🔔 The Opening Bell

Elon Musk called it.

Back in January, he said OpenAI’s $500B Stargate project didn’t have the funding it needed. Now? The project is stalling, and Musk is doing a victory lap.

Meanwhile, two of Bitcoin’s loudest bulls are back in the headlines. Michael Saylor’s Strategy just bought more, and Trump’s media company is loading up, too. Seems like they’re competing to see who can take more BTC-related headlines.

And Polymarket is returning to the US, so you’ll soon be able to legally bet on whether Polymarket will get re-banned from the US or not.

Let’s get into it.

🌾 Farmland: The real asset investors turn to in uncertain times

Over the past 30 years, farmland has delivered stock-like returns with about one-third the volatility.

Intrinsic value. Food is indispensable. You can’t just print more of it

Stable. Positive historical correlation to inflation

Income-generating. It generates steady cash flow,

Utility. Real-world demand regardless of economic cycle

FarmTogether sources and manages institutional-grade farmland investments, giving accredited investors access through both individual properties and a diversified fund.

Right now, the standout opportunity is Landmark Mandarin Grove — a producing citrus orchard in California’s Central Valley:

🍊 80-acre grove growing Tango and Golden Nugget mandarins

💧 Dual water sources: surface water and private well

📈 Targeting 11.1% net IRR and 9.4% net cash yield

📆 10-year unlevered hold with seasoned local operator

Prefer a fund-based approach? FarmTogether’s Sustainable Farmland Fund offers exposure to a curated portfolio of U.S. farms across multiple regions and crops. It’s targeting:

🌱 8–10% net IRR with 4–6% annual distribution

🪵 Properties in CA, OR, CO, and OK — citrus, grapes, pecans, and row crops

⏳ 2-year lockup, evergreen structure

For investors looking to rebalance into resilient, income-producing assets, farmland is emerging as a compelling alternative.

Investments are open to accredited investors only.

Historical data is not indicative of future results and may not reflect fees which may reduce actual returns. Any historical information is illustrative in nature and may not represent future results, therefore any investor investing through the FarmTogether platform may experience different returns from examples and projections provided on the website. You should not make investment decisions based solely on the information and charts contained in this email.

FarmTogether does not provide tax advice or guidance. Any information provided within this document is for reference only. We recommend consulting a tax professional for your individual tax Situation.

📰 Market Headlines

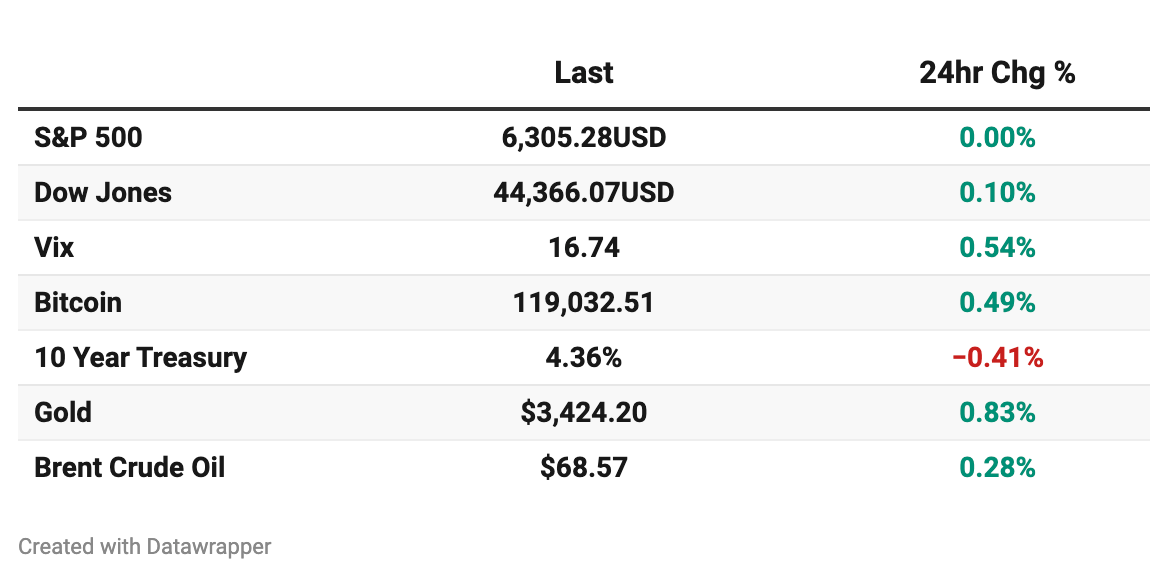

S&P 500 sprinted past 6,300 for the first time ever on Monday, while the Nasdaq notched its sixth-straight record close.

