Good morning.

Trump floated $1,000-2,000 stimulus checks funded by tariff revenue, describing it as "almost like a dividend to the people of America." His debt strategy: "You grow yourself out of that debt, it's not a question of paying it." That money could go straight into retail traders’ Robinhood accounts, just like in 2020. Regardless, the Trump administration wants to outgrow the national debt through economic expansion… which sounds more bullish than bearish to us, even as the deficit runs over $2 trillion annually.

Meanwhile, Jeff Bezos think we’re approaching a bubble and Goldman Sachs CEO David Solomon says prices will come down in the next two years.

Remember: the Fed is cutting rates into 2.9%+ core PCE inflation, jobs reports remain suspended due to the ongoing government shutdown, and the Mag 7 are spending $100 billion+ per quarter on AI capex.

Bubble or not, it seems like the market wants you to buy equities (or lose out on growth).

In partnership with AltIndex

When an AI Model Is Outperforming the S&P 500

There are so many opportunities to outperform the market. You just don’t know where to find them.

Seagate is up 198.25% year to date.

Robinhood is up over 220% year to date.

Palantir is up 139.17% this year.

Need I go on?

If you were in on these trades, congrats. You also still missed a bunch of opportunities (MU, APP, AVGO, CRWD).

If you missed everything, would you believe me if I told you our AI model recommended every one of these stocks as a buy before they took off?

And AltIndex’s top 15 picks returned an average of 47.5% over the past six months… crushing the S&P 500 (19% returns, same period).

AltIndex rates stocks based on alternative data like the social sentiment in millions of reddit comments and tweets, congress trades, and hiring data (plus traditional analysis).

And our AI model updates its stock ratings daily, not once every three months. Because even a stock that looks bad now can turn into the next 220% gainer.

Get a free trial of our app and gain access to all of our stock ratings and data 24/7.

The next top performer is already taking shape. Will you be looking at the right data?

Please support our partners!

Market Headlines

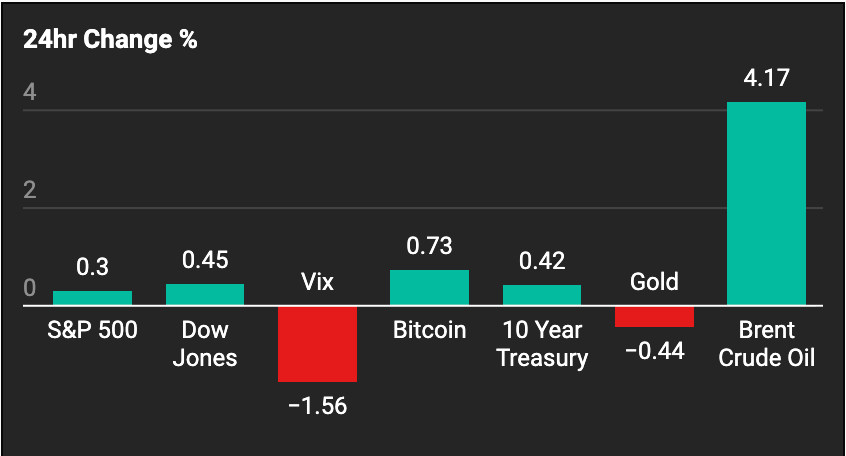

Stocks climbed to fresh records Thursday as AI optimism outweighed shutdown worries.

The Nasdaq rose 0.4%, the S&P 500 gained 0.1%, and the Dow added 0.2%, with all three indexes closing at new highs.

Trump floated sending Americans $1,000-2,000 stimulus checks funded by tariff revenue, calling it "almost like a dividend to the people of America." When asked about paying down the national debt, Trump said: "You grow yourself out of that debt, it's not a question of paying it. You grow yourself out." The proposal would echo pandemic-era stimulus but funded through trade policy rather than deficit spending. The administration's growth-first approach to debt sounds decidedly bullish.

