause on reciprocal tariffs, triggering a historic rally.

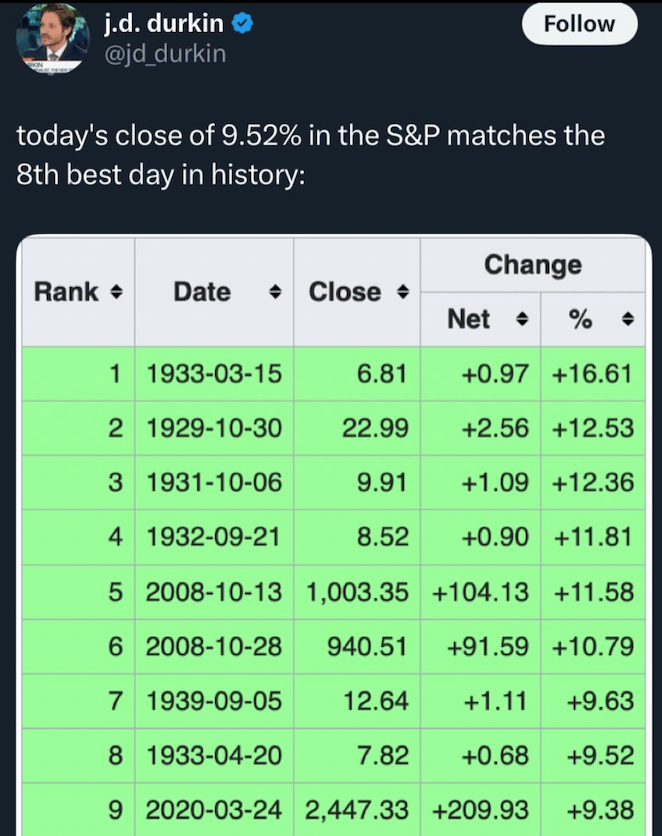

The S&P 500 climbed over 9.5%, the Nasdaq surged 12%, and the Dow rose more than 7.8%.

