4 Reasons The Dollar Could Collapse

If you’ve noticed that your dollars don’t seem to go as far as they used to, you’re not alone. Millions of Americans are in the same boat.

The recent inflation rate, the highest in over 40 years, was a wake up call that made many people realize that the financial stability they had taken for granted for decades no longer exists.

The US government has been tempted to use its reserve currency status to its financial advantage. This has resulted in massive devaluation of the dollar.

A way to help protect your dollars is to diversify your money with assets that don’t depend upon the strength and health of the dollar for their value. Precious metals like gold and silver, for instance, are in demand around the world 24/7 and aren’t dependent upon the value of the dollar.

To find out reasons why experts are predicting the collapse of the dollar, request your free digital copy of the 4 Reasons the Dollar Could Crash eBook.

*Offer valid on qualified orders of Goldco premium products only. Receive up to 10% in free silver based on purchase amount; cannot be combined with other offers. Additional terms apply—see your customer agreement or contact your representative for details.

📰 Market Headlines

Markets pushed through Moody's downgrade to rise on Monday, with all three major indexes closing higher.

The S&P 500 notched its sixth straight gain, rising 0.1%, the Dow added 0.3%, and the Nasdaq rose 0.02%.

30-year yields spiked to 5% for the first time since late 2023 before pulling back later in the session.

China has accused the US of undermining their Geneva talks. The accusation comes after the US told American companies not to use advanced Chinese computer chips, including Huawei’s. We’re just barely one week into the US-China tariff pause, and it’s unclear if we’re on good terms—is the truce already breaking?

Demand for Japan’s bonds just hit a 10-year low, and Japan’s debt-to-GDP ratio is 234%, second only to Sudan. Low appetite for bonds (plus the worst bond auction in almost 40 years) could mean this is the beginning of a true debt collapse for the country—and analysts fear the US might not be too far behind.

Judge blocks President Trump’s USIP shake-up. Judge Beryl Howell slapped down the Trump administration's takeover of the US Institute of Peace, ruling that DOGE's actions were unlawful. She ordered the reinstatement of the institute's acting president.

Tariff relief? Not so much. The US and China recently agreed to lower their respective tariffs for 90 days, bringing US tariffs on many Chinese goods down to 30% from a punishing 145%. Small businesses report that the remaining duties still threaten their margins and survival. "It still sucks," says one founder, noting the lower rate is still crippling costs for US importers.

😱 Fear and Greed Index

🧠 Make yourself heard

What’s your take on our new AltIndex AI Stock Pick section?

⚔️ Trade Wars

President Trump’s reciprocal tariff policy returned for countries that failed to reach deals during the 90-day pause that began April 9.

The European Commission downgraded growth forecasts to 1.1% for the EU and 0.9% for the Euro area, citing US tariffs and trade uncertainty.

Utz flagged a modest impact from tariffs thanks to its US-based supply chain.

🥇 AltIndex Top Stock Pick

We hope you like Mediterranean food, because AltIndex’s AI-driven stock analysis just gave Cava (CAVA) a buy signal on May 18th.

👉 Current price: $90.34

🎯 Target price: $113.20

📈 Upside: 25.7%

Key reasons for the buy rating:

🫰 YoY Revenue Increase

🧑🏭 Improved business outlook among employees

💻 MoM growth in web traffic and app downloads

📱 Spikes in social media followers

Always do your own research.

📊 Alternative Investing News

TXNM Energy, parent company of Public Service Company of New Mexico, struck an $11.5 billion acquisition deal with Blackstone Infrastructure.

Financial software firm Finastra sold its treasury and capital management business to private equity advisory firm Apax Partners.

Kayne Anderson closed its Kayne Private Energy Income Fund III at $2.25 billion, far exceeding its $1.5 billion target.

🤖 AI/Future/Tech News

President Trump signed the Take It Down Act on Monday, criminalizing both authentic and AI-generated revenge porn with penalties including fines, imprisonment, and restitution.

Google locked in 600 megawatts of solar power from EnergyRe's South Carolina projects to fuel its data centers.

Google rolled out its NotebookLM AI tool as a mobile app on Android, with an iOS release following shortly.

🪙 Crypto

JPMorgan will now let clients buy bitcoin and will list holdings in statements, though it won’t custody assets.

DigiAsia Corp announced a Bitcoin treasury reserve strategy and is exploring a $100 million capital raise.

