As the RNC winds up, It’s time to examine how Trump and his allies’ policy positions could affect your investments over the next several years.

Check out my full analysis of how to invest during the Trump administration.

AvaWatz: Collaborative AI + robotics

"Behind-the-scenes" tech for complex tasks

With all the hype around AI and robots, there's a misconception that robots just work on their own.

They don't. To get the job done, robots need to:

Interpret data from sensors

Communicate the appropriate action

Overcome obstacles when stuff goes wrong (which is all the time)

Sounds simple! But in the real world it gets complicated, fast.

AvaWatz develops systemsthat work together to do complex tasks. This is known as collaborative AI.

One use-case is airport safety. AvaWatz robots can detect small but harmful junk on airport runways.

See here:

There are a bunch of applications for this. Defect detection on power lines. Enhancing medical imaging analysis. All sorts of precision training.

Why Invest in AvaWatz?

Innovative: AvaWatz enables multiple systems to collaborate seamlessly, and complete intricate tasks with precision and reliability.

Versatile: Their tech can be applied across multiple industries, from logistics and manufacturing, to security and inspection.

Scalable: The platform’s modular design allows for easy scaling.

High growth potential: The market for autonomous systems is rapidly expanding.

Proven Expertise: The team behind AvaWatz brings extensive experience in AI and autonomous technology.

Invest in AvaWatz. They're pushing the boundaries of what autonomous systems can achieve.

📰 Market Headlines

Markets floundered Wednesday, with the Nasdaq plunging 2.7% in its worst day since 2022. The S&P 500 fell 1.3%, while the Dow rose 0.6%.

Tech led the selloff driven by potential tighter US chip export curbs to China and Trump's comments on Taiwan.

Nvidia dropped 6%, ASML fell 12%, and TSMC sank 7% on the news.

Housing starts rose 3% in June on multifamily construction. Single-family starts fell 2.2%.

President Biden tested positive for COVID-19 while campaigning in Las Vegas. He has mild symptoms and will isolate in Delaware.

Amazon Prime Day sales hit $7.2 billion on day one, up 11.7% from last year.

🕶️ Market Vibes

🎰 Market Forecasts and Futures

😱 Fear and Greed Index

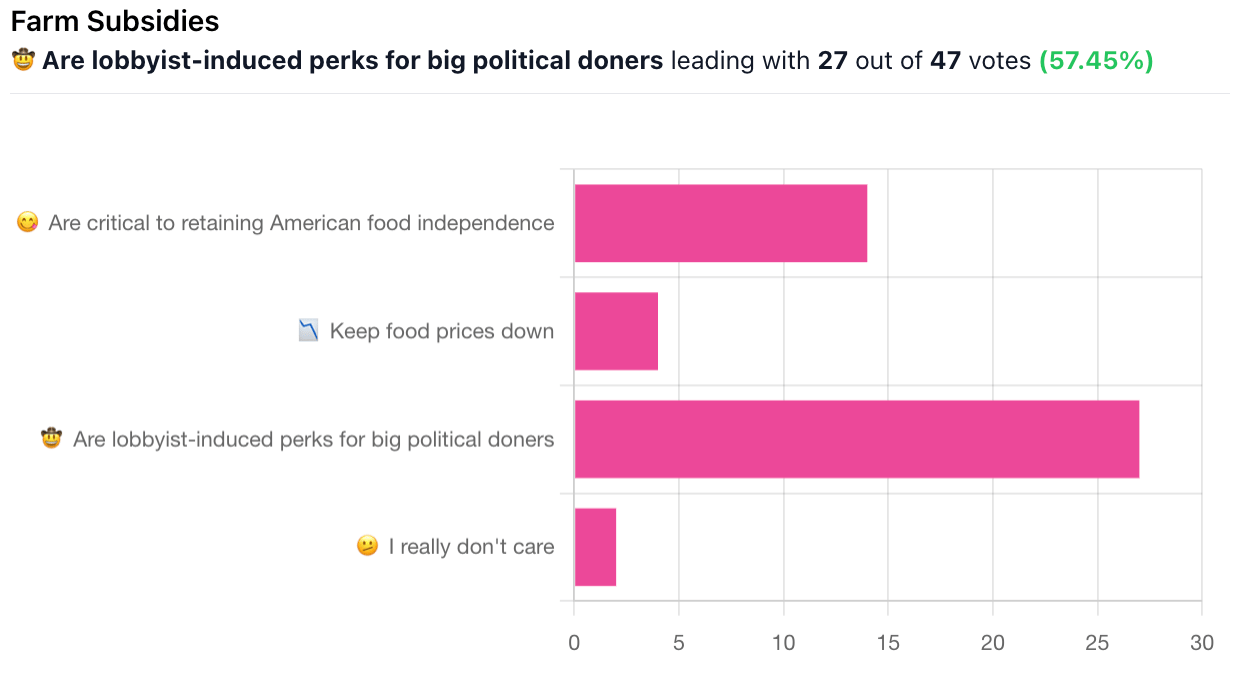

🎤 What you said last time

📈 Trends you need to know

Two worrying facts for homeowners:

Nearly a quarter of US homes saw price cuts in June, the highest rate since 2018.

