*past 24-hour performance

💨 TL;DR

CPI came in as expected, more or less. Markets rallied.

The Fed reports today. No change is expected.

Epic won its anti-trust case against Google.

Elon lost his Starlink subsidy.

Alts are perfect for SDIRAs

In this issue, we'll show you why self-directed IRAs (or SDIRAs) are the perfect vehicle for investing in alternatives.

Alto allows you to invest in alternative assets with their retirement funds. You can transfer cash from any existing 401(k) or IRA, or initiate a new contribution to invest in alternatives. Alto helps you with all the administrative stuff.

They've recently launched Alto Marketplace, a platform that connects individual accredited investors to private alternative opportunities.

Their suite of integrated partners includes some names you might recognize:

Startups (with AngelList)

Peer-to-peer lending (with Prosper)

Real estate (with CalTier)

Artwork (with MasterWorks)

Infrastructure (with InfraShares)

Optimize your retirement strategy, diversify your portfolio, and minimize your tax burden with a tax-advantaged retirement account from Alto.

Create an Alto IRA today. Go to altoira.com/marketplace to learn more.

Disclaimer:

Alto Marketplace offerings are currently available only to accredited investors. Private securities involve risk and may result in significant losses. Important disclosures apply. Alto does not provide investment advice. Consult an investment advisor to determine whether an investment is appropriate for your portfolio.

SPONSOR

📰 Market Headlines

Inflation ticked up slightly, increasing by 0.1% MoM.

Undeterred, the Dow and S&P 500 hit a 23-month high. The Nasdaq advanced as well. Oil was off 4%. 51 different S&P 500 stocks saw record highs yesterday.

Meanwhile, everyone’s holding their breath this morning, waiting to see what the Fed will do with rates. Futures are up slightly.

The COP28 climate summit approved a deal that would, for the first time, push nations to transition away from fossil fuels to avert the worst effects of climate change.

🕶️ Market Vibes

🎰 Market Forecasts and Futures

The markets are forecasting:

1% chance for a +25 bp rate hike at today’s FOMC meeting.

3% chance of a 25 bp rate cut in January

43% chance of a cut for the March meeting

and 100% chance of a cut by the April 30-May 1 meeting

100% feels very high. Odds are only 75% by July at Kalshi.

End-of-year forecasts

Macro forecasts

😱 Fear and Greed Index

🧠 What do you think?

The Dodgers just handed Shohei Ohtani a $700m contract, sort of.