Senate leadership revived the GENIUS Act, a bill to regulate stablecoins, after Democratic opposition blocked it earlier this month.

The DOJ opened a probe into a cyberattack on Coinbase that could cost the exchange up to $400 million.

💡 Ideas, trends, and analysis

The rising national debt is predicted to slash US GDP by $340 billion by 2035 and eliminate 1.2 million jobs.

The average effective tariff rate has hit 17.8%, the highest since 1934.

Mortgage rates jumped back above 7%.

🌍 International Markets

🇮🇳 India’s central bank proposed new investment rules for lenders in Alternative Investment Funds, allowing up to 5% of a scheme’s corpus without restrictions.

🇮🇩 Economists expect Bank Indonesia to cut rates by 25 basis points on May 21, as the rupiah rebounds 2.4%.

🇷🇴 Bucharest Mayor Nicușor Dan claimed victory in Romania’s presidential election with nearly 54% of the vote, defeating an ultranationalist rival.

🇬🇧 The pound rallied 0.7% against the dollar, and UK gilt yields jumped 7 basis points after Britain and the EU agreed to reset post-Brexit relations.

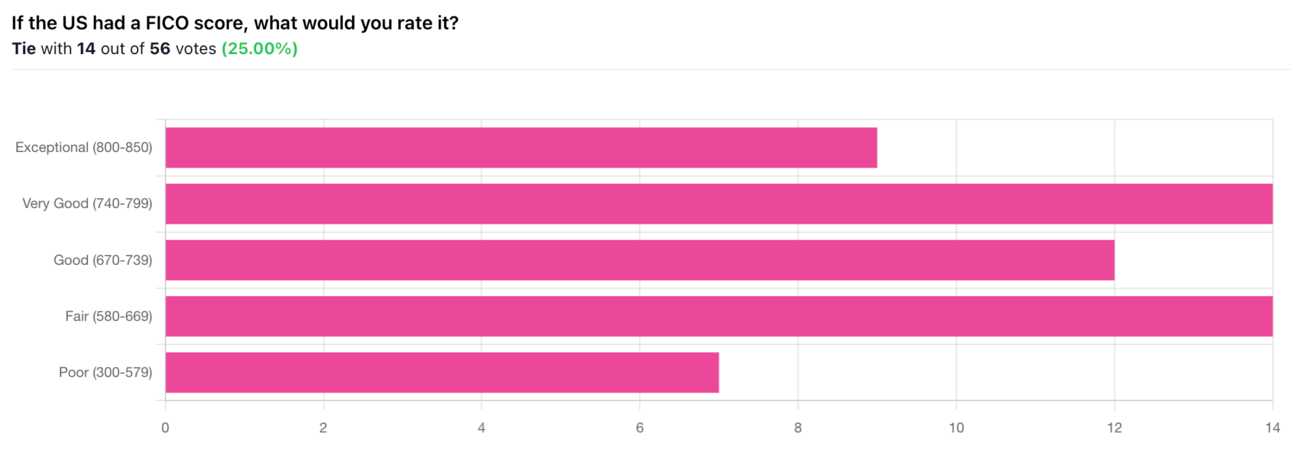

🎤 What you said last time

“Not even high enough to qualify for a Mitsubishi vehicle...”

🚚 Market movers

The USTA unveiled an $800 million investment to modernize US Open facilities.

Apple was fined $130,483 by Russian courts in four separate cases, with three violations related to "LGBT propaganda" laws.

Elon Musk's xAI partnered with Microsoft to host its Grok AI models on Azure while simultaneously suing the tech giant.

RTX announced it will resume talks with the union representing 3,000 striking Pratt & Whitney workers as the work stoppage entered its third week.

📊 Earnings this week

Trip.com reported Q1 revenue up 16% year-over-year, driven by a 60% surge in international bookings and 100% growth in inbound travel; shares rose 3.28%.

🧠 Miscellanea

Retired social worker Paul Jenkinson listens to strangers talk about anything for free across Canada.

A 61-year-old Michigan man won his second lottery jackpot in just over a year.

Ancient footprints discovered in eastern Australia just pushed back the timeline for amniotes by 35-40 million years.

The small town of Landerneau in France broke the world record for the largest gathering of Smurfs with 3,076 participants.

📗 Recommended Reading

Do you like newsletters? We like newsletters.

Here are some newsletters our readers tend to enjoy, covering topics like:

Finance

AI

Wealth building

Health

And more.

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt