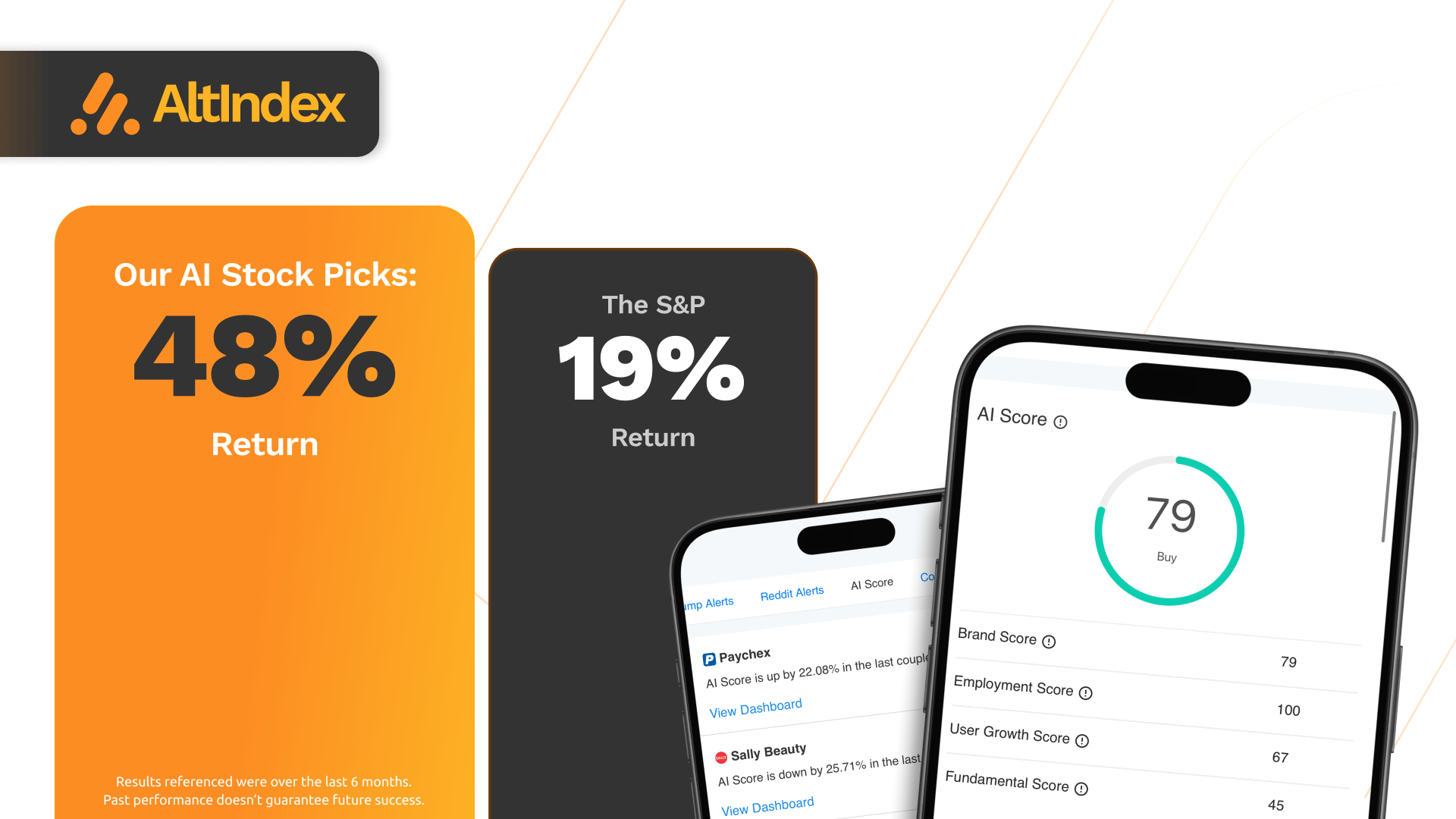

In partnership with AltIndex

Good morning.

We hope you had a great Thanksgiving and that Black Friday hasn’t been too crazy.

A lot of people waste money on Black Friday; the deals get them to spend more than they need.

