Good morning.

$META is up 4% today because Zuckerberg’s ditching the metaverse (he hadn’t already?).

Netflix is buying Warner Bros. at $30/share.

And AltIndex has laid out some interesting Congress trading numbers.

Let's get into it.

In partnership with Roku

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Please support our partners!

📰 Market Headlines

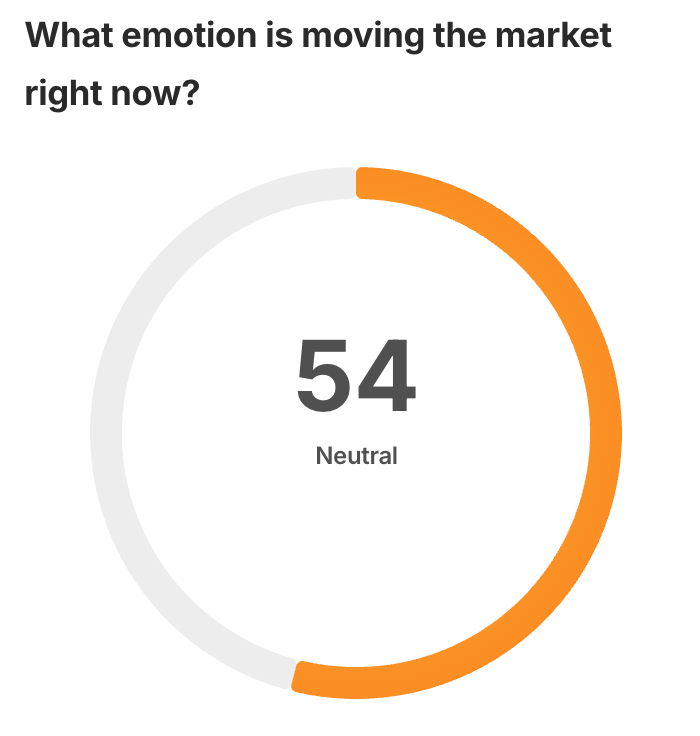

Stocks closed mixed Thursday as Wall Street cemented expectations for a December rate cut.

The Dow slipped 0.07%, the S&P 500 rose 0.1%, and the Nasdaq added 0.2%.

Netflix (NFLX) just announced its acquisition of Warner Bros. According to AltIndex’s Reddit Alerts, “There is a mixed reaction among Reddit users, with some expressing concern about potential increases in [Netflix] subscription costs to finance the deal, while others express dissatisfaction with the company's decision-making. The deal includes Netflix offering $30 a share for studio and streaming assets, as well as a $5 billion break-up fee.” See all breaking Reddit Alerts here →

Meta shares surged 3.4% after Bloomberg reported that CEO Mark Zuckerberg plans to slash metaverse spending by up to 30%. The cuts would likely include layoffs and affect the company's VR game Meta Horizon Worlds and Quest headsets. Meta's Reality Labs division has burned through billions, losing $4.4 billion in the most recent quarter alone while generating just $470 million in revenue.

Yieldstreet, the failed “private market investments for retail” platform, may have rebranded to “Willow Wealth,” but failures keep piling up even under its new name. The company just announced $41 million in new losses to investors and removed 10 years of data from public view. Not pretty. Here’s our guide to other options for real estate investing →

The top candidates for inclusion in the S&P 500 today as the index rebalances are as follows: CRH, Reddit, Vertiv Holdings, SoFi, Carvana, Zoom, Strategy, Alnylam Pharmaceuticals, Astera Labs, and Ares Management. X trader Luc picked out an interesting pattern that leads him to believe the winner will be SoFi.

Amazon slipped 1.4% following a report that it may drop the USPS and build its own postal network. The current contract, worth billions annually and accounting for 7.5% of USPS revenue, expires in 2026. Talks have been strained by President Trump’s push to privatize the postal service.

AMD fell 0.7% after CEO Lisa Su said the company is ready to pay a 15% export tax on AI chip shipments to China. AMD has licenses to ship its MI 308 chips under a deal with the Trump administration, which some legal experts say could violate the Constitution’s export tax clause.

TD Bank posted a strong Q4 with adjusted EPS at C$2.18, up 27% year over year. The bank finished its US retail restructuring, but US retail segment earnings dropped 4.5% to $2.6B as total assets shrank 11%. Wholesale banking and wealth management earnings soared 77% and 100%, though analysts warn these segments can be volatile.

Senators dropped the SAFE CHIPS Act to block President Trump from easing AI chip export curbs to China for 2.5 years. The bill would require the Commerce Department to deny license requests for advanced US AI chips to China, Russia, Iran, or North Korea, and force Congressional review before any rule changes.

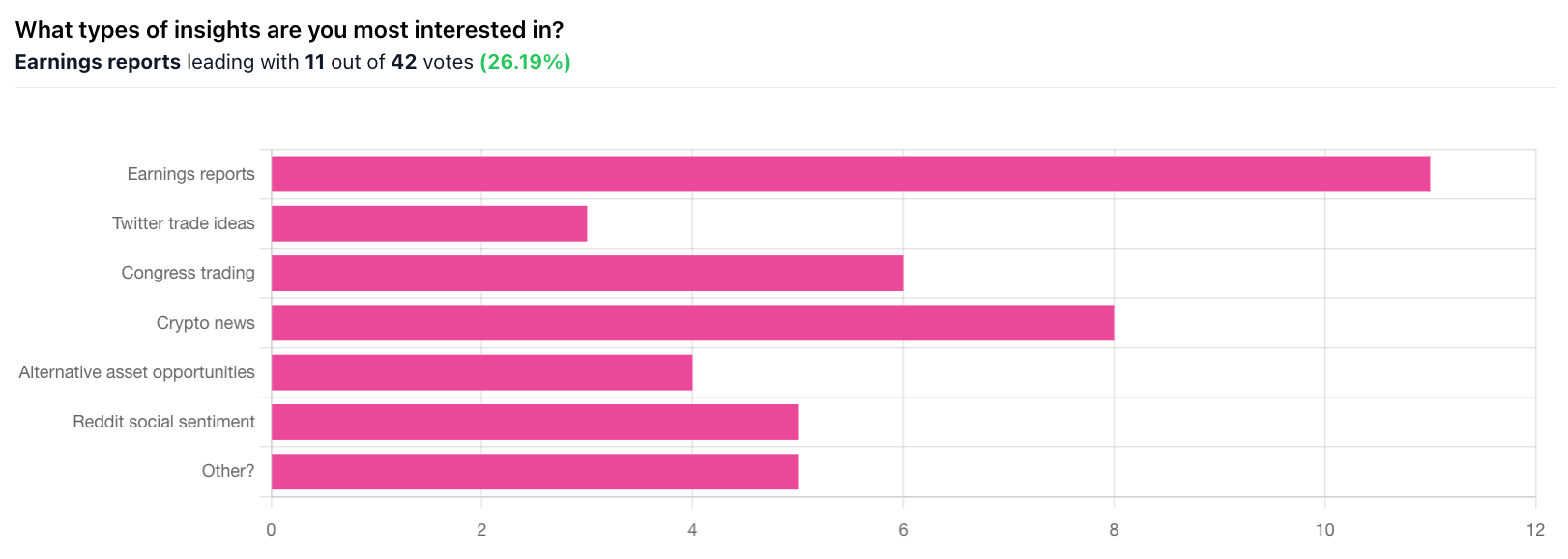

The Top 5 Most-Active Congress Traders of 2025

With Nancy Pelosi and Marjorie Taylor Greene retiring next year, we’re curious to see who will become the next #1 Congress trader to watch. Our bet is that it will be someone from this list (or the permanent tech bull Rep. Cleo Fields).

These 5 Congress members traded more than any of their colleagues this year, and we’re certainly going to be keeping an eye on them in 2026.

AltIndex updates its Congress trading data daily and factors their trades into its own stock ratings. See the data here:

🪙 Crypto

Binance’s new co-CEO is one of its co-founders and the “Life Partner” of Changpeng Zhao, Binance’s former CEO and co-founder.

Binance also just launched “Binance Junior,” which is “a parent-controlled app and sub-account for kids and teens.”

The CFTC greenlighted spot crypto trading on US exchanges for the first time.

🤫 Insider Trading

💍 Alternative Investment: Estate Jewelry

The estate jewelry market surged as collectors sought heritage brands like Tiffany, Cartier, and Van Cleef & Arpels for price appreciation and resale demand. Tiffany resale orders rose 41% year over year on 1stDibs, while Bulgari’s Serpenti line jumped 140% in resale value.

High-end buyers stayed active despite gold volatility, with most transactions landing in the $2,500–$10,000 range. Dealers said scarcity of signed vintage pieces pushed demand for unsigned jewels of equal craftsmanship, often at lower entry prices.

Reports state that fine jewelry resale prices had climbed 17% since 2024, and searches for vintage engagement rings spiked 198%. Millennials and Gen Z drove the boom, drawn by sustainability, provenance, and the appeal of jewelry as a wearable store of value.

📊 IPOs and Earnings

DocuSign delivered strong Q3 results, with revenue climbing 8% to $818.4 million and billings growing 10% year-over-year.

Ulta Beauty beat earnings expectations with revenue climbing to $2.86 billion, and shares popped more than 6% in extended trading.

Kroger beat Q3 earnings estimates but missed on revenue as total sales sank 0.9% year-over-year; the stock slid 4.9%.

❓Market Trivia Corner

🎤️ What you said last time

🧠 The Missing (Market) Links

Elon Musk’s X was just fined $140 million because of “‘deceptive’ blue checkmark and lack of transparency,” according to CNBC.

Home prices plummeted in forecasts for 22 major cities next year. Cape Coral-Fort Lauderdale led declines at 10.2%.

Anthropic interviewed 1,250 professionals using AI. 86% said AI saved them time, but creatives worried about displacement, while scientists refused to trust it for core research.

Trump's new accounts deposited $1,000 for newborns born 2025-2028, converting to IRAs at 18.

Friends co-bought homes to crack the housing crisis. One D.C. duo split a $905K house 60/40, while NYC friends bought a Bronx three-family home for $730K.

📜 Quote of the Day

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.