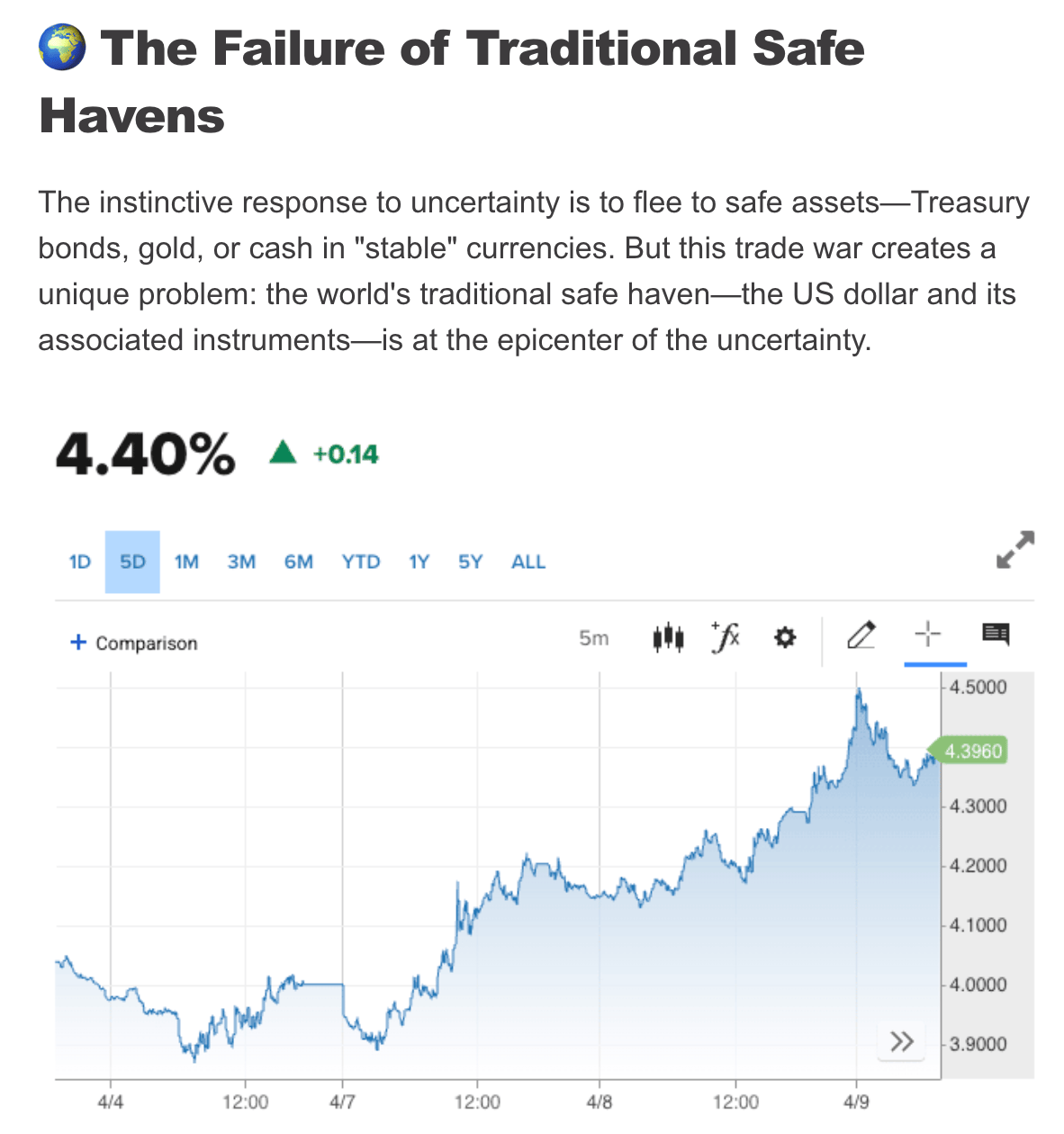

The 10-year Treasury yield continued climbing, settling near 4.4% after its biggest three-day jump since 2001.