Why not buy something that could actually help you make better trades throughout the next year?

AltIndex is running a half-off deal for Black Friday, and today, we’re going to dive into some of their most useful data points, features, and alerts. (We’ll include actual stocks in each section, too!)

Let’s begin.

AltIndex: The Ultimate Alternative Data Platform

AltIndex has positioned itself as the one-stop platform for every type of meaningful alternative data. You’ve seen it first hand in Stocks & Income many times, and now you have the chance to access it for yourself at a 50% discount.

Just use the code BLACKFRIDAY25 →

Articles On AltIndex’s Effectiveness:

Here are some case studies and examples of the returns that AltIndex’s picks have been able to generate.

And without further ado, here are some of the features we think you’ll get real value from (with actual stock data included):

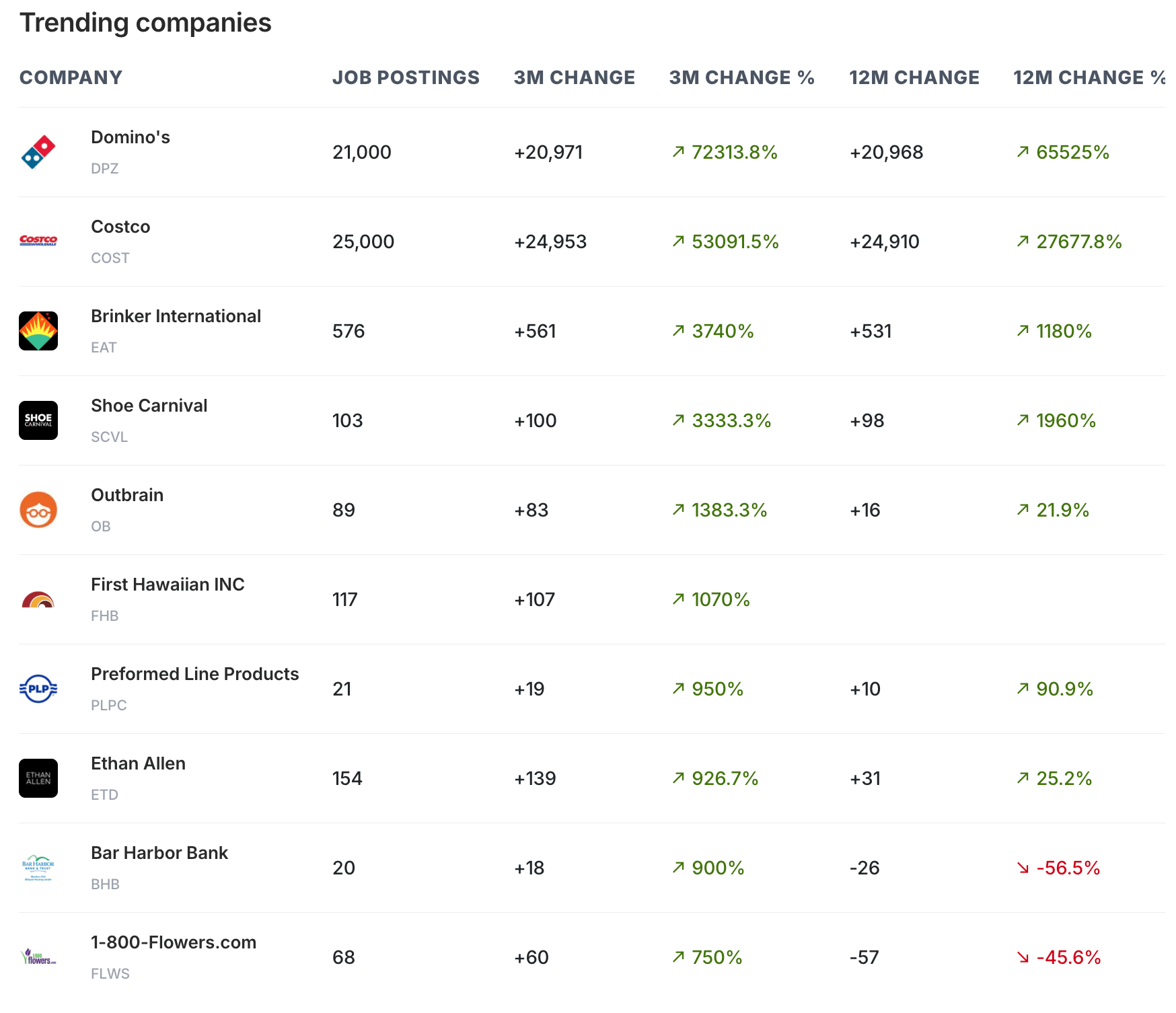

Job Postings

We’ve covered the importance of looking at a company’s layoffs and job postings recently in this guide, but to explain here briefly:

Traders should consider looking at a company’s job postings because they can be an indicator of growth or decay.

If a company’s hiring 10,000 new employees for some reason, you probably don’t need to wait for the next earnings report to guess that their operations are growing.

Likewise, if a company announces massive layoffs out of nowhere, it’s hard not to think they’re shrinking and/or losing money.

Also, remember that you can set phone notifications for each of the data metrics in this list. Imagine getting a ping on your phone whenever there’s a spike in hiring, an increase in web traffic, or a surge in Reddit buzz.

AltIndex lets you sort by highest and lowest job postings. Example:

