Good morning.

The week’s just started, but things are already moving. Lot of ground to cover today:

President Trump narrowed the Fed chair search to “the two Kevins”

The company that makes Roomba declared bankruptcy (down 83%)

Cannabis stocks are going higher

Plus, if can’t think of anything to ask for for Christmas besides Bitcoin at $1,000, why not some Warren Buffett & Charlie Munger Rubber Ducks? (Not an ad.)

In partnership with AARE

A New way to Earn Income from Real Estate

Commercial property prices are down as much as 40%, and AARE is buying income-producing buildings at rare discounts. Their new REIT lets everyday investors in on the opportunity, paying out at least 90% of its income through dividends. You can even get up to 15% bonus stock in AARE.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

Please support our partners!

📰 Market Headlines

Markets tumbled Friday, capping a brutal week for tech stocks.

The Nasdaq plunged 1.6%, the S&P 500 dropped 1%, and the Dow held up better with just a 0.5% decline.

For the week as a whole, the Nasdaq fell 1.6%, the S&P lost 1%, while the Dow gained 1% as investors rotated from growth to value.

iRobot, the company behind Roomba, is down 83% after declaring bankruptcy. It will be acquired by Picea, a Hong Kong-based robot manufacturer. The stock will be delisted and current shareholders will lose their investments.

President Trump narrowed his Fed chair search down to "the two Kevins": former Fed Governor Kevin Warsh and current National Economic Council Director Kevin Hassett. In a Wall Street Journal interview, Trump said the next Fed chair should consult with him on interest rate decisions, breaking with decades of Fed independence. "I'm a smart voice and should be listened to," Trump said, though he added the Fed doesn't have to follow his advice exactly.

AltIndex’s AI model has found the top 10 dividend stocks that are most likely to outperform (based on its alternative data insights). Note that these all have quite high dividend yields; investors might want to consider balancing these with lower-yield, higher-consistency dividends, as covered in our $1,000/month dividend portfolio guide. Here are AltIndex’s top 3:

Pembina Pipeline (PBA): 7.15% yield

Trinity Capital (TRIN): 13.50% yield

Vale (VALE): 21.10% yield

Interesting: Paul Tudor Jones seems seriously bullish heading into 2026. Here’s his breakdown in an interview from this weekend; he focuses heavily on interest rates and the current macro environment, similar to themes we covered in our Special edition of Stocks & Income last weekend.

Trump is expected to sign an executive order easing marijuana restrictions; cannabis stocks surged Friday at the news (Tilray (TLRY) is up 4.49% pre-market today).

Copper could be in for another highly positive year in 2026, according to industry experts. The metal hit multiple new historic highs in 2025, and “stronger demand led by the energy transition and artificial intelligence sectors” could push that trend further (CNBC).

Have you thought about trading single-stock ETFs? Many of them use leverage to amplify the gains (and losses) of single stocks, which means you can capture more growth for your dollars… but also potentially higher losses. There are currently 377 single-stock ETFs on the market, and 276 of them launched just this year.

Many investors think investing in a 2x leverage ETF means something like this: if AAPL goes up 100% in a year, a 2x AAPL ETF will go up 200%. But that’s not how it works at all in reality (be careful).

Meanwhile, Trump's tariff promises keep multiplying faster than the revenue can support them. The president had floated at least nine different uses for tariff revenue by this week, from $2,000 dividend checks to Americans to funding tax cuts, farm bailouts, and even a sovereign wealth fund. The problem? Most of these promises cost more than the roughly $236 billion in tariff revenue collected this year. One round of dividend checks alone could cost $600 billion, requiring two years of tariff income to fund.

