Good morning.

Wall Street just got clobbered, but the world still needs critical metals... and this miner found a huge supply of the space-age metal.

Yesterday, the Dow dropped over 800 points, the S&P 500 fell 2%, and year-to-date gains got fully wiped out. The culprit was, of course, Greenland tariff threats and negotiations.

Investors are running scared and “selling America.” Gold climbed above $4,880 for the first time ever, and one analyst summed it up: "The debasement trade is on fire."

Today:

See Reddit’s top 10 Penny stocks from last week (+17,000% mentions)

Trump on how far he’ll go to get Greenland: “You’ll find out”

Arctic blast is driving natural gas prices through the roof

AltIndex’s 10 highest-rated stocks include huge names right now

Let's get into it.

In partnership with Capital Trends

The Metal China Controls (And the US Desperately Needs)

Fighter jets. Rockets. Nuclear submarines. They all depend on one metal, and the US imports 90% of it.

If lithium is the metal of batteries, this is the metal of everything else. And China just increased its grip from 40% to 75% of global supply in six years.

The metal is titanium, and Project Blue warns that a titanium squeeze is coming. Aerospace and defense will feel it first.

And Saga Metals’ new Radar Project in Canada just revealed a titanium deposit potentially larger than China's Panzhihua mine (the world's biggest).

Magnetic readings were so intense they maxed out survey equipment.

The site sits miles from deepwater shipping, hydropower, and industrial infrastructure. First drill results are in. A major program is underway.

This could be the most strategic titanium discovery in North America.

Please support our partners!

📰 Market Headlines

Markets got clobbered on Tuesday, with the Dow plummeting over 800 points in Wall Street's worst session since October.

The S&P 500 fell about 2%, the Nasdaq sank 2.4%, and year-to-date gains for both indexes were fully wiped out.

In the midst of all this geopolitical uncertainty, three things remain certain: death, taxes, and Redditors finding new penny stocks. Here are Reddit’s top 10 favorite penny stocks from last week, including one with a 17,000% increase in mentions and a biotech stock, an AI, a medical device stock, and more.

The latest on Trump’s quest for Greenland: when asked how far he’ll go in order to obtain the territory, he said “You’ll find out.” Trump will be meeting with other world leaders at the Davos economic forum starting today, so we’ll hopefully know more soon about his plans.

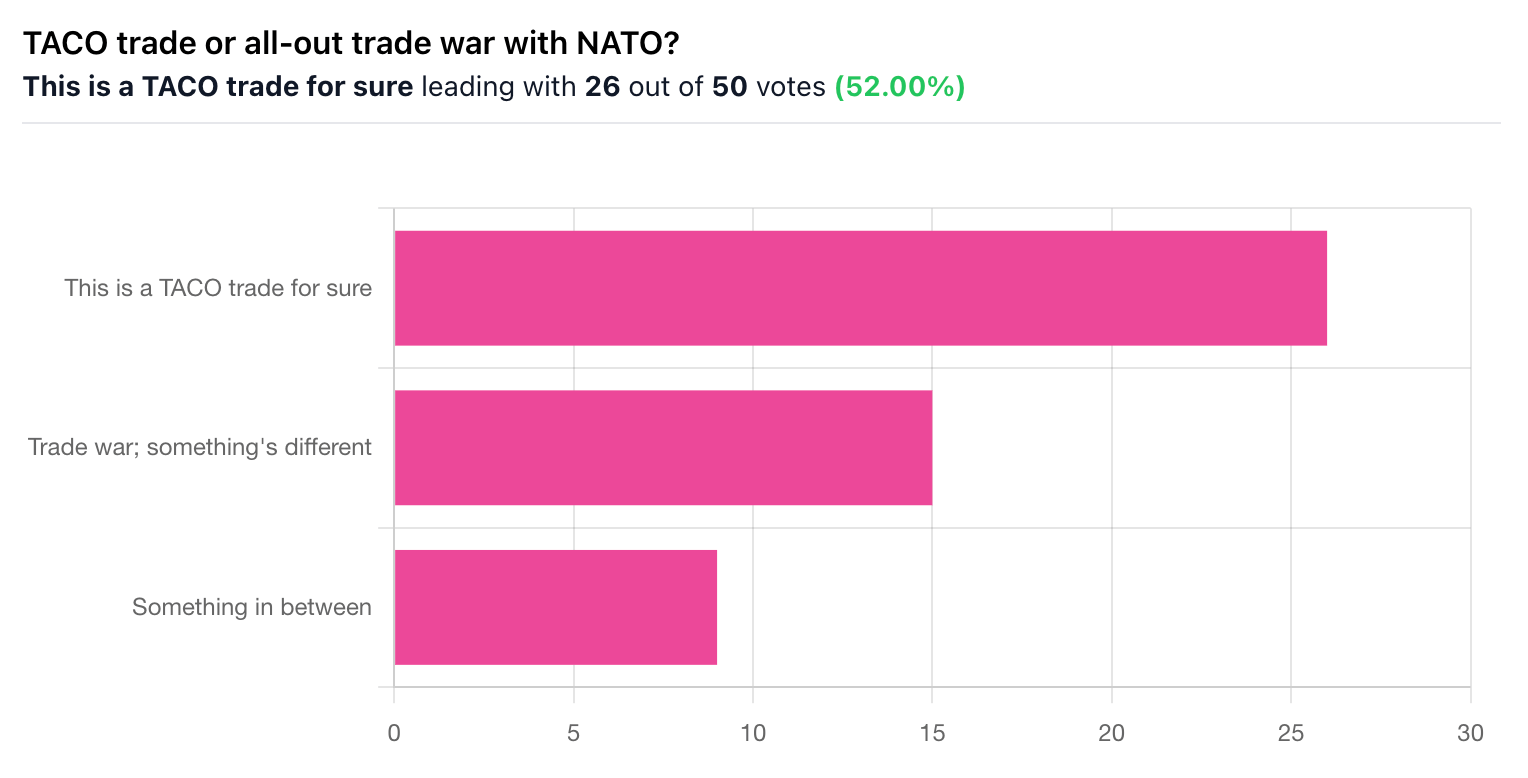

Remember that the TACO trade is very much still in play. Here’s our breakdown. This is not financial advice.

AltIndex’s top 10 list is covered with high-quality names that you’ll likely recognize, and one stock has one of the highest ratings we’ve ever seen (86/100). Here’s the full list. Some of the names include:

Nebius (NBIS)

Anglogold Ashanti (AGI)

Paramount Skydance (PSKY)

Circle (CRCL)

Gold and silver surged to fresh records as investors fled to safety. Gold futures climbed above $4,800 per ounce while silver hit $95, driven by central bank demand, fiscal concerns, and mounting geopolitical chaos. One analyst called it: "The debasement trade is on fire."

Natural gas jumped 26%, its biggest single-day gain in nearly four years. An arctic blast is descending on the US, with forecasters warning of major cold outbreaks across the eastern two-thirds of the country. Freeze-offs could knock out up to 10 billion cubic feet per day of supply in Appalachia alone. Texas is bracing for below-freezing temps and a potential ice storm by Sunday.

Mortgage rates spiked 14 basis points to 6.21%, erasing last week's three-year low that had triggered a surge in applications. The Greenland drama and a sell-off in Japanese bonds are to blame.

China met its soybean commitment. Treasury Secretary Bessent confirmed Beijing purchased the agreed 12 million metric tons of US soybeans, with another 25 million tons pledged for next year. But economists warn President Trump's shifting tariff policy could blow up the deal at any moment.

🤖 AI/Future/Tech News

Indian vibe-coding startup Emergent tripled its valuation to $300 million with a $70 million Series B four months after its Series A.

OSHA fined SpaceX $115,850 after a crane collapsed at Starbase in June. The company hadn't documented monthly inspections in over a year.

Meta's Oversight Board reviewed permanent account bans for the first time after a year of mass ban complaints.

Salesforce CEO Marc Benioff called for AI regulation after several suicides linked to AI models.

🚚 Market Movers

Serve Robotics, the Uber-backed sidewalk delivery company, is acquiring Diligent Robotics for $29 million to push its autonomous bots into hospitals.

Wonder's Grubhub scooped up Claim, a restaurant rewards app valued at $62 million, to roll out cash-back dining perks across its 415,000 merchants.

KeyCorp reshuffled its board after activist investor HoldCo demanded the CEO's ouster and blasted the bank's stock performance. The company named a new lead independent director and pledged $300 million in Q1 buybacks.

🤫 Insider Trading

🎙 Make yourself heard

What stock data are you most interested in from Reddit?

🎤️ What you said last time

🧠 The Missing (Market) Links

The US dairy herd swelled to its largest size in nearly 30 years, and milk prices are crashing as supply drowns out demand.

"Beef-on-dairy" crossbreeding is giving dairy farmers a new revenue stream that's quietly reshaping the entire industry's economics.

NYC hotels posted an 84.1% occupancy rate and $333.71 ADR, the highest in the country. San Francisco's RevPAR jumped 11.8%.

📜 Quote of the Day

📢 We want to hear from you.

Your feedback matters to us! Let us know what you liked or didn’t like about today’s edition.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance doesn’t guarantee future results.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.open