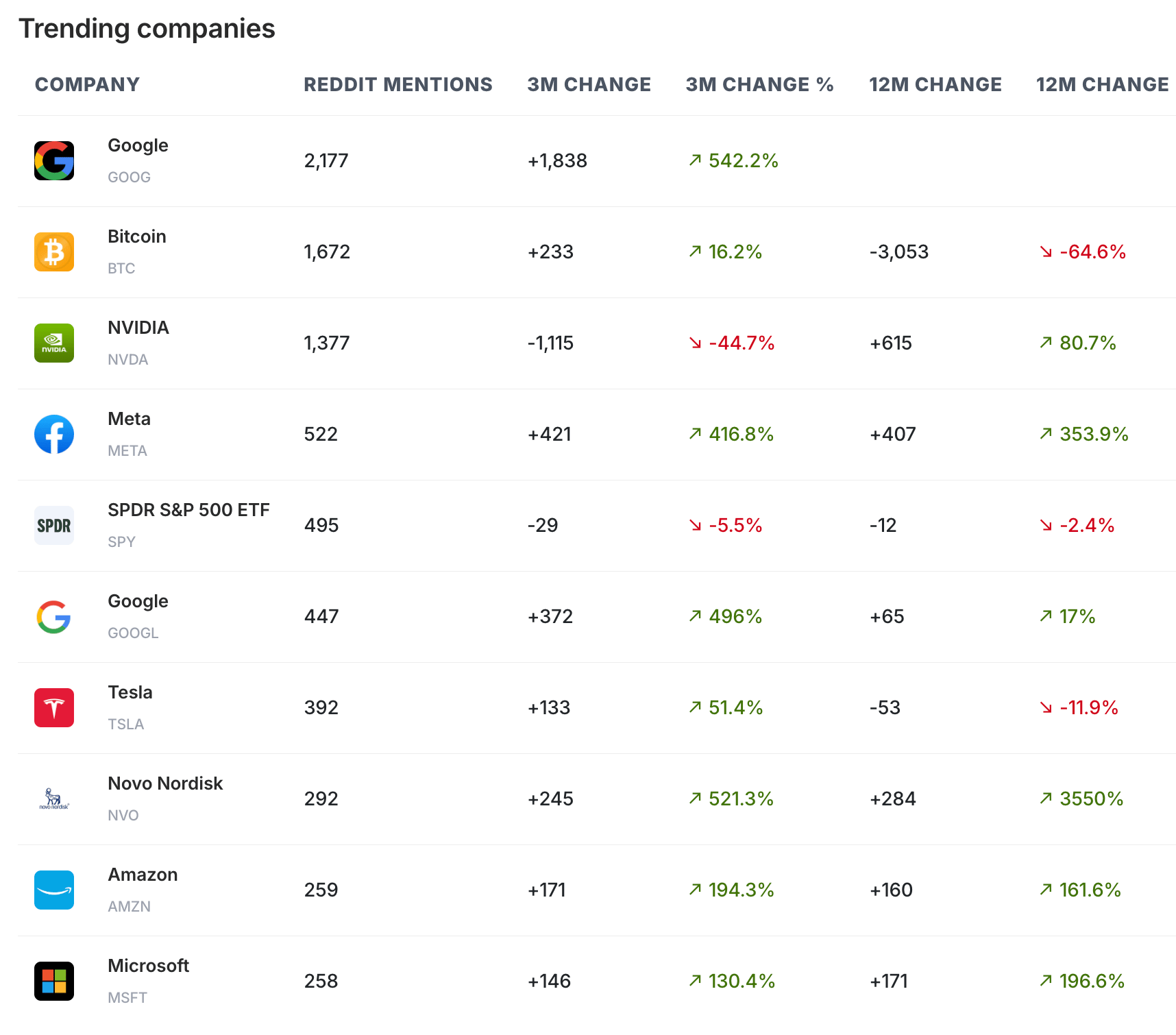

Reddit Mentions

We’ve also covered how Reddit mentions of a stock can indicate that a big move is happening (and may continue for months). You can read about it here.

But the idea is this: Earlier this year, the S&P 500 produced 19% gains over a six month period. Reddit’s top 15 most-mentioned stocks produced a 60% gain in the same period.

Now, a lot of people try to poke holes in that statement by saying, “Well of course the stocks that went up the most had a lot of chatter on Reddit. The stock moving up is causing Reddit mentions to spike, not the other way around.”

That’s a valid critique… until you look at the time frame. This isn’t 60% gains over a few days. This is over 6 months. We’re talking mid-term performance, not day trading.

Here’s AltIndex’s “Trending on Reddit” page:

Get access to AltIndex for 50% Today

This Black Friday sale won’t last forever. You can get every AltIndex stock signal and data point for less than $0.30 a day for an entire year. Click below to sign up.

Twitter Mentions

Same idea as Reddit mentions, but with Tweets.

Why would you want social sentiment data from two different social media platforms?

Because Twitter and Reddit users tend to talk about different stocks. Also, Twitter is far more crypto focused than Reddit is. See the top 5 here (BTC’s at the top!):

