🔔 The Opening Bell

Good morning.

As part of the White House’s pressure campaign to get the Fed to lower interest rates, President Trump visited Fed Chair Jerome Powell in person yesterday and had a tension-filled joint interview. The highlight was Trump and Powell arguing on live TV (while wearing hard hats).

In the tech sector, Google’s 1% drop from yesterday turned into a surge as its golden earnings call boosted confidence. In contrast, airlines are struggling big time right now, posting huge losses—but why?

And Coke may be getting a cane sugar version, but today’s ex-PepsiCo partner has solved a more pressing problem:

Former PepsiCo Exec Invented A Plastic That Dissolves in Water

If anyone knows a thing about plastic’s impact on the planet, it’s Manuel Rendon. The former PepsiCo executive and environmental engineer is using his 20 years of expertise to solve one of the world’s biggest problems with Timeplast.

Up to 450 million metric tons of plastic are wasted each year. Microplastics seep into our bodies, and mountains of bottles pile up in the ocean. But Timeplast has patented a water-soluble, time-programmable plastic that vanishes without harming the environment.

Major players are already partnering with Timeplast for its patented technology—their sales grew 6,000% in the first month.

You have just a few days left to invest as Timeplast scales in its $1.3T plastic market, from packaging to 3D printing. Become a Timeplast shareholder by midnight, 7/31.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

📰 Market Headlines

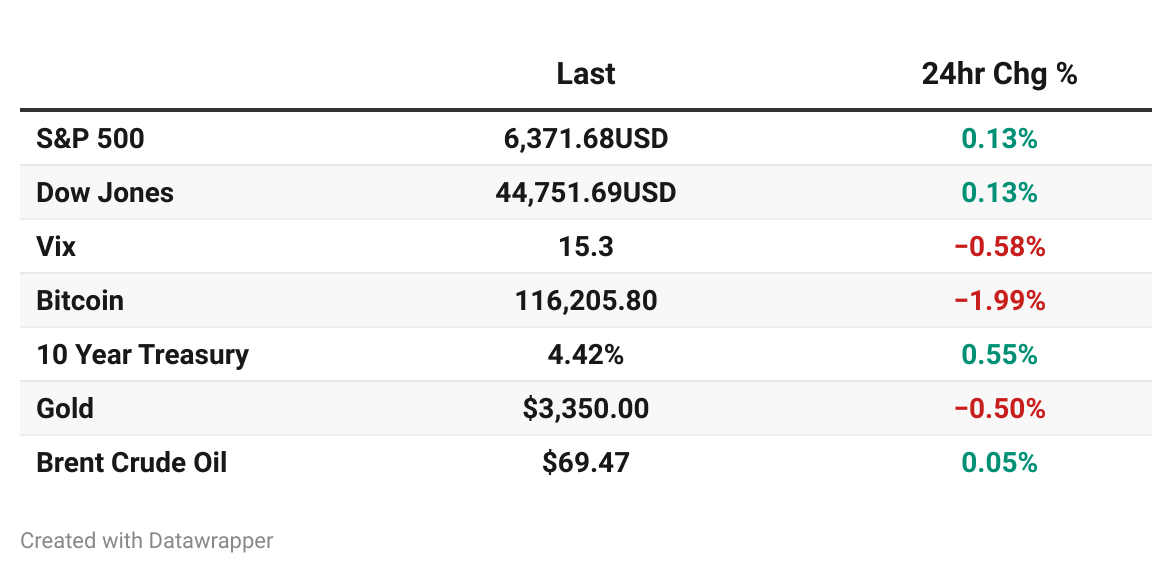

Markets continued their climb on Thursday, with the S&P 500 and Nasdaq notching records for the fourth consecutive day.

The S&P inched up 0.1%, the Nasdaq climbed 0.2%, while the Dow slid 0.6%.

BREAKING: Nvidia chips still made it to China through a thriving black market.

Jobless claims fell for the sixth straight week to 217,000, marking the lowest level since mid-April. This represents the longest stretch of declines since 2022 and underscores resilience in the labor market.

After a brief 1% drop, $GOOGL ( ▲ 1.43% ) surged on its golden earnings call, with CEO Sundar Pichai highlighting AI as the key growth catalyst. The Google parent's quarterly results lifted other tech giants like Nvidia.

Airlines hit turbulence on weak travel forecasts:

$AAL ( ▼ 6.24% ) American Airlines plunged 6% after forecasting a big third-quarter loss, with CEO Robert Isom calling July "tough" and blaming "uncertainty during the primary booking period."

$LUV ( ▼ 3.28% ) Southwest shares sank over 12% after slashing its full-year profit guidance from $1.7 billion to $600-800 million, citing macroeconomic challenges.

$IBM ( ▼ 0.74% ) shares tumbled 7.6% after disappointing software sales in its core division failed to impress investors, even with overall revenue beating estimates.

President Trump visited Federal Reserve headquarters on Thursday, increasing tensions with Fed Chair Jerome Powell after months of public criticism. The live conversation between the two of them was almost comical at some points as Trump argued with Powell about the Fed’s renovation costs. For now, Powell and the Fed are holding their ground on interest rates, but analysts seem to think September might see rate cuts.

What's your favorite section in Stocks & Income?

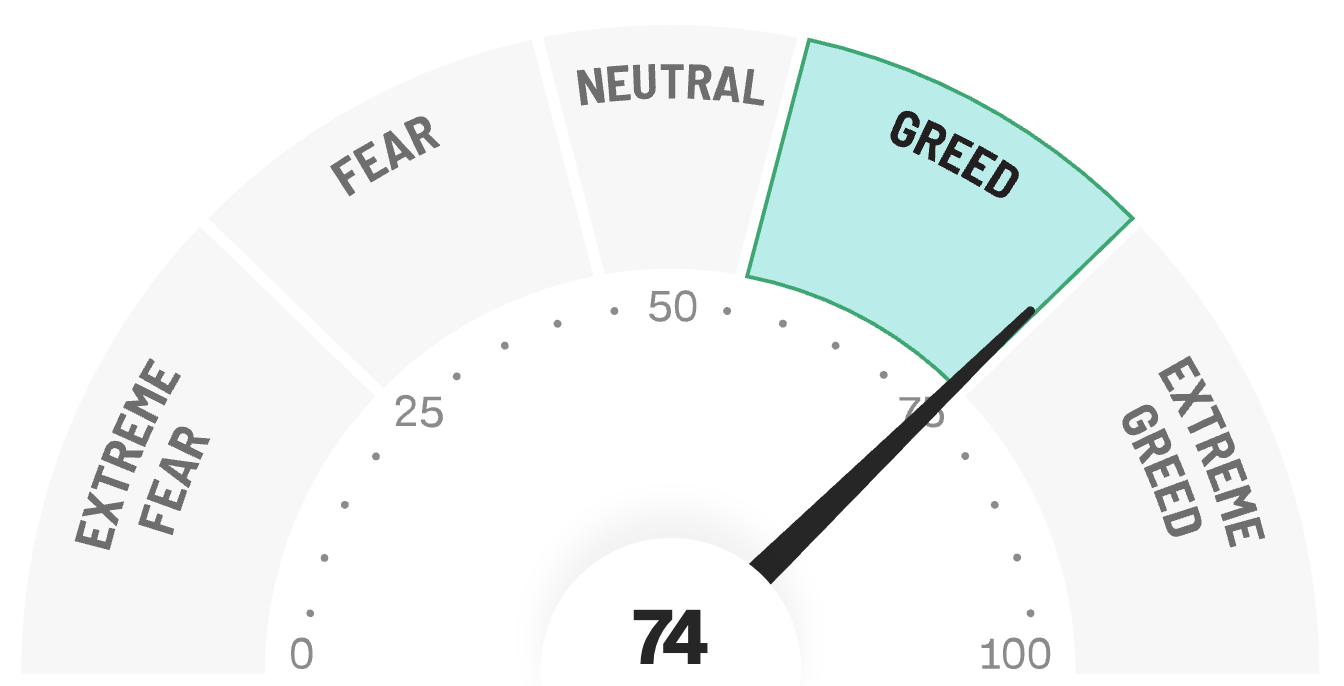

😱 Fear and Greed Index

🧠 The Missing (Market) Links

Nvidia AI chips, valued at over $1 billion, were shown to have entered China through a thriving black market.

The US housing market “remains historically unaffordable,” according to the Kobeissi Letter, with a brutal mix of record-high prices with less and less sales.

The SUPPLY ACT wants to make it easier to build tiny homes in backyards.

Elon Musk believes that a $20 trillion market cap is possible for Telsa (no, that’s not a typo).

Tesla sold its Bitcoin holdings in 2022 at one of the worst times possible.

After franchise bankruptcies, Del Taco relaunched 17 company-owned restaurants in Colorado while parent Jack in the Box explored selling the brand.

🤡 Meme Stocks

$HCTI ( ▼ 17.53% ), a $0.05 stock in the healthcare industry was responsible for 15% of all traded shares on all US exchanges yesterday.

See what tickers r/WallStreetBets is talking about right now on AltIndex.

American Eagle became a meme stock yesterday morning, rising 12% in pre-market trading after releasing an ad campaign with Sydney Sweeney.

Over the past month, Opendoor rose a total of almost 900% before dropping 50% this week.

Some analysts believe Opendoor is actually a legitimate turnaround story, not just a “meme stock.”

🪙 Crypto

MicroStrategy bolstered its preferred stock offering to $2 billion to fund more Bitcoin purchases. The company’s treasury now holds 607,770 BTC.

BlackRock’s Ethereum ETF, $ETHA, blazed past $10 billion in assets, becoming the third fastest ETF in history to hit that mark.

A sharp pullback sent liquidations to $735 million, with Ether and XRP futures taking bigger hits than Bitcoin.

💰 Alternative Investing News

Gold prices fell 0.6% to $3,367.72 per ounce as signs of easing global trade tensions between the US and EU dampened demand for safe-haven assets.

Quant hedge funds hit their worst performance slump since late 2023, losing 4.2% since early June.

Private equity firms are increasingly targeting farmland as a climate-resilient alternative asset.

🤖 AI/Future/Tech News

Amazon slashed the price of its color screen Kindle to $249.99 for a 16GB model, offering a high-contrast display for the budget market.

Armada, backed by major investors like Founders Fund and Microsoft, clinched $131 million to expand its mobile AI data centers.