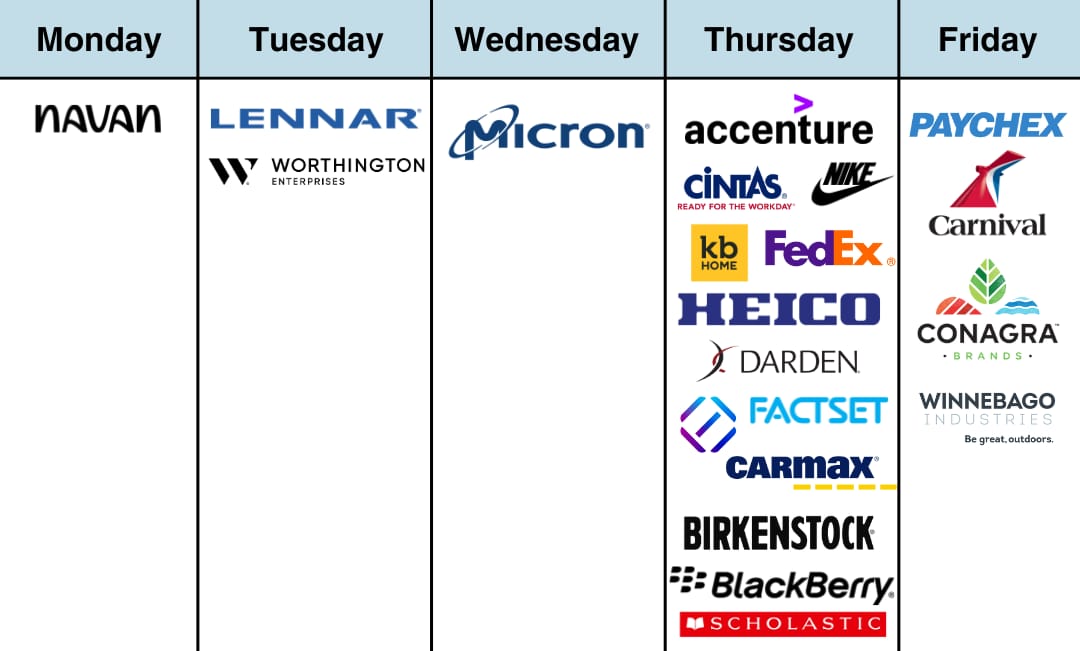

Earnings reports this week:

Wednesday: Micron Technology (MU), General Mills (GIS)

Thursday: Accenture (ACN), Nike (NKE), Cintas Corporation (CTAS), FedEx Corporation (FDX)

Friday: Paychex, Inc. (PAYX)

🪙 Crypto

JP Morgan plans to launch a tokenized money market fund on Ethereum.

The SEC released an investor bulletin on crypto custody, signaling a shift from its prior enforcement-first stance.

Standard Chartered and Coinbase expanded their partnership to build trading and custody services for institutional clients.

🚨Trending on Reddit

Tesla trends as users debate its resilience amid a three-year low in EV sales and a 30% drop in Europe, with comparisons to Rivian and bearish options speculation.

Rocket Lab trends as Redditors discuss its Neutron rocket, DCF valuations of Space Systems, funding gaps, equity dilution, and comparisons with other space stocks.

🤫 Insider Trading

📊 IPOs and Earnings

❓Market Trivia Corner

🎤️ What you said last time

🧠 The Missing (Market) Links

Rob Reiner, director of The Princess Bride & This is Spinal Tap, was found dead at home with his wife, likely the victim of homicide.

He co-founded the incredibly successful Castle Rock Entertainment production studio, responsible for Seinfeld & The Shawshank Redemption.

Financial fraud cost older adults up to $81.5 billion in 2024, according to CNBC. More than half of cases involve losses of over $100,000 at once.

What is Dow theory?

Looking for a Christmas gift for your favorite investor (or yourself)?

A Politico analysis found half of U.S. imports, worth at least $1.7 trillion, avoided Trump's tariffs due to thousands of exemptions.

Cannabis stocks exploded Friday, with Tilray jumping 44% and Canopy Growth 52% on reports Trump will reclassify marijuana.

The UK economy unexpectedly shrank 0.1% in October, partly due to a cyber-attack that crippled production at Jaguar Land Rover.

📜 Quote of the Day

Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.