The Dow slipped just below the flatline, the Nasdaq gained 0.38%, and the S&P rose 0.14%.

🪙 The Crypto Consolidation Continues

MicroStrategy now owns 3% of all Bitcoin in existence—totaling 607,770 BTC. That’s 12x more than the next-biggest bitcoin-holding company.

Trump Media & Technology Group just disclosed $2 billion in crypto exposure, now making up two-thirds of its $3B in total assets. The stock popped 5% on the news.

📊 Retail trading (and betting) is picking up steam

FINRA is slashing the day trading threshold from $25K to just $2K, a huge change that makes it far easier for retail investors to trade equities and options more than 4 times in 5 days. The new rule opens the gates to active trading for a much broader slice of the population.

Polymarket is re-entering the U.S., acquiring a small derivatives exchange for $112 million. The move will let Americans legally bet on real-world events—like elections, inflation, or GDP numbers—through “opinion trading.” CEO Shayne Coplan says it's about giving the public back the power to speculate.

📉 Economic Policies and Market Risk

Trump’s new tax and spending law is projected to add $3.4 trillion to the national deficit over the next 10 years. Cuts to Medicaid could leave 10 million Americans without coverage by 2034.

🤖 OpenAI Hits a Wall?

Elon Musk’s prediction may be coming true: Reports suggest OpenAI is struggling financially to launch its $500B Stargate supercluster. Musk warned back in January that it would have serious funding issues, and here we are. Not that Musk has much room to talk—xAI may have the funding it needs, but it seems like Grok still has some major issues to iron out.

Who do you trust most to lead the future of AI?