🌏 Alternative investing news

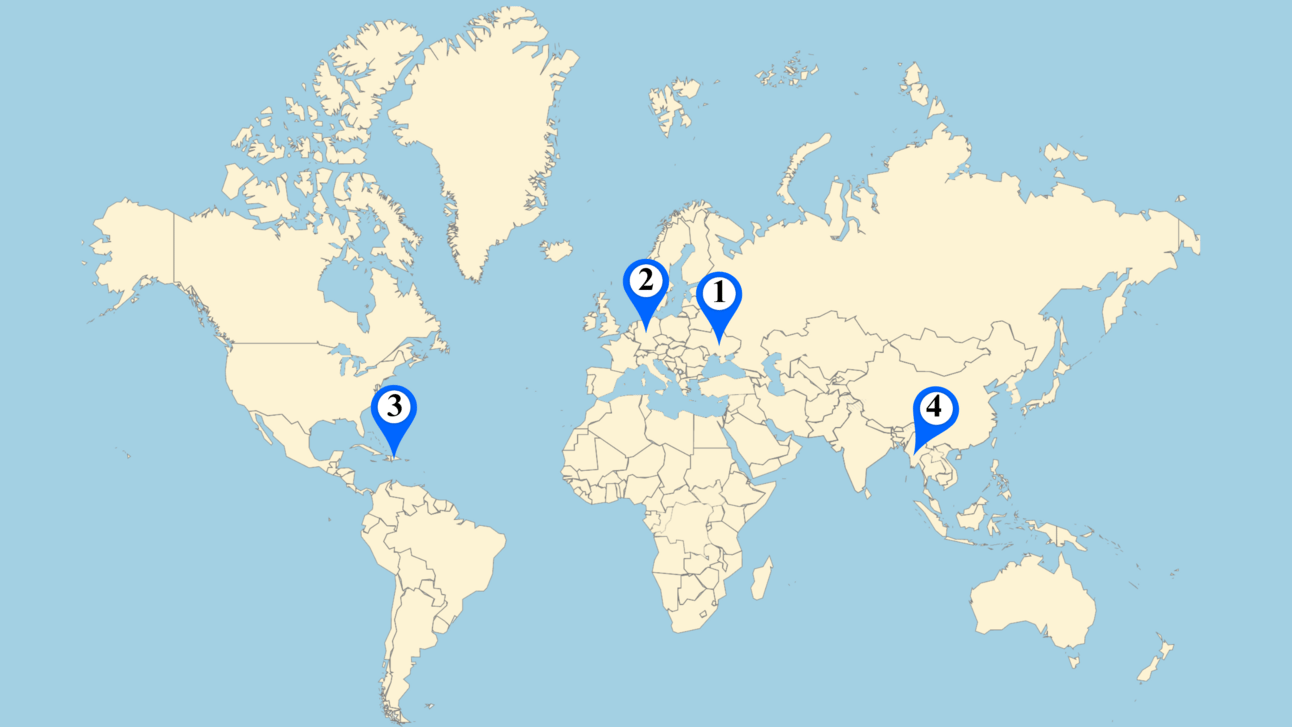

Five weeks ago, when the trade war began in earnest, Wyatt wrote a great issue on diversifying outside the US.

As you've no doubt noticed, the situation has escalated since then.

We, and our members, have taken note. From a Swiss community member this morning:

I am becoming increasingly cautious about investments related to the US or the USD. The odds: Swiss Franc—US Dollar are working against me. Also, the new president doesn't have my trust, to say it nicely. So, this makes me increasingly reluctant to invest in anything related to US relations.

Regardless of how you feel about the tariffs, it's undeniable that the world has changed forever.

There are two ways to approach an increasingly uncertain macro climate:

Go completely risk off, fleeing to the safest thing possible, or

Realize risk is rising everywhere, so you may as well hunt higher returns

Check it out 👇

📊 Ideas, trends, and analysis

Making an iPhone in the US would cause its cost to surge 90%, according to Bank of America analysts.

It would be wise to look at the years the other 7 best days happened.

🧠 Make yourself heard

What is ultimately worse for markets?

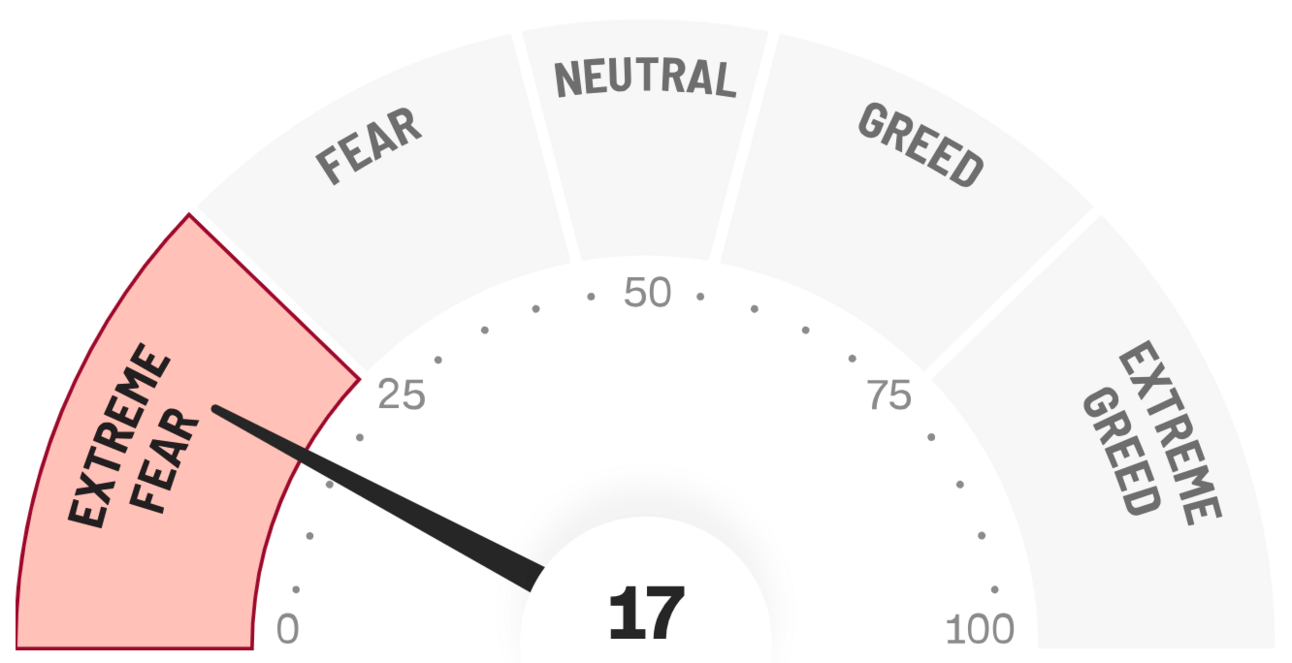

😱 Fear and Greed Index

📊 Earnings this week

Constellation Brands reported Q4 earnings that beat estimates, with revenue up 2%; shares climbed 7.2%.