Housing inventory is the highest it’s been since the beginning of the pandemic.

🧠 What do you think?

How's the residential real estate market where you live?

📊 Stocks

Get $20 free shares at public.com using code ALTSCO.

Winners and losers

Earnings, upgrades, and acquisitions

ASML's earnings beat forecasts, but shares sank 7% on concerns over potential tighter U.S. restrictions on China exports.

United Airlines grew Q2 profit over 20%, but its Q3 forecast missed estimates amid industry overcapacity. Shares fell 2%.

Darden Restaurants announced it will acquire Tex-Mex restaurant Chuy's for $605 million. Shares slipped 1% after hours.

Johnson & Johnson beat Q2 expectations but cut its full-year profit outlook on acquisition costs. Up 3.7%.

U.S. Bancorp beat estimates by 2 cents. Shares jumped 5%.

Alcoa posted a smaller-than-expected Q2 loss as revenue climbed 12% to $2.9 billion. Down 3%.

Market movers

California received $30 million to start planning the nation's first $1.2 billion hydrogen energy hub.

Novo Nordisk and Eli Lilly shares slid after Roche announced promising results from its new once-daily weight loss pill.

The SEC sued Digital World's ex-CEO Patrick Orlando for securities fraud related to the Trump Media SPAC deal.

Charles Schwab stock fell for a second day after disappointing earnings and analyst downgrades.

China's restaurant stocks are slumping as consumers cut back on dining out amid economic pressures.

Regional bank stocks rallied on hopes of Fed rate cuts and a potential second Trump term.

Ideas, trends, and analysis

US economic activity expanded slightly from late May through early July, with firms expecting slower growth ahead.

Nearly a quarter of US homes saw price cuts in June, the highest rate since 2018.

Fed Governor Waller said interest rate cuts are getting closer, pointing to a potential September move.

America's freight recession nears its end, with retail orders and rates headed higher.

Americans now hold a record $2.4 trillion in Treasurys.

Alphabet could join Apple, Microsoft, and Nvidia in the $3 trillion club by the end of 2025.

🌍 Global Perspectives

🇬🇧 The pound hit its highest level against the dollar in a year as investors bet on higher UK rates for longer.

🇩🇪🇺🇦 Germany plans to halve its military aid for Ukraine in 2025, a cut of roughly €4 billion.

🇺🇸🇵🇸 The U.S military officially scrapped its troubled temporary pier intended to bring aid into Gaza.

🇹🇷 Turkey's wealth per adult grew 157% between 2022-2023, the most in the world, despite soaring inflation.

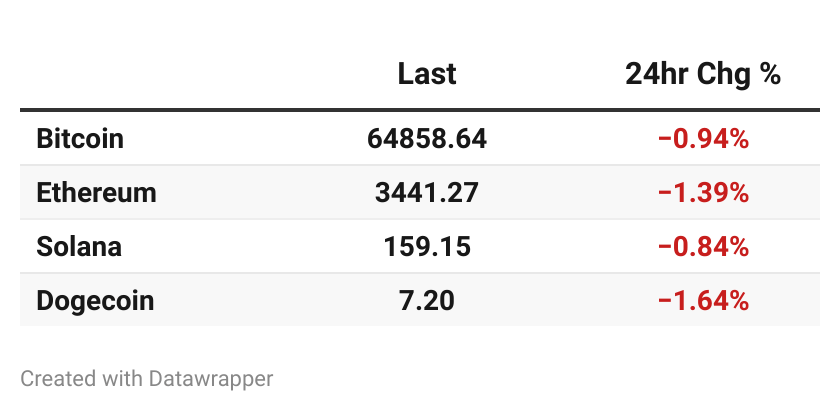

📊 Crypto

Former President Trump said he would consider JPMorgan CEO Jamie Dimon, a vocal Bitcoin critic, for Treasury Secretary if elected.

Crypto miners are scrambling to boost revenues by forging deals with AI developers to capitalize on rising demand for GPUs.

The launch of spot Ether ETFs is expected to push ETH prices above $5,000, with $15 billion of net inflows predicted in the first 18 months.

The German government netted $2.8 billion from the emergency sale of 49,858 Bitcoin seized in the Movie2k piracy case.

🧠 Errata

SpaceX unveiled the super-powered Dragon capsule it's building to deorbit the International Space Station in 2030.

A stegosaurus skeleton nicknamed Apex sold for $44.6 million at a Sotheby's auction, the most ever paid for a fossil.

Rural U.S. hospitals built during the baby boom now face a baby bust.

Squeeze incredible environmental efficiency from your python meat burger.

📺 What to Watch Today

Anyone want to invest in a python farm?

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Wyatt