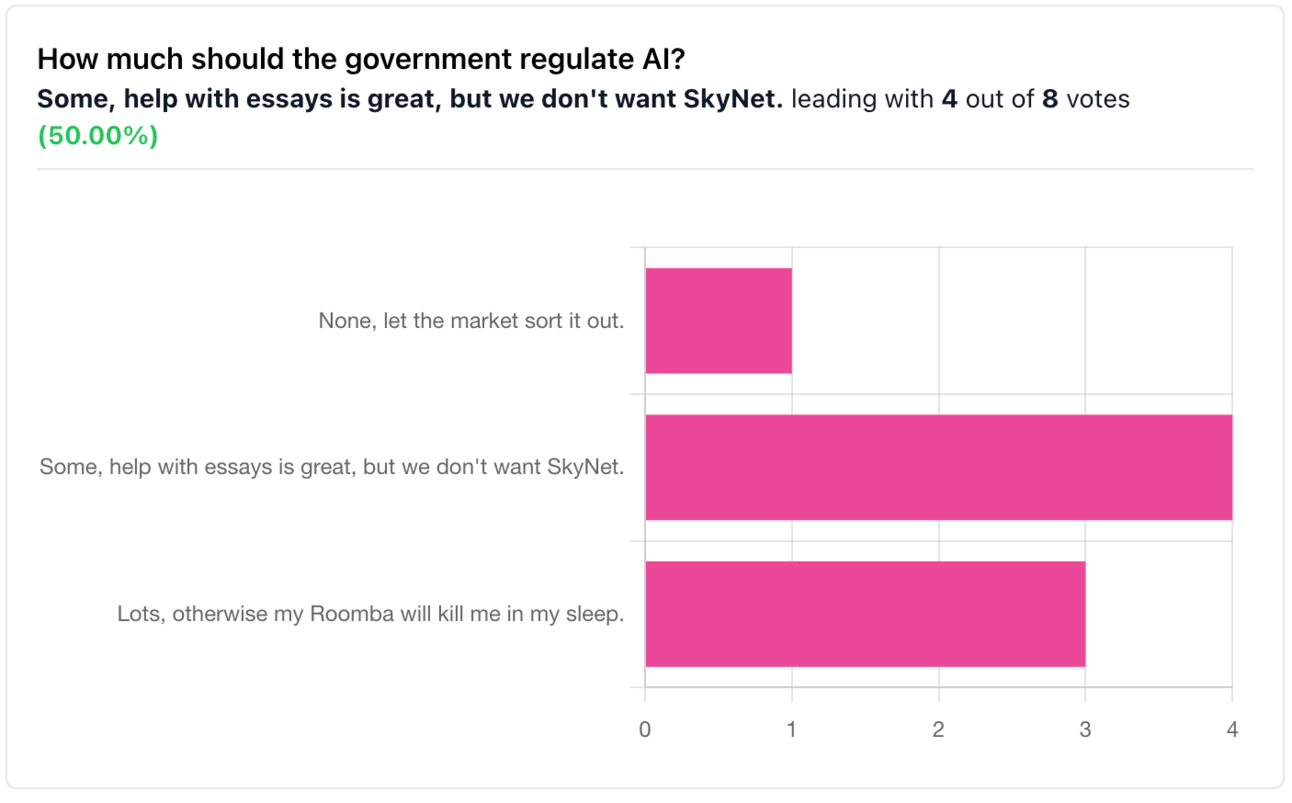

🎤 What you said last time

Y’all are really not into AI. Noted.

📊 Stocks

Want to invest like Buffet? With Public.com, you can emulate Berkshire Hathaway’s portfolio with just a few clicks.

Winners and losers

Earnings, upgrades, and acquisitions

Oracle missed estimates; shares were down 12%.

Icosavax is being acquired by Astra Zenica. Its shares were up 50%.

Further, Seagen rallied +3.6% after Pfizer said it had received all required regulatory approvals to close its acquisition of the company on December 14.

Likewise, Piper Sandler upgraded HubSpot; shares were up 5.35%.

Market movers

Choice Hotels is launching an $8 billion hostile takeover offer for Wyndham Hotels & Resorts.

Hasbro is cutting 1,100 positions or 20% of its staff. Shares were down slightly.

The UAW is accusing Honda, Volkswagen, and Hyundai of union-busting.

Starlink has lost its $900 million subsidy from the US government.

