Good morning.

Follow the data, not the crowds. That’s the advantage you can control.

Today’s market:

Google is taking Zillow’s job; Z fell 9%

VMAR rose 123% in 20 min; Reddit’s talking about a “2nd pump”

Warner Bros to reject Paramount’s $108B counter bid

Another day on the markets, another day of becoming a smarter investor.

Let’s get to it.

In partnership with FinanceHQ

Successful Career. Strong Savings. What’s Your Next Financial Move?

Whether you’ve acquired wealth through business leadership, years of diligent saving, or a windfall, the right financial advisor can help you protect it and grow it further. With FinanceHQ, get a free, personalized match to advisors experienced in serving high-achieving professionals.

Please support our partners!

📰 Market Headlines

Markets slipped on Tuesday after investors weighed a mixed jobs report and shifting corporate strategies.

The Dow fell 0.6%, the S&P 500 dropped 0.2%, and the Nasdaq edged up 0.2% thanks to a record-setting run from Tesla.

Zillow (Z) shares dropped 9% earlier this week on reports that Google has begun to test inserting real estate listings in its search results. The search result listings would include key information that Zillow’s listings provide; however, it’s important to note that Zillow’s business doesn’t rely very much on organic search results for exposure anyway.

Huge Reddit alert: Vision Marine Technologies (VMAR) is trending as Redditors react to VMAR’s explosive 123% surge in 20 minutes, speculating about a possible “second pump” and sharing high-risk trading strategies around the volatility.

Warner Bros Discovery is expected to reject Paramount’s $108.4 billion hostile offer over financing concerns and reaffirm its $72 billion deal with Netflix. The board could announce its decision as soon as Wednesday. WBD shares have surged 160% this year on takeover speculation.

Amazon (AMZN) is looking at a $10 billion investment in OpenAI including use of Amazon’s chips. AMZN is up 1% premarket on the news. We hadn’t seen a huge investment announcement involving the ChatGPT developer in a while, but it could be that we’ll see more of these investments ahead of the likely IPO coming up in 2026.

Pfizer warned of rough years ahead, forecasting 2026 profits below expectations as COVID product sales fade and drug price cuts squeeze margins. The company expects revenue between $59.5 billion and $62.5 billion next year and doesn’t see growth returning until 2029. Shares fell 5.2%.

Paypal (PYPL) has applied to form a bank that will offer small business loans and bank accounts.

Japan’s central bank is expected to hike interest rates to a 30-year high right after the Fed lowered them last week in the US. Also, Japan’s exports grew by their fastest rate in nine months this November.

Gold ticked higher as investors bet the Fed will cut rates next year. Spot gold rose 0.2% to $4,310 per ounce, while silver retreated slightly from record highs. Analysts say if gold finishes the year above $4,400, it could test $5,000 in 2026.

🤖 AI/Future/Tech News

Here’s a video of Wendy’s (fast food) supply chain president explaining how Palantir handles Wendy’s supply chain data.

Shares of Chinese chipmaker MetaX rose 700% after its IPO today.

Databricks landed over $4 billion in new funding, rocketing its valuation to $134 billion as its AI products topped $1 billion in run-rate revenue.

OpenAI continued its "code red" warpath against Google, releasing its GPT Image 1.5 model with 4x faster generation speeds.

🪙 Crypto

The BTC-to-gold ratio halved this year, dropping from 40 to 20 ounces per BTC as gold surged 63% and central banks bought 254 tonnes.

Bitcoin slipped 3.7% Monday before rebounding 1.5% Tuesday, heading for its fourth straight annual loss and down about 7% for 2025.

The Marshall Islands launched the first blockchain-based universal basic income program using a US Treasury-backed digital bond on Stellar.

🤫 Insider Trading

🖥️ Alternative Investment: Vintage Tech

Collectors are hunting for early computers, gaming consoles, and sealed electronics, driving up prices across the market. Original Apple I computers have sold for nearly $500,000, while first-generation iPhones in pristine condition fetch six figures from nostalgia-driven buyers.

Retro gaming consoles like NES, Sega Genesis, and limited-edition handhelds have surged in value. Sealed cartridges and mint-condition packaging are especially prized, with rare titles commanding premiums. Searches for early video game hardware have spiked on collector marketplaces, signaling growing interest in digital-era artifacts.

Classic home computers, calculators, and tech gadgets from the ’70s and ’80s are experiencing renewed demand. Collectors favor devices with unique design or historical significance, such as early Macintosh models or rare programmable calculators, viewing them as undervalued cultural and technological investments.

📊 IPOs and Earnings

Worthington Enterprises (WOR) missed Q2 2026 estimates with EPS of $0.55 versus $0.71 expected and revenue up ~27% to $327.5 million; shares fell ~7% on slower operating profit growth.

Lennar (LEN) missed Q4 fiscal 2025 estimates with EPS of $1.93 versus $2.22 expected and revenue of $9.37 billion, topping forecasts; shares dropped ~4% after weak profit and cautious housing commentary.

❓Market Trivia Corner

Which index fund is up the most YTD in 2025?