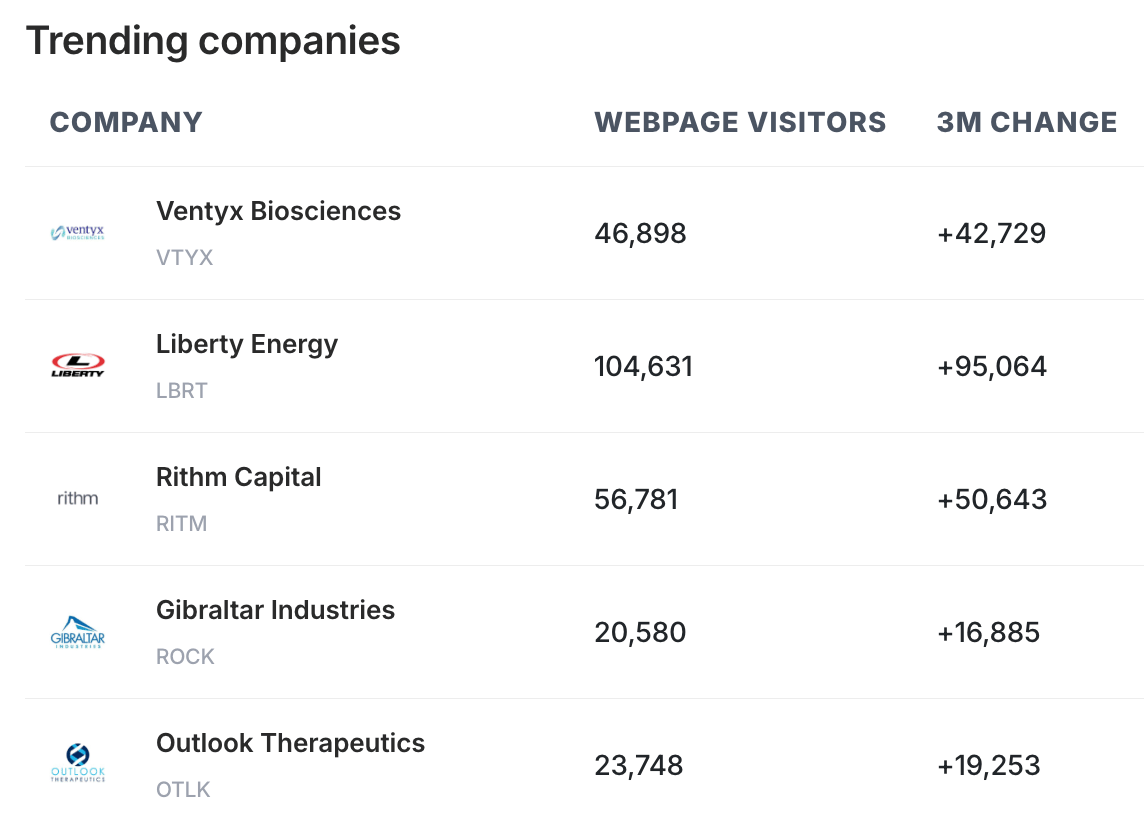

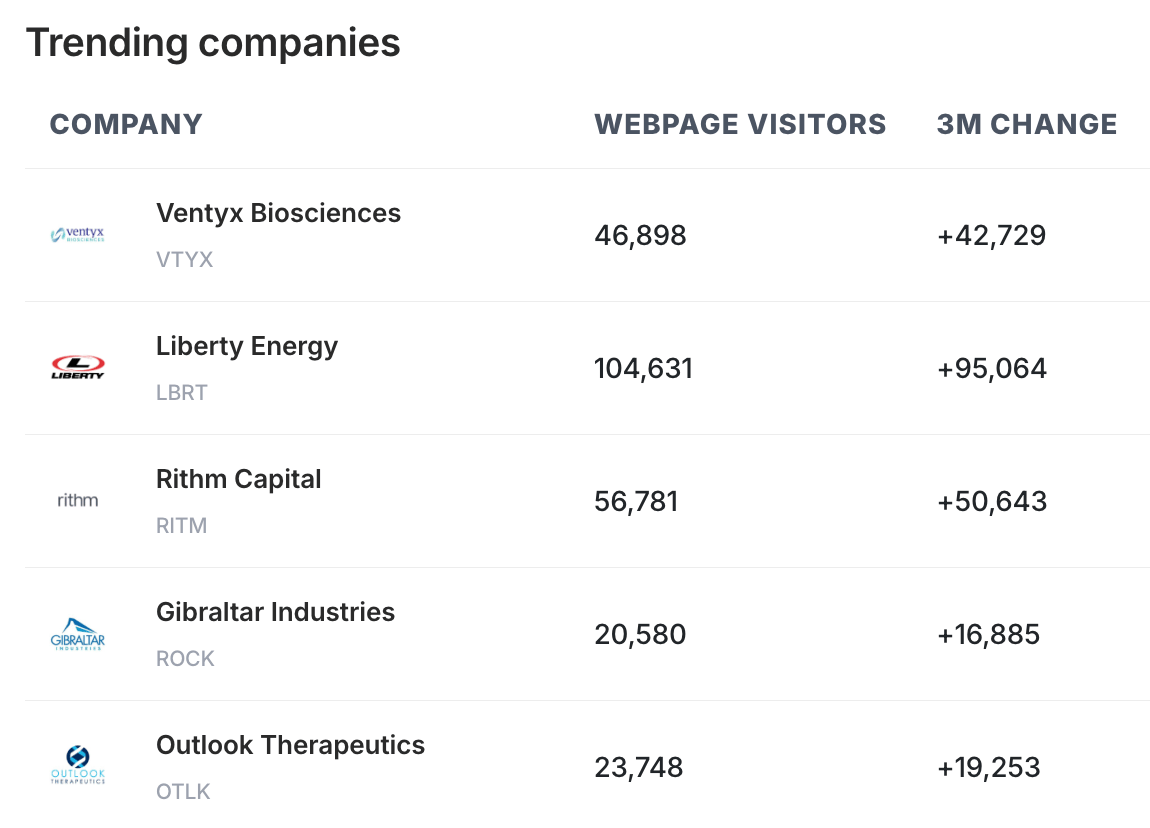

Webpage Visitors

This statistic is more than a popularity contest between stocks. Webpage visitors can be correlated to customer acquisition (read: sales).