Ideas, trends, and analysis

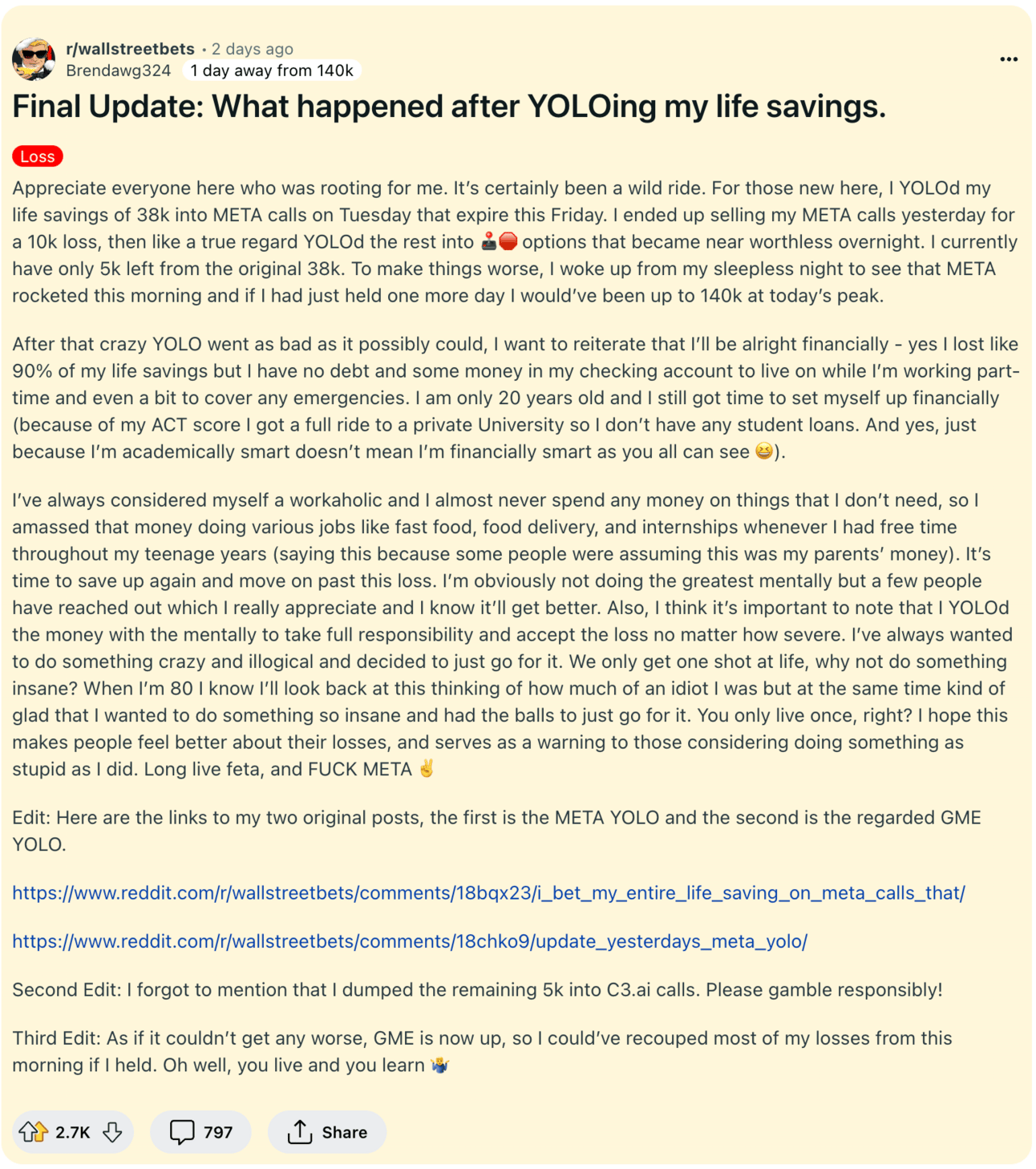

Don’t be like this guy.

Trade options like the pros.

If you want to learn to trade options effectively, we’ve got the thing for you.

No crazy schemes.

No speculation.

Just institutional-grade strategies that yield outstanding risk-adjusted returns.

We’ve teamed up with Benedict Maynard — the guy who literally wrote the book on options trading — to show you how the pros do it.

Twice a month, you’ll learn a new options trading strategy. How it works, why it works, and how to implement it in today’s markets.

Prices will go up when we launch, but the first 50 people to sign up lock in a 50% discount for life. Just use the code Forever100.

📊 Income

The 10-year German bund yield fell by -4.4 bp to 2.226%. The 10-year UK gilt yield fell sharply by -11.0 bp to 3.967%.

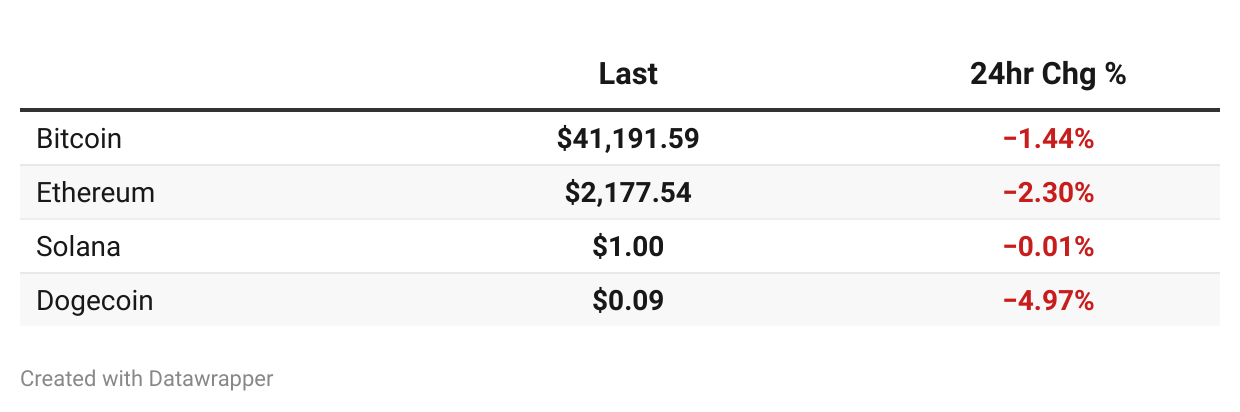

📊 Crypto

Prices as of Saturday 2am EST.

🌍 Global Perspectives

🇨🇳 China's banking system is collapsing, and the real estate crisis in the country could end up wiping out $4 trillion from its financial system. But Zhang Yadong, chairman of property developer Greentown and a man keen not to be disappeared, says an economic recovery will help trigger a turnaround in the second half of next year.

🇦🇷 Argentina will weaken its peso over 50% to 800 per dollar, cut energy subsidies, and cancel public works tenders.

🇻🇳 Why everyone wants to be Vietnam’s friend.

🇬🇾 🇻🇪 Guyana vows to defend itself ‘by all and any means’ from Venezuela.

🇬🇧 The UK has voted to send asylum-seekers to Rwanda.

🇬🇧 Sticking with the UK, its economy shrank more than expected in October.

💎 Wealth Watch

Gas prices have fallen 19% since September. See where fuel is the cheapest.

The "American Dream" costs far more than most people will earn over their lifetime.

The most affordable place to retire in America.

🗳️ Outside the Box

📺 What to Watch Today

Based in Reno, Dragonfly Energy is a leader in the green energy storage industry. Shares are down 96% this year, but the company’s popularity continues to grow.

That’s all for today. Did we miss anything? Smash the reply button to let us know.

Cheers,

Wyatt

Notes

Please read this disclaimer. The authors of Alt Assets, Inc. are not attorneys, investment advisers, accountants, tax professionals or financial advisers and any of the content should not be taken as professional advice. They are self-taught accredited investors, sharing information, research, entertainment and lessons learned based solely on their own experience and circumstances. Individual results may vary. The published content is unique, based on certain assumptions and market conditions at the time of publishing, and is intended to serve solely as research, not financial advice. For entertainment purposes only. Not investment advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several, or all of the alternative asset classes that Alt Assets, Inc. publishes content about on its site. Any of the Fund’s investments that have positive designations on the Alt Assets, Inc. site are purely coincidental, as the Fund is actively managed and guided by its own investment parameters, as summarized in the relevant private placement memorandum. Alternative investing involves a high degree of risk, including complete loss of principal and is not suitable for all investors. Past performance does not guarantee future results. The newsletter may contain affiliate links, meaning that Alts.co and its associated entities may receive compensation for referring customers to the noted companies. We recommend seeking the advice of a financial professional before you make any investment in an alternative asset class or any associated entities, and we accept no liability whatsoever for any loss or damage you may incur.