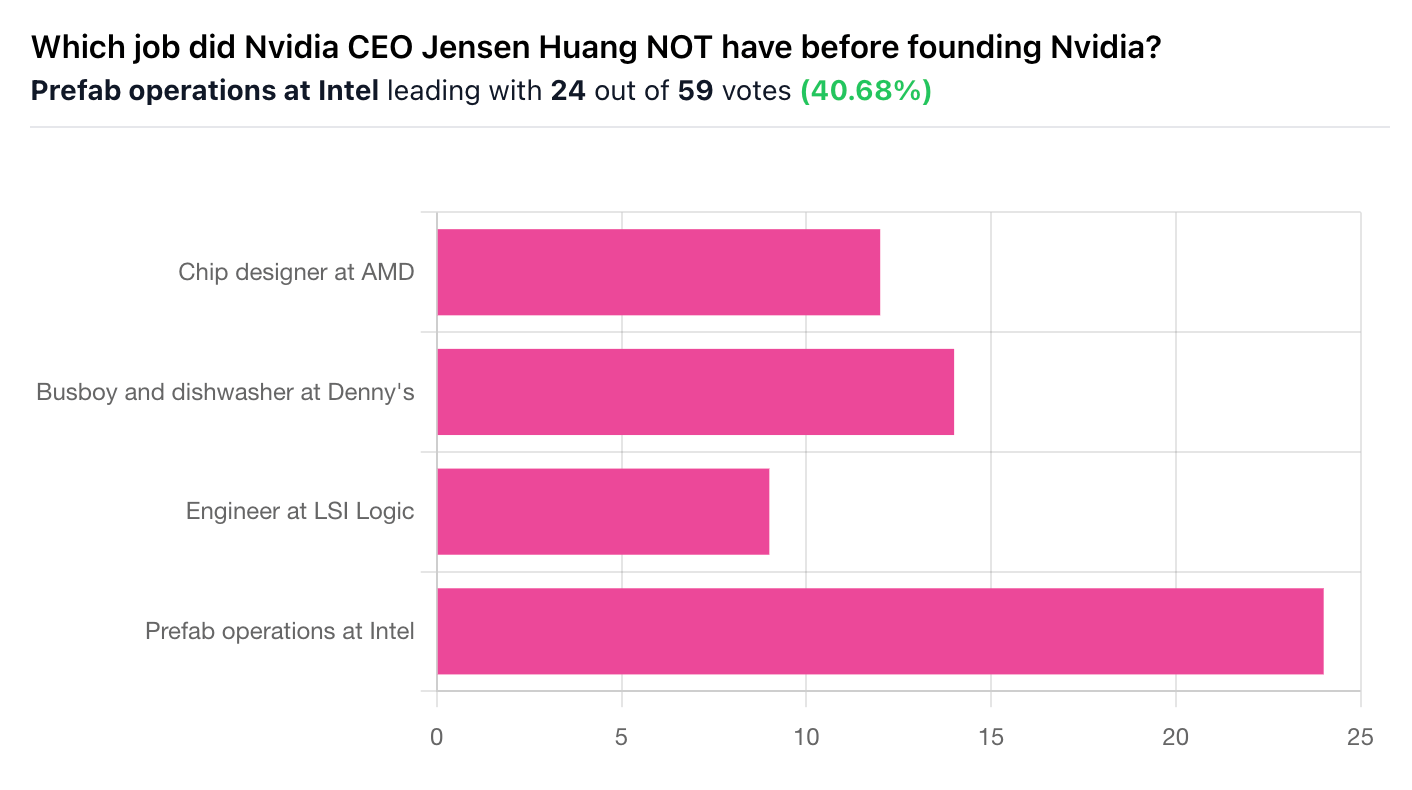

🎤️ What you said last time

Correct answer: Prefab operations at Intel!

Imagine meeting Jensen Huang at Denny’s. Talk about a Grand Slam.

🎪 Crowdfunding Showcase

Shieldwise is using AI to make public spaces safer with cameras that detect concealed weapons under clothing or in bags, before violence occurs. Designed for schools, airports, and other high-traffic areas, its system combines advanced imaging with machine learning to identify threats in real time.

The company’s model blends hardware, installation, and SaaS for recurring revenue, while its technology promises to shorten airport lines and proactively prevent school shootings.

Founded by Ali Hosseinzadeh, a veteran in IT services and cybersecurity, Shieldwise has raised $52K of its $1.1 million goal, with early backers including Nasrin Gharajeh, who invested $50K, calling it “a scalable solution that blends technology, responsibility, and impact.”

🧠 The Missing (Market) Links

According to world no. 1 chess pro Magnus Carlsen, hedge funds have been recruiting chess players.

Interesting: a 2013 email from Elon Musk on why SpaceX should stay private until it “reaches certain technological milestones.”

The new hiring trend for tech companies is “storytelling” roles.

Mortgage rates are moving higher after the Fed’s rate cut last week.

A new poll revealed 65% of Americans believe professional athletes are throwing games for gamblers.

Economic anxiety hammered President Trump's approval rating, which slid to 39% as cost-of-living concerns mounted.

📜 Quote of the Day

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.open