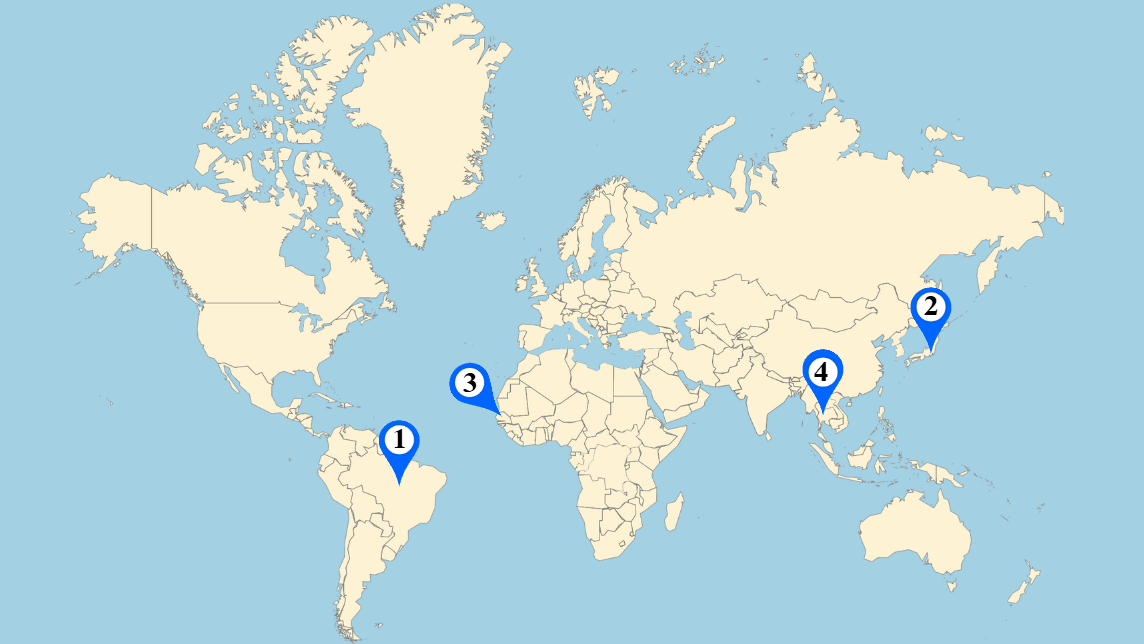

🌍 International Markets

🇧🇷 Brazil's WEG reconfigured exports to offset most impacts from US tariffs, despite geopolitical uncertainties affecting long-term visibility.

🇯🇵 Japan's Topix rocketed 1.75% to a record high of 2,977.55, fueled by trade deal optimism with the US and potential agreements with the EU.

🇸🇳 Senegal's eurobonds climbed 4.9% as the IMF announced new program talks set to begin in August, with the 2033 dollar bond leading gains.

🇹🇭 Only Thailand stumbled as its SET Index fell 1.1% amid border clashes with Cambodia, contrasting with broader Asian market rallies.

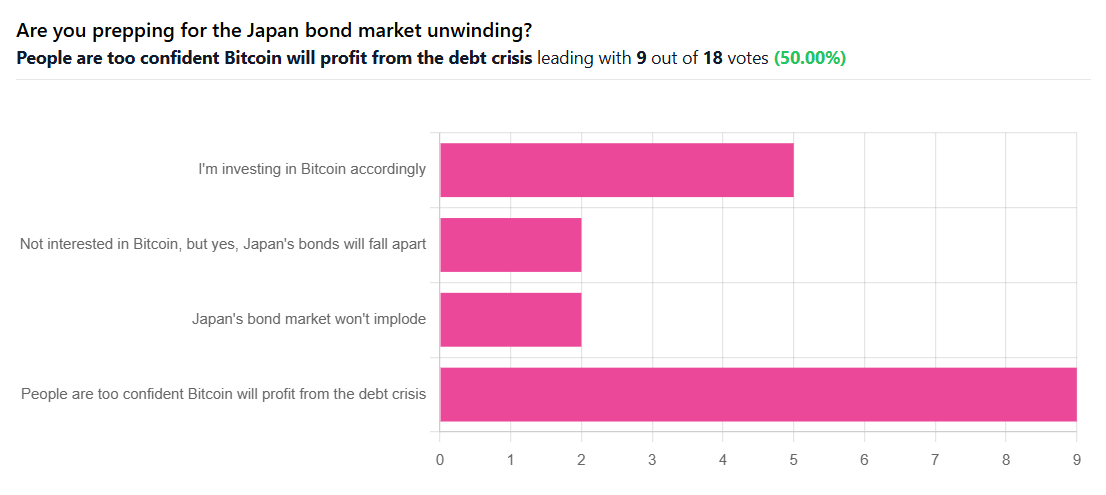

🎤️ What you said last time

“Correlation is not causation.”

🚚 Market movers

Intel announced it would cut its workforce by 15%, reducing headcount to 75,000 by year-end, which sent shares up 2%.

Tesla shares plunged over 8% due to challenges with declining EV sales and regulatory hurdles for its robotaxi expansion.

McGraw Hill raised $415 million in its IPO, pricing shares below the touted range.

📊 Earnings

American Airlines reported a 29.84% earnings surprise, but shares plummeted over 9.6%.

Blackstone exceeded earnings expectations with a 14.98% surprise, sending the stock up over 3.5%.

Honeywell raised its profit forecast, but margin concerns led to a 6% drop in shares.

Intel reported earnings as anticipated, but layoff announcements sent shares dipping 3.7%.

Keurig Dr Pepper reported earnings fairly even, as expected; shares edged up just over 0.2%.

Southwest Airlines suffered from a recently filed class-action lawsuit, sending shares plummeting over 11%.

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt

Thumbnail image: Michael Daddino, flickr

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.