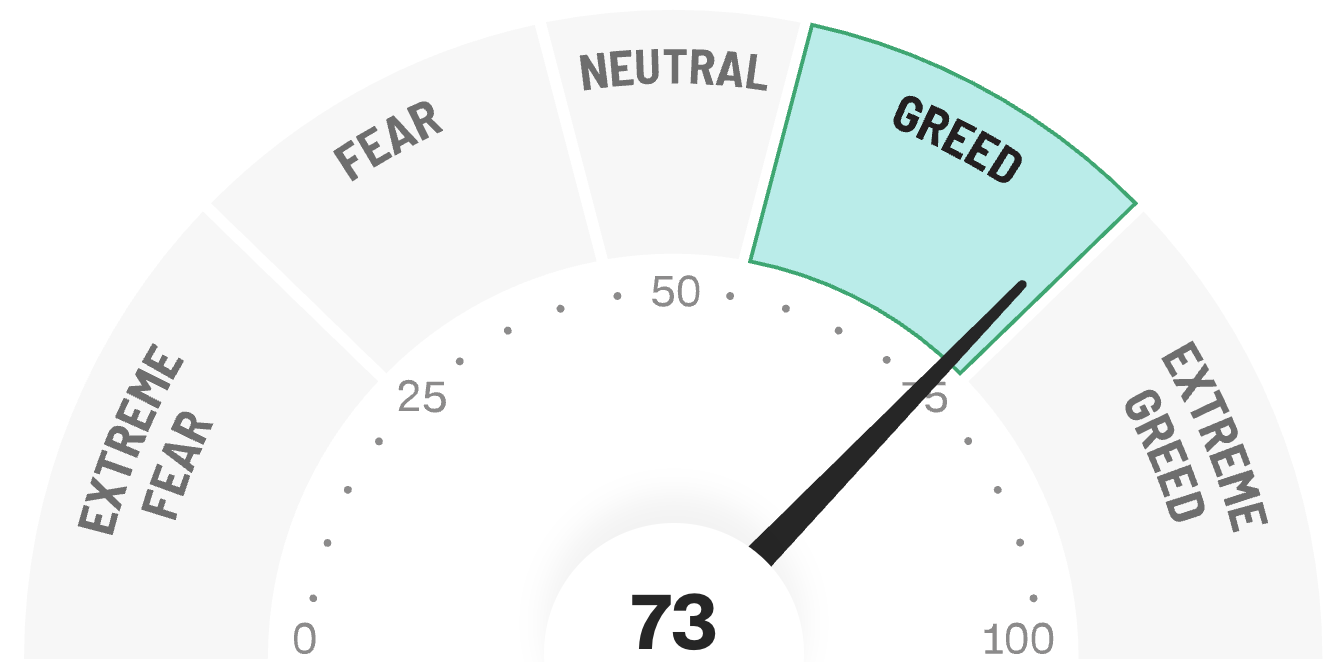

😱 Fear and Greed Index

🧠 The Missing (Market) Links

A full list of big economic events this week, included Jerome Powell speaking, earnings reports, and new housing data

Who saves the most between Boomers, Gen X, Millennials, and Gen Z?

How wealthy people are investing in gold right now (fractions vs. bullion)

See how a top guitar string company is navigating tariffs in their “trade war room”

Have you heard of the “Power Law?” It’s how venture capitalists make millions (and how pea farmers make a living)

🪙 Crypto

Ether skyrocketed to its highest level this year after President Trump signed the GENIUS Act into law. Here’s Altindex’s rating of the crypto.

BitGo quietly filed for a US IPO after the crypto market cap crossed $4 trillion.

Ethereum validators signaled support to raise the gas limit to 45 million units.

Shares of crypto-linked firms jumped Monday, with Solana ETF SLON up 17.2% and BitMine rising 2.7%.

The COINS Act, a new model law in India, proposes a Bitcoin reserve and a dedicated regulator.

💰 Alternative Investing News

Oregon’s public pension system sparked concern with over 27% allocated to private equity, nearly triple the national average.

Private equity firms are increasingly using portability clauses to bypass leveraged loan banks in M&A deals, cutting Wall Street out of lucrative fees.

🤖 AI/Future/Tech News

ChatGPT users send 2.5 billion prompts daily, more than doubling in roughly eight months

A new zero-day vulnerability in Microsoft SharePoint hit thousands of servers, with CISA warning of active exploitation.

Google unveiled the Pixel 10 design nearly a month before its August 20 launch event.

AI voice startup Hyper closed a $6.3 million seed round to automate non-emergency 911 calls.

📗 Recommended Reading

Do you like newsletters? We like newsletters.

Here are some newsletters our readers tend to enjoy, covering topics like:

Finance

AI

Wealth building

Health

And more.

💡 Ideas, trends, and analysis

A new historical analysis of US carbon emissions showed how policy missteps and energy crises deepened coal dependence.

US peanut exports dropped 18% year-over-year.

Las Vegas tourism plunged in recent months, with hotel occupancy tumbling 14.9% in June

⚔️ Trade wars

Stellantis projected a $2.7 billion loss in the first half of 2025, citing President Trump’s auto tariffs and production cuts.

The Commerce Department set a 93.5% tariff on graphite imports from China after finding evidence of dumping.

President Trump confirmed that 25% tariffs on imports from Mexico and Canada would begin on Tuesday..

🌍 International Markets

🇻🇪 Venezuela sent 90% of its oil exports to China in June and held output at 910,000 barrels per day.

🇳🇬 After its GDP rebasing, Nigeria ranked as Africa’s fourth-largest economy.

🇮🇳 India’s retail inflation fell to 2.1% in June, the lowest level since January 2019.

🇸🇬 The Singapore dollar strengthened 6% against the US dollar this year, showing safe-haven traits.