Goldman Sachs CEO David Solomon warned that stock markets are headed for a "drawdown" after years of AI-fueled gains. Speaking at Italian Tech Week in Turin, Solomon said some investors were overlooking "things you should be skeptical about" in AI. "I think that there will be a lot of capital that's deployed that will turn out to not deliver returns," he said, according to CNBC. He predicted the correction would hit within the next two years, adding "people won't feel good" when it arrives.

Jeff Bezos said AI is in an "industrial bubble" but the technology itself is legitimate and transformative. He explained at Italian Tech Week that during bubbles, every experiment or idea gets funded, “The good ideas and the bad ideas. Investors have a hard time in the middle of this excitement, distinguishing between the good ideas and the bad ideas. And that's also probably happening today.” He continued, "But that doesn't mean anything that is happening isn't real. AI is real, and it is going to change every industry."

OpenAI's shopping integration signals "agentic commerce" is arriving. The company announced shoppers will soon buy items directly through ChatGPT, partnering with retailers to enable AI-powered purchasing decisions. Investor's Business Daily reported the trend offers "big opportunities" for Amazon, Alphabet, Meta, Walmart, Shopify, and eBay as AI chatbots become shopping assistants that understand users' tastes, budgets, and needs.

Top money managers are going all-in on megacap growth despite bubble warnings. Benjamin Lau, chief investment officer at Apriem Advisors, told IBD his top ETF pick is Vanguard Mega Cap Growth, where Nvidia, Microsoft, and Apple represent 39% of the portfolio. "If you're going to invest in growth, it's hard to say that all 500 companies in the S&P 500 offer that growth," Lau said. "The bottom 493 are just not going to be the Mag 7."

Invesco American Franchise Fund's manager explained why he holds all seven Magnificent 7 stocks and rarely sells winners. Ron Zibelli, who beat the S&P 500 over 1, 3, 5, and 10-year periods, told IBD: "The biggest misperception about the stock market's greatest winners has to do with sustainability... They underestimate the future compounding that's still yet to occur." His fund is up 16.18% annualized over the past decade versus 15.12% for the S&P 500.

Bitcoin is now a 4% allocation in some institutional portfolios, up from 2.5% a year ago. Lau said his firm doubled its bitcoin exposure and doesn't hold gold in any portfolios. "This is our hedge against a weak dollar," he explained, noting bitcoin adoption potential is even greater in countries without stable currencies.