Delta Air Lines pulled its 2025 forecast and halted expansion plans due to weak bookings, though shares shot up 23.3%.

Market movers

Microsoft paused its $1 billion Ohio data center project and other AI infrastructure expansions.

Sam's Club plans expansion with 15 new stores per year and renovations of all 600 existing locations.

Walmart pulled its Q1 operating profit guidance due to President Trump's new tariffs.

xAI's Grok announced that it’s hiring safety teams after the chatbot generated racial slurs and NSFW content.

Microsoft scheduled another round of layoffs in May, targeting middle managers and non-coding roles.

Like good newsletters?

Here are some other ones popular with Stocks & Income readers:

📊 Crypto

US House pushes forward with crypto regulation efforts.

Pakistan embraces Bitcoin mining to utilize surplus power, with former Binance CEO Changpeng Zhao serving as strategic advisor.

🌍 Global Perspectives

🇨🇳 🇺🇦 President Zelenskyy revealed that over 155 Chinese mercenaries are fighting for Russia in Ukraine.

🇩🇪 Germany's new conservative-led coalition unveiled plans to cut taxes and take a tougher stance on migration.

🇩🇴 A Dominican Republic nightclub collapsed, the death toll hitting 124 victims.

🇲🇲 A third of Myanmar has no Internet, hindering aid to earthquake victims.

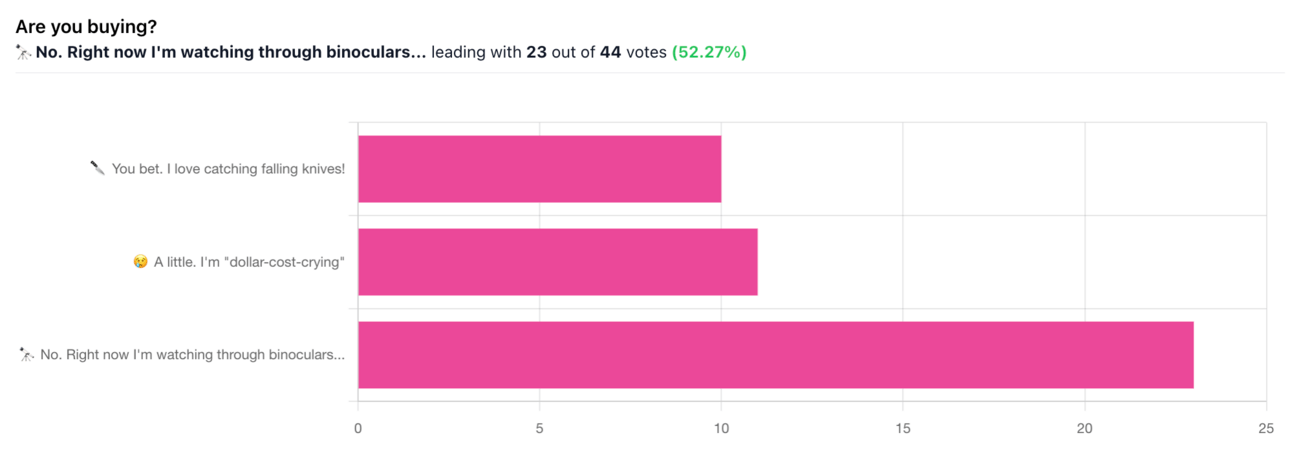

🎤 What you said last time

Congrats to yesterday’s dip buyers!

Doesn’t matter if it was skill or luck - well done regardless! 😂👏

“My investment timeline is like 40 years, if I don't buy as much as I can now I'm sure I'll regret it.”

🧠 Miscellanea

A Chinese court is desperately trying to auction off 100 tons of crocodiles.

Japanese town turns local middle-aged men into trading cards.

An Alaskan woman shattered the world record for the largest mouth with a jaw-dropping 2.98 inches.

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Or find me in the Alts Community.

Cheers,

Stefan and Wyatt