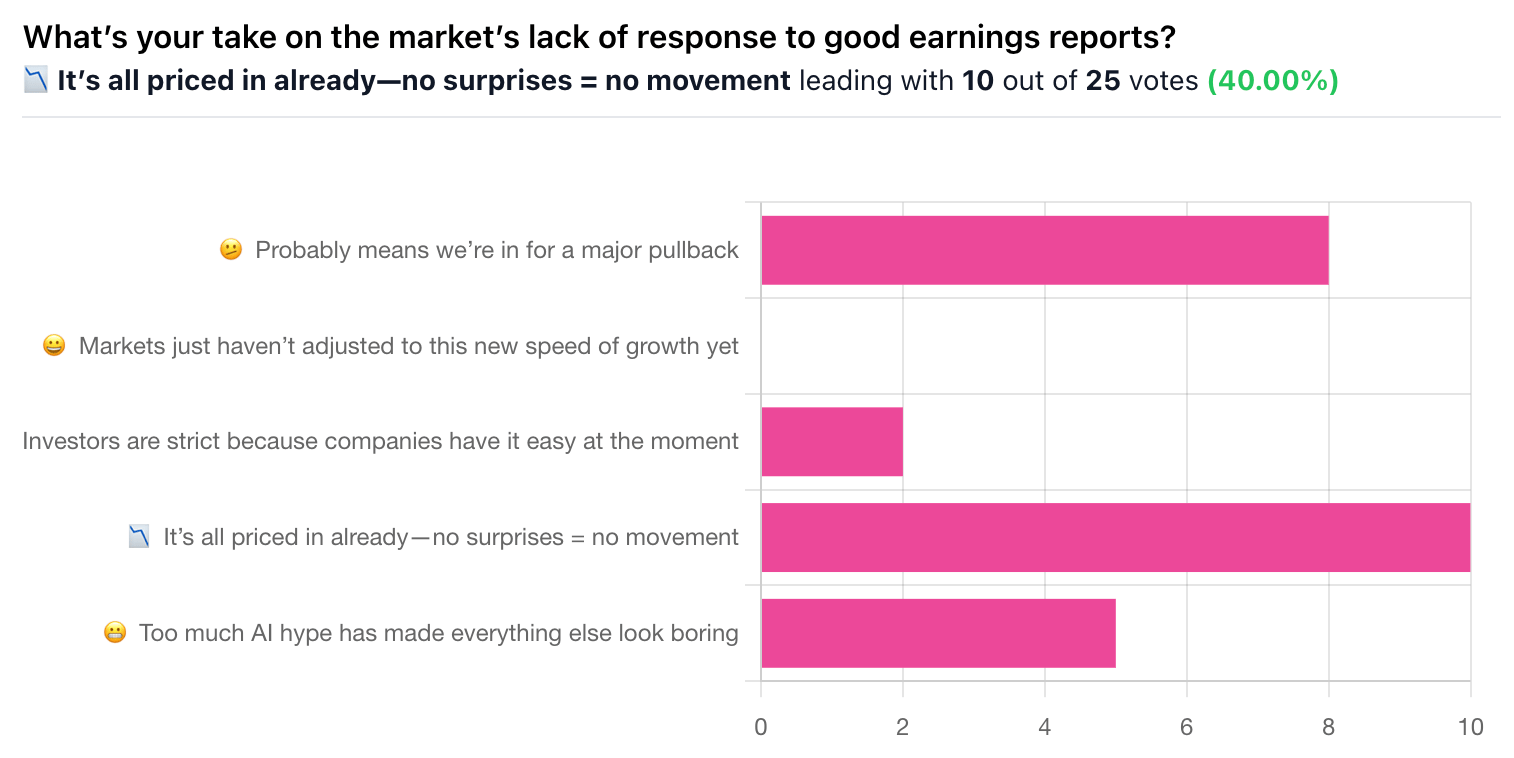

🎤️ What you said last time

“I think it varies on which sector the business is in.”

🚚 Market movers

Chevron closed its $55 billion acquisition of Hess after winning arbitration against Exxon. Altindex still doesn’t like the stock very much.

Kraft Heinz weighed a spinoff of slower-growing brands like Velveeta and Oscar Mayer.

Pepsi launched a prebiotic cola with 3g of fiber, just months after acquiring Poppi for $1.95 billion.

PharmChem agreed to a $3.75/share buyout by Alcohol Monitoring Systems, a 22% premium over its January price.

📊 Earnings

Cleveland-Cliffs got a price target boost from Citi to 11.00 after a smaller-than-expected Q2 loss and a revenue beat at 4.9 billion; shares advanced 2.1%.

Domino's Pizza posted 3.4% US same-store sales growth for Q2, beating estimates, but missed earnings; shares fell over 2%.

Steel Dynamics Inc. missed Q2 earnings and revenue estimates with adjusted EPS of 2.01 and revenue of 4.57 billion, and shares tumbled 4.3%.

Verizon raised its annual profit forecast after beating Q2 sales and profit estimates, despite a surprise drop of 9,000 monthly subscribers, so shares climbed 3.5%.

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.