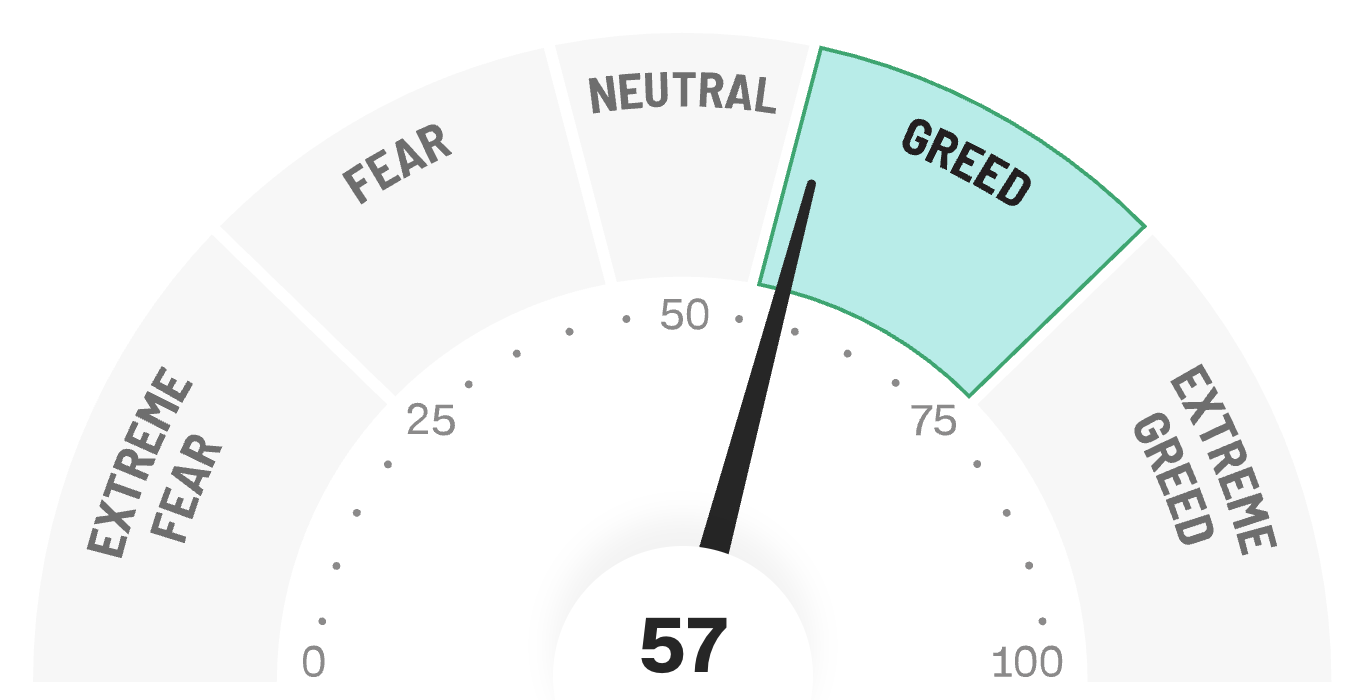

😱 Fear & Greed Index

In partnership with Longview Tax

Tax automation that clears your desk and your mind

Tax leaders are juggling shifting regulations, growing complexity, and leaner teams. In this on-demand webinar, discover how automation reduces manual work, increases accuracy, and frees your team to focus on strategy instead of spreadsheets. You will see how Longview Tax helps you streamline compliance, gain real-time insights, and turn your department into a true strategic asset.

Please support our partners!

🤖AI/Future/Tech News

Shares of Samsung Electronics and SK Hynix soared 4.7% and 12% after securing a deal to supply chips for OpenAI's Stargate AI data center project.

AI search startup Perplexity made its Comet browser free worldwide, adding pressure on Chrome and other incumbents.

Fleet payments company WEX (NYSE: WEX) pushed further into AI fueling and digital wallets at its trucking summit.

🤫 Insider Trading

🚚 Market Movers

The Department of Energy canceled $7.56 billion in clean energy projects, wiping out 321 awards, including California’s $1.2 billion hydrogen hub. Many of the cuts were concentrated in Democratic-led states.

China’s securities regulator ordered S&P China to “rectify” its operations, citing weak disclosure and quality controls.

The Trump administration warned of federal layoffs within days if the shutdown continues. OMB Director Russell Vought said agencies will issue reduction-in-force notices, while Vice President JD Vance confirmed military and federal paychecks are on hold.

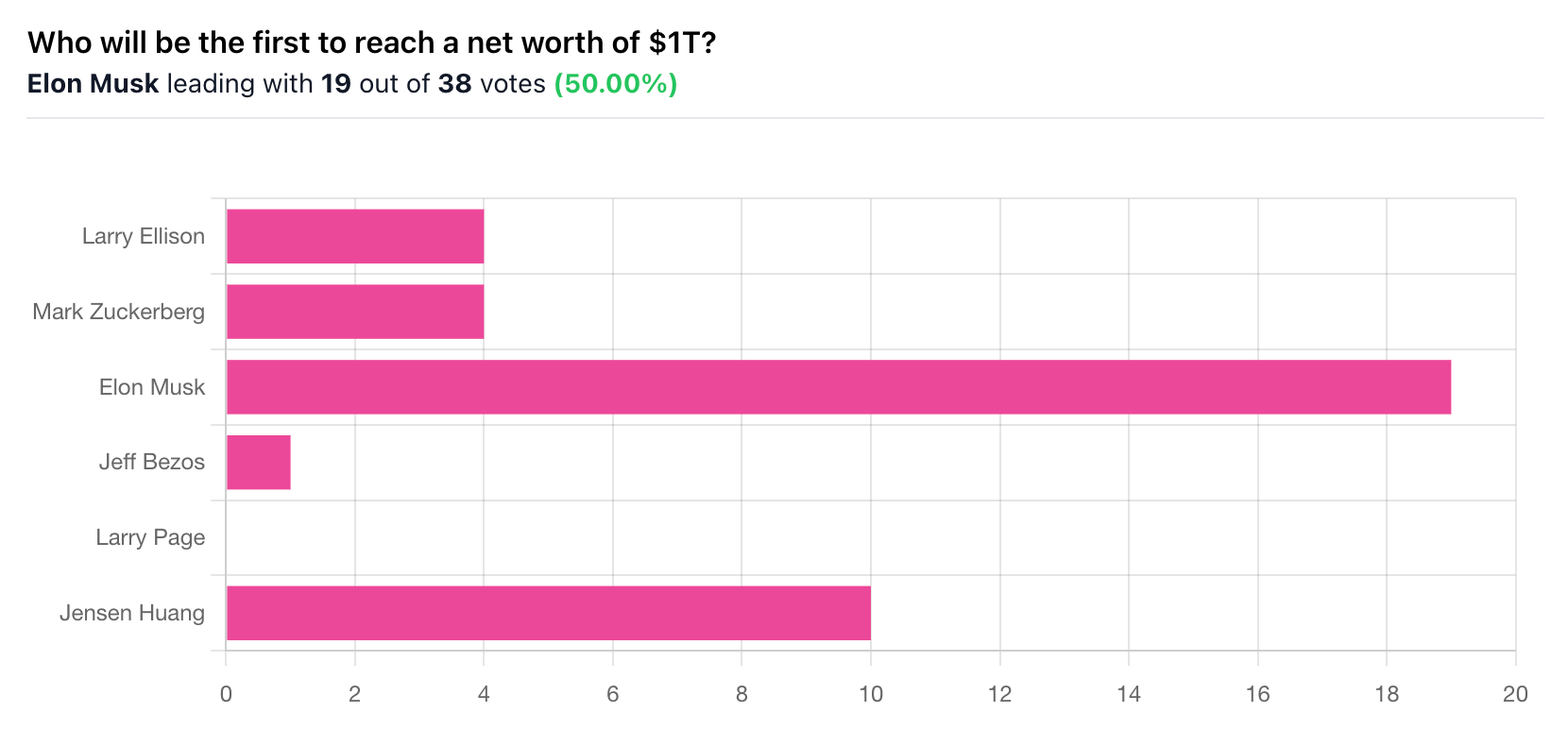

🎙 What Do You Think?

Your views on stimulus checks?

🎤️ What you said last time

🎪 Crowdfunding Showcase: Jasper

Jasper is building an AI-driven grief support platform that starts with pet loss, a $60–450 million revenue opportunity in the $3 billion+ grief care market. The app combines adaptive AI, certified counselors, and peer communities to deliver timely, personalized support. Founded by a former Uber exec, Jasper has grown entirely through organic channels, with 20% of users joining via word-of-mouth.

🧠 The Missing (Market) Links

Analyst Dan Ives said the AI M&A floodgates were about to burst open, with Apple and IBM expected to go on buying sprees. His takeover targets swung wildly this year, from Sandisk up 200% to C3.ai down 49%.

Oil prices slumped to multi-month lows, with Brent under $66 and WTI near $62, as shutdown fears and OPEC+ supply rumors rattled traders. A break below $60 could have triggered another sharp drop.

Natural gas rallied off $2.50 support and pushed toward $3.60. A clean move higher would have set up a run toward $4.70.

A Queens dispensary became the first in the US to launch AI cannabis shopping. The system asked customers about wellness goals, then recommended products based on cannabinoid research.

📜 Quote of the Day

“An investment in knowledge pays the best interest”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: Federalreserve, Flickr

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.