If a company’s webpage visits are skyrocketing, it might be gaining a lot of new customers; if webpage visitors are falling, the opposite is true.

Here are the top 5 websites by change in visitors currently:

Google Trends

This is a data metric that’s great to pair with webpage visitors. Google Trends data shows the overall search interest in a topic (or in this case, in a company). You can use this data to understand the broader market and potential seasonality better.

Here are the top companies by Google Trends:

House & Congress Trading

This one’s always interesting. US congressmen and congresswomen are notorious for their trading activity (and success).

AltIndex updates its Congress trading reports daily and factors Congress buys & sells into its stock ratings, along with all the other alternative data here.

Here are the most recent Congress trades on AltIndex (Lisa McClain was quite busy selling):

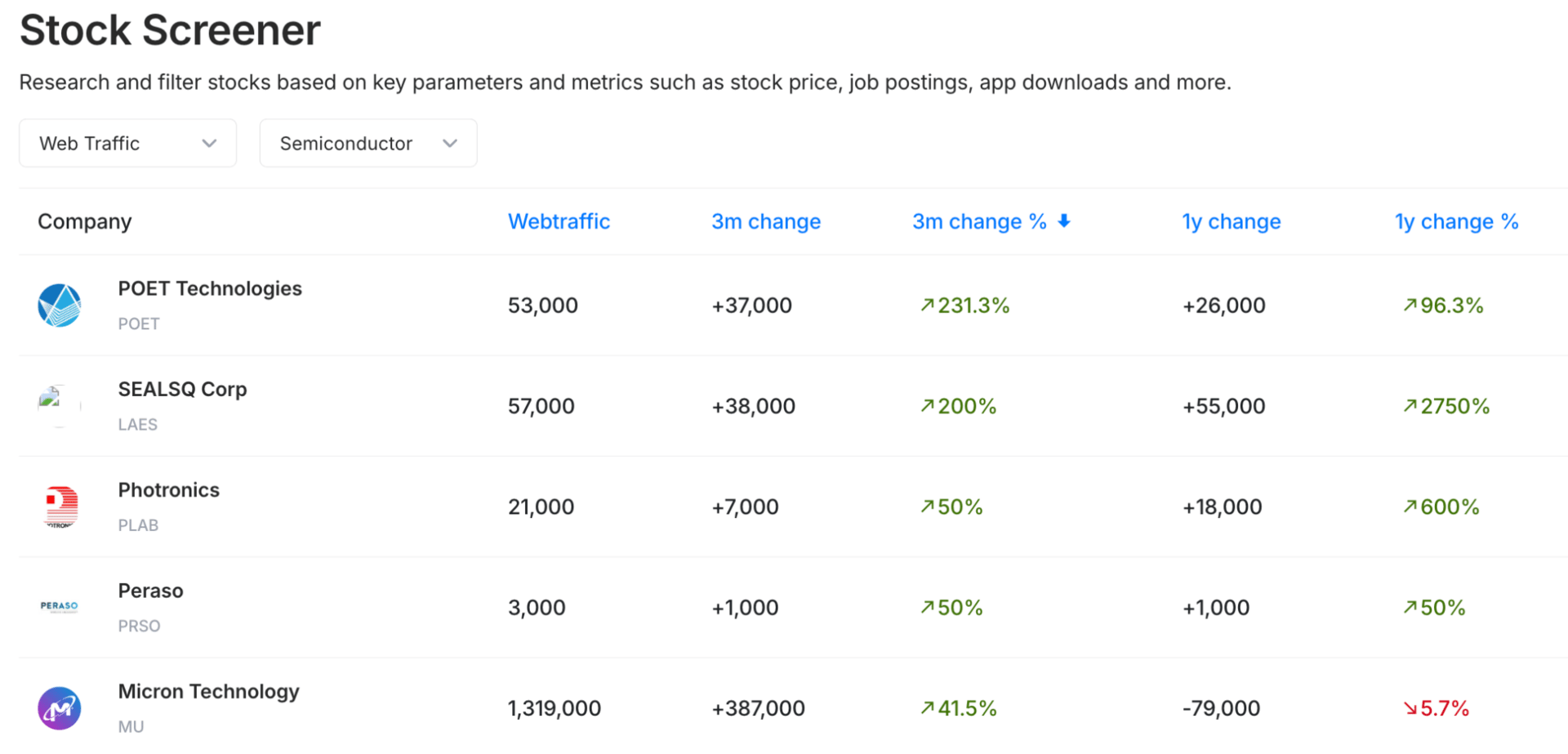

Stock Screener

This is one of the most useful tools on the entire platform. Here, you can sort through every stock on AltIndex by data metric and industry, honing in on the specific set of stocks you want to analyze without having to go to each stock’s page.

In the example below, we screened for the stocks with the highest growth in web traffic in the semiconductor industry specifically:

Reddit Alerts

And here’s one of the most useful data sets on the site. This function of AltIndex takes thousands of Reddit comments about a stock and distills down all the conversation into one paragraph of the most important developments. Then it pings you with a phone notification to show you the Reddit Alert.

This saves you from having to read all the comments or even having to visit Reddit in the first place (massive time saver).

Here are some recent examples of helpful Reddit Alerts:

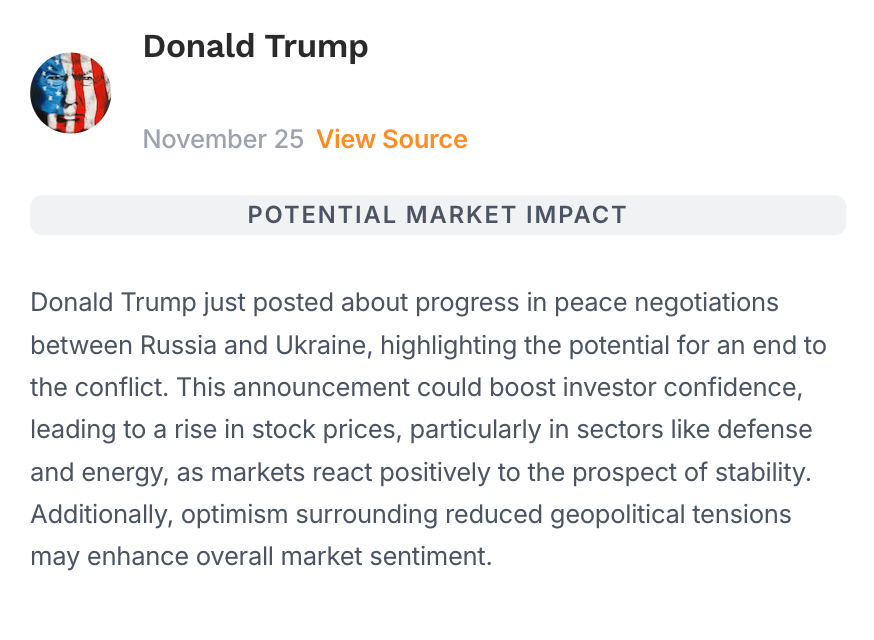

Trump Alerts

And finally, a different type of alert. President Trump’s Truth Social posts have clearly had massive effects on markets, and any serious trader is tuned in to what he’s posting. He makes industry-changing posts about tariff changes, government investments, foreign policy updates, and AI regulation all the time, and

AltIndex’s app keys you in whenever he posts something relevant to markets. That way, you aren’t left wondering why stocks are soaring or tanking. You can decide what you want to do with the information.

Here are some recent examples of Trump Alerts from the app:

Get AltIndex Half Off for Black Friday

For less than 30 cents a day, you can get access to all of these data points (and many more) for an entire year.

To take advantage of AltIndex’s sale, sign up here and begin revamping your portfolio today:

⭐️ What did you think of today's edition?

🫡 See You Next Week

That’s all for today’s special edition. We hope you got value from it. Reply and let us know if you did.

Until next week,

— Brandon & Blake

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.