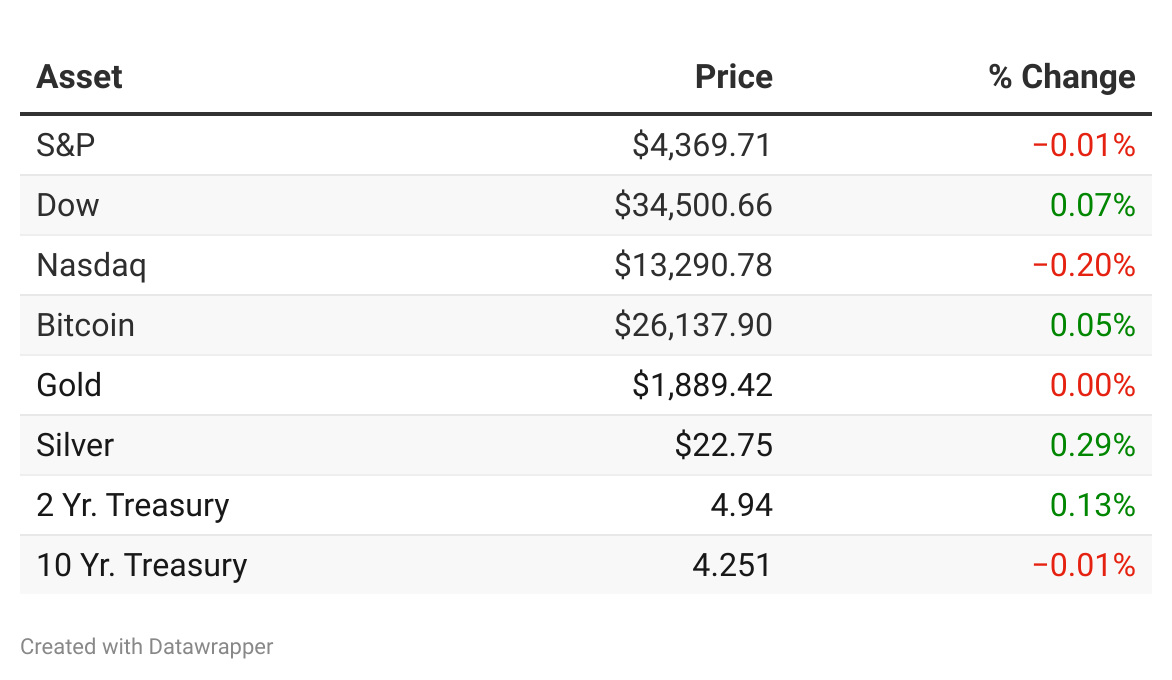

*past 24-hour performance

Upcoming Week:

Tuesday: The U.S. housing market comes into focus with the release of the National Association of Realtors (NAR) report on Existing Home Sales for July

Thursday: The BRICS summit starts in Johannesburg, South Africa

Friday: Fed Chair Jerome Powell will speak at the Jackson Hole Symposium, where investors will look for clues on the central bank’s stance on interest rates for the remainder of the year

Earnings Calendar:

Monday: Zoom Video Communications (ZM)

Tuesday: Lowe’s Companies (LOW), Baidu (BIDU), Dick’s Sporting Goods (DKS), BJ’s Wholesale Club (BJ), Toll Brothers (TOL), Macy’s (M), Urban Outfitters (URBN), La-Z-Boy Inc. (LZB)

Wednesday: Nvidia (NVDA), Snowflake Inc. (SNOW), Bath & Body Works (BBWI), Williams-Sonoma (WSM), Advance Auto Parts (AAP), Kohl’s (KSS), Peloton (PTON), Foot Locker (FL), Abercrombie & Fitch (ANF)

Thursday: Intuit (INTU), Royal Bank of Canada (RY), Toronto Dominion Bank (TD), Marvell Technology (MRVL), Dollar Tree (DLTR), Ulta Beauty (ULTA), Burlington Stores (BURL), The Gap (GPS), Nordstrom (JWN)

Instacart eyes September IPO: Instacart is aiming to list for an IPO in early September 2023, according to reports. The company will not go public via a SPAC as it was previously believed, choosing to list on Nasdaq instead (Bloomberg)

BRICS expansion: As Xi Jinping travels to the BRICS summit today, he is expected to attempt to push the Brics bloc of emerging markets to become a full-scale rival to the G7 (AP)

Gamblin’ with Robux: In a new class action lawsuit filed in the Northern District of California last week, two parents accuse Roblox (RBLX) of illegally facilitating child gambling (TechCrunch)

WeWork isn’t giving up: WeWork Inc. (WE) the troubled co-working company on the brink of collapse, is moving forward with a 1-for-40 reverse stock split in a bid to save its listing on the NYSE (Bloomberg)

Ether futures incoming: The SEC is poised to allow the first exchange-traded funds based on Ether (ETH) futures, a major win for several firms that long have sought to offer the products (Bloomberg)

Indian spinoff debuts: Shares of Jio Financial Services (JFS), $20 billion spinoff from Reliance Industries Ltd., made a weak start in a widely watched trading debut this morning (TechCrunch)

DuPont deal: Materials & chemicals maker DuPont De Nemours (DD) is in advanced talks to sell its Delrin resins unit to PE firm The Jordan Company for about $1.8 billion (Yahoo Finance)

Why high interest rates are great for most, even if we crash: So long as the economy doesn't crash and burn due to overly restrictive interest rates, most of us will be net beneficiaries of higher interest rates. Let’s go through some positive thinking. Read more »

It may make more sense to keep renting than buy a home right now: In July 2019, a home buyer who put 20% down and had the average mortgage rate stood to save roughly $700 in monthly costs compared with the typical rent price. By July 2023, a buyer’s savings relative to renting was just $237. Read more »

Skip AI stocks and turn to value: Research Affiliates’ founder Rob Arnott argues that the rise in large-cap tech stocks due to AI looks a lot like the the dot-com bubble that burst in 2000. Not that AI isn’t real… rather that it will take a while to impact earnings. Investors will be better off in value stocks. Read more »

Get your money from Zuck: The deadline to claim your piece of Meta’s $725 million class-action settlement over Cambridge Analytica is Friday. If you were a Facebook user between May 2007 and December 2022, fill out the form on the site. Read more »

The under-$20,000 new car is history (Axios)

How to save money on streaming services (Consumer Reports)

To afford rent in America’s most expensive college towns, students would need to earn about $72,000 a year (In My Area)

How tourists are ruining the world’s greatest destinations (The Guardian)

Kraft Heinz sees a $25 billion opportunity—in schools (WSJ)

‘Forever Chemicals’ are everywhere. What are they doing to us? (NYT)

Share Stocks & Income → Get Our Free Report

We just launched our brand new report: 5 Stocks Paying 10% Yields... You Probably Haven't Heard Of.

Want access? All you have to do is refer 1 friend to Stocks & Income with your personal referral link and we will send the report to you for free.

You can also copy/paste the link here: {{rp_refer_url}}

Thunderclap Research is a professional investment research firm focused on understanding and profiting from market anomalies.

We take both a quantitative and qualitative approach to research and focus extensively on strategies for established money managers and everyday retail investors.

We are a small, self-funded team of real humans going up against the hype-filled, sensational news outlets in the world. You can check out